Hire And Reward Car Insurance Cost

The Cost of Hire and Reward Car Insurance

If you’re a driver who is looking to use their car for hire and reward services, then you’re probably looking for the best car insurance deal you can get. But how much does hire and reward car insurance cost?

The cost of hire and reward car insurance depends on a few different factors. Most insurers will look at the age of the driver, their driving history, the type of car they own, the value of the car and the type of cover they require. All of these factors will determine the cost of the insurance policy.

For example, younger drivers may be required to pay more for hire and reward cover than older drivers, as insurers see them as a higher risk. Similarly, drivers with a history of speeding or other offences may also be required to pay more for their cover. The type of car you own will also affect the cost of your insurance; for example, a car with a higher value may cost more to insure.

In addition to these factors, the type of hire and reward cover you require will also affect the cost of your insurance. If you’re looking for a simple hire and reward policy, then you may be able to get a cheaper deal than if you require more comprehensive cover.

How Can You Reduce the Cost of Hire and Reward Car Insurance?

There are a few different ways you can reduce the cost of your hire and reward car insurance. Firstly, you can look for insurers who offer discounts for drivers who have a good driving record. You can also take out a black box policy, which monitors your driving and rewards you for good driving habits. This can help to reduce the cost of your insurance.

You can also look for insurers who offer discounts for drivers who have a good no-claims bonus. If you’ve been driving without making any claims for a certain period of time, then you may be eligible for a discounted rate. Finally, you can also look for insurers who offer discounts for drivers who have taken out additional cover such as breakdown cover or legal cover.

Get the Best Deal for Your Hire and Reward Car Insurance

If you’re looking to get the best deal on your hire and reward car insurance, then it’s important to shop around. You should compare policies from different insurers to make sure you’re getting the best deal. You should also make sure you read the policy documents carefully, as some policies may have exclusions or restrictions that could affect the cost of your insurance.

It’s also important to make sure you’re honest when filling out the application form, as any false information could invalidate the policy. Finally, if you’re still unsure about which policy is best for you, then it’s worth speaking to a specialist broker who can help you find the best deal for your hire and reward car insurance.

Looking at the costs of auto insurance in Ontario, and ways motorists

Alberta Car Insurance Premiums Under NDP and UCP Governments : Edmonton

Insurance Prices - Triple-I Blog | Commercial insurance rates variable

The Average Cost of Car Insurance in the US | Car RC

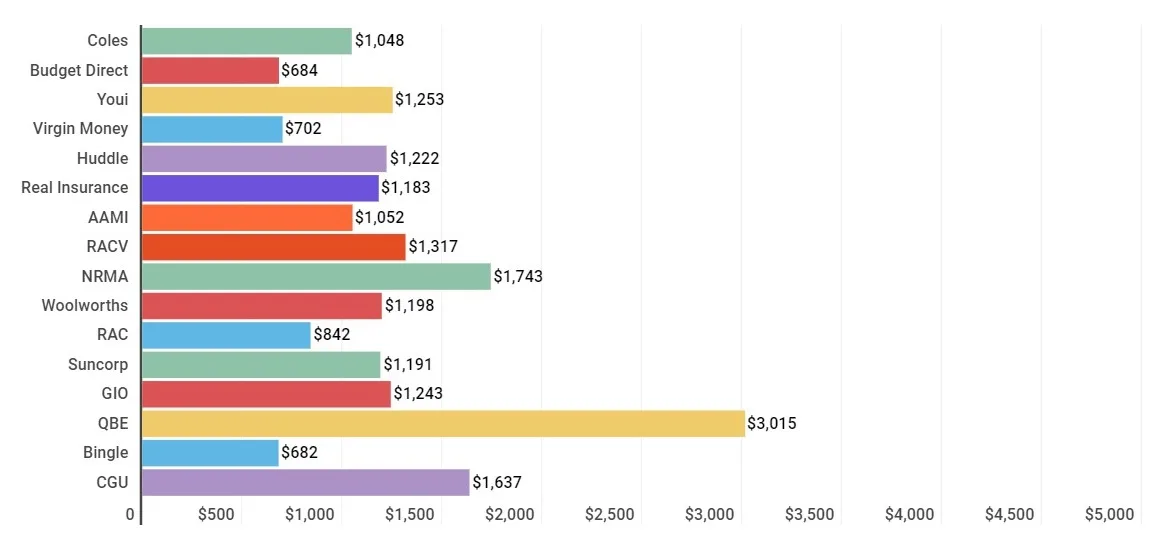

Cheap car insurance | See who we ranked as cheapest | Finder