Hdfc Ergo General Insurance Motor Claim Form

A Comprehensive Guide to HDFC ERGO Motor Claim Form

What is HDFC ERGO Motor Insurance?

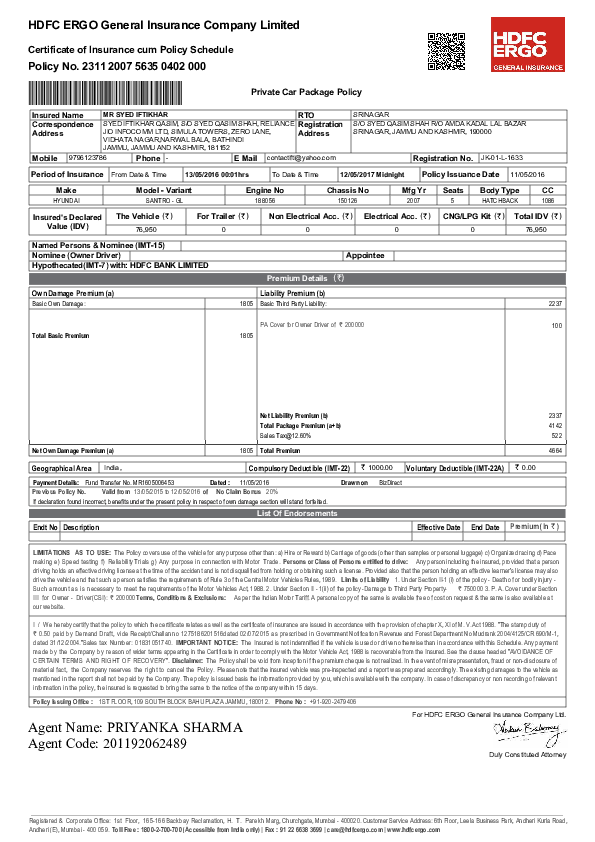

HDFC ERGO General Insurance is a leading insurance provider in India, offering a range of motor insurance products for every kind of motor vehicle. It provides comprehensive motor insurance coverage for cars, two-wheelers and commercial vehicles. One of the key features of their motor insurance policies is the availability of motor claim forms to help policyholders make claims for their losses or damages due to an accident. HDFC ERGO Motor Claim Form is a useful tool to help policyholders make their claims quickly and easily.

What are the Benefits of HDFC ERGO Motor Claim Form?

HDFC ERGO Motor Claim Form is a simple and convenient way to make a claim for your motor insurance policy. It is easy to fill and submit, which helps policyholders in getting their claims processed quickly and efficiently. The form also offers multiple options for making a claim, such as cashless or reimbursement. The form also helps in tracking the status of your claim, making it easier for policyholders to keep a tab on their claim process.

How to fill HDFC ERGO Motor Claim Form?

Filling HDFC ERGO Motor Claim Form is quite easy and can be done in four easy steps:

- Step 1: Fill in the basic details such as policyholder’s name, address, contact details, vehicle details and details of the accident.

- Step 2: Fill in the details of the claim such as the type of claim, date and time of the accident, description of the damage and the estimated cost of repair or replacement.

- Step 3: Attach documents such as photographs, bills, repair estimates and other relevant documents.

- Step 4: Sign the form and submit it along with the required documents to the nearest HDFC ERGO branch.

What Documents Are Required to Submit HDFC ERGO Motor Claim Form?

The documents required for submitting HDFC ERGO Motor Claim Form are:

- Driving license of the driver

- Registration certificate of the vehicle

- Insurance policy copy

- Police report in case of theft or third party damage

- Photographs of the damaged vehicle

- Repair bills and/or estimates

- Forms related to the claim

Conclusion

HDFC ERGO Motor Claim Form is a simple and easy way to make a claim for your motor insurance policy. It allows policyholders to make their claims quickly and efficiently. The form is simple to fill and requires just a few documents to be submitted along with it. Therefore, it is important for policyholders to be aware of the process of filing for a motor claim and the documents required for it.

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Ergo General Insurance Motor Claim Form [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Hdfc Ergo Health Insurance Claim Form

Kyc Form Hdfc Ergo - Fill and Sign Printable Template Online | US Legal

Hdfc Insurance Claim Form Pdf

Commercial General Liability Insurance Proposal form HDFC ERGO by Sahil