Budget Home And Contents Insurance Quote

Get The Best Budget Home And Contents Insurance Quote

When it comes to protecting your home and its contents, there is no substitute for a good home and contents insurance policy. Your home is likely to be the biggest investment you ever make, and it’s important to make sure that you are adequately insured to protect yourself should anything happen. Contents insurance covers the cost of replacing your furniture, electronics and other personal items if they are damaged, destroyed or stolen.

Finding the right home and contents insurance policy can be a daunting task, but it doesn’t have to be. There are a number of online resources that can help you compare different policies and find the one that best fits your needs and budget. Here are some tips to help you find the best budget home and contents insurance quote.

1. Shop Around

When it comes to home and contents insurance, it pays to shop around. Different companies offer different levels of cover and different prices, so it’s important to compare different policies and make sure you’re getting the best deal. Look for companies that offer discounts for multi-policy holders, or for installing security systems in your home.

2. Read The Policy Carefully

It’s important to read the policy carefully and make sure you understand what’s covered and what’s not. Make sure you know what type of damage is covered, as well as what’s excluded. It’s also important to check the policy limits, so you know how much you’re covered for.

3. Get The Right Level Of Cover

It’s important to make sure you get the right level of cover. If you live in a high-risk area, you may need to pay more for a higher level of cover. If you have valuable items in your home, you will need to make sure that these items are adequately covered. You may also need to pay extra for flood or earthquake cover.

4. Check The Excess

It’s important to check the excess on your policy. This is the amount that you will have to pay out of your own pocket if you need to make a claim. The higher the excess, the lower the premium, but you may not be able to afford the excess if you need to make a claim.

5. Check The Claims Process

Make sure you check how easy it is to make a claim on your policy. Check how long it takes to process a claim, and whether you need to provide any additional documentation. It’s also important to check what the policy covers in terms of replacement items and repairs.

6. Check The Cancellation Policy

Finally, make sure you check the cancellation policy of the policy. Some companies may allow you to cancel your policy at any time, while others may require you to give notice before you can cancel. Make sure you know what the cancellation policy is before you sign up for a policy.

By following these tips, you can make sure you get the best budget home and contents insurance quote. Make sure you shop around and compare different policies to make sure you are getting the best deal. Make sure you read the policy carefully and understand what’s covered and what’s not. Lastly, make sure you check the cancellation policy of the policy before you sign up for a policy.

Get A Reliable And Affordable Budget Insurance Quote Today

How I Reduced My Home & Contents Insurance Cost By $1,702 Without

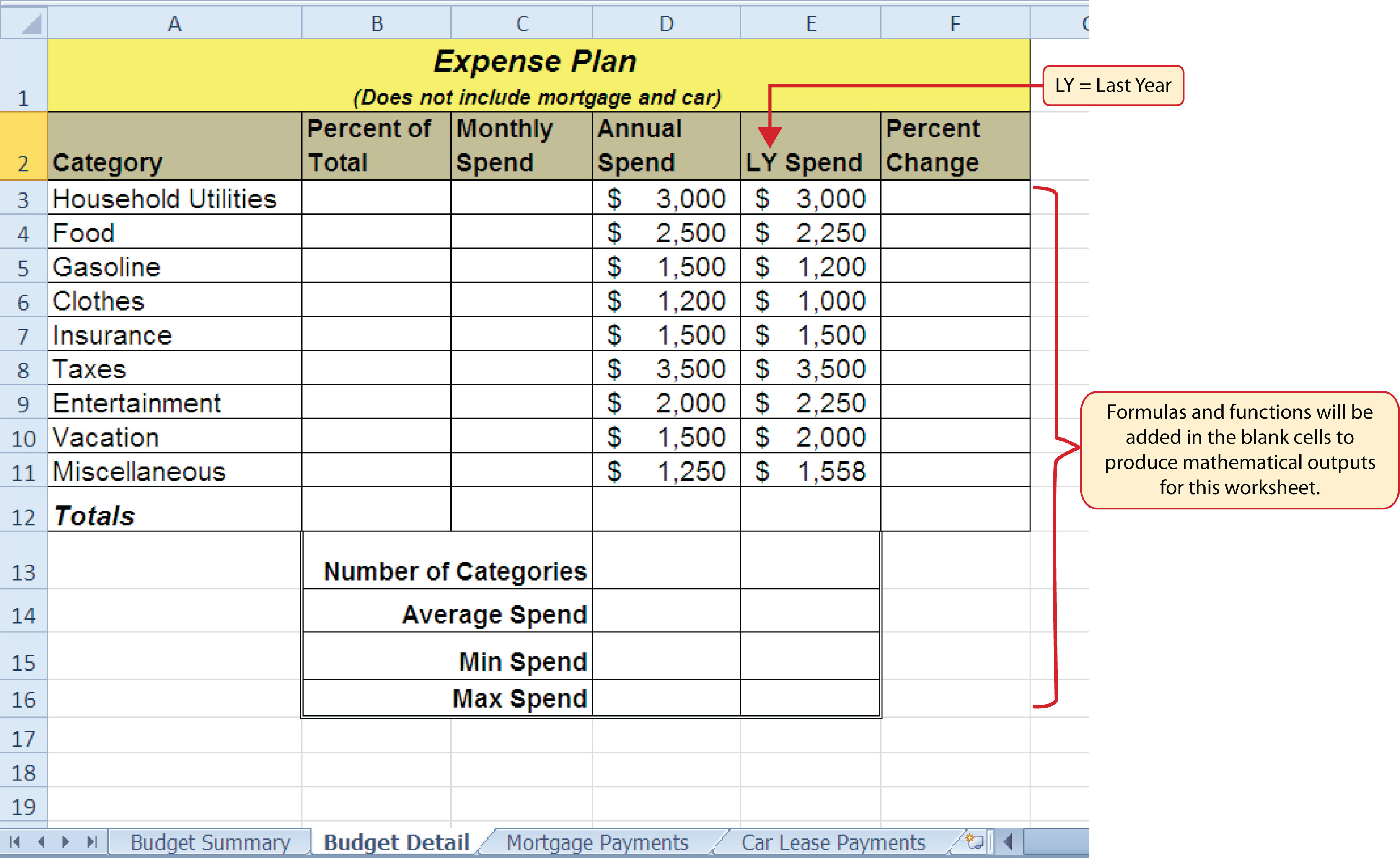

Sample Family Budget Spreadsheet for Easy Family Budget Worksheet

Home Contents Insurance Calculator Spreadsheet Spreadsheet Downloa home