Car Insurance Named Driver No Claims

What is a Named Driver No Claims Discount?

A named driver no claims discount (NDNCD) is a discount applied to an insurance policy when the individual named on the policy has a certain amount of no claims history. This type of discount is usually applied when the named driver has held a policy for at least a year or two without making any claims on the policy. The no claims discount allows the named driver to pay a lower premium for the policy.

The discount is usually applied when the named driver has a history of no claims on the policy. The no claims discount is usually applied in increments of five or more years, depending on the insurance company. The longer the no claims discount, the more the premium will be discounted.

How Does Named Driver No Claims Discount Work?

Named driver no claims discount works by offering a discount on the insurance premium based on the number of years that the named driver has gone without filing a claim. The discount is usually applied in increments of five or more years, and the more years the named driver goes without filing a claim, the more the premium will be discounted.

For example, if the named driver has been insured for five years without filing a claim, the premium will be discounted by a certain amount. The discounts may vary from insurer to insurer, but the general idea is the same.

What Are The Benefits Of Named Driver No Claims Discount?

The main benefit of a named driver no claims discount is the cost savings it provides. By not filing a claim on your policy, you can often save a significant amount of money on your insurance premium. This is especially true for drivers who have held a policy for a long period of time without making a claim.

Another benefit of a named driver no claims discount is that it can act as an incentive to drive safely and responsibly. If a driver knows that they will be rewarded for not filing a claim, they are more likely to be careful on the roads and less likely to be involved in an accident.

Are There Any Disadvantages To Named Driver No Claims Discount?

The main disadvantage to a named driver no claims discount is that it is not available to all drivers. The discount is usually only available to drivers who have held a policy for a certain minimum number of years without filing a claim. Additionally, the maximum discount that can be earned may be capped at a certain amount, depending on the insurer.

It is also important to be aware that some insurers may not offer a named driver no claims discount. In this case, it may be necessary to shop around for a different insurer that does offer this type of discount. Additionally, some insurers may require the named driver to submit proof of no claims history in order to qualify for the discount.

Conclusion

Named Driver No Claims Discount is a great way to save money on your car insurance premium. By not filing a claim on your policy, you can often save a significant amount of money on your insurance premium. This is especially true for drivers who have held a policy for a long period of time without making a claim. However, it is important to be aware that some insurers may not offer a named driver no claims discount, and that the discount may be capped at a certain amount.

If you are considering taking out a named driver no claims discount, it is important to do your research and shop around for the best deal. You should also make sure that you understand the restrictions and requirements of the policy before signing up.

Property And Casualty Insurance Companies For Sale - STAETI

Car Insurance Additional Driver No Claims Bonus - New Cars Review

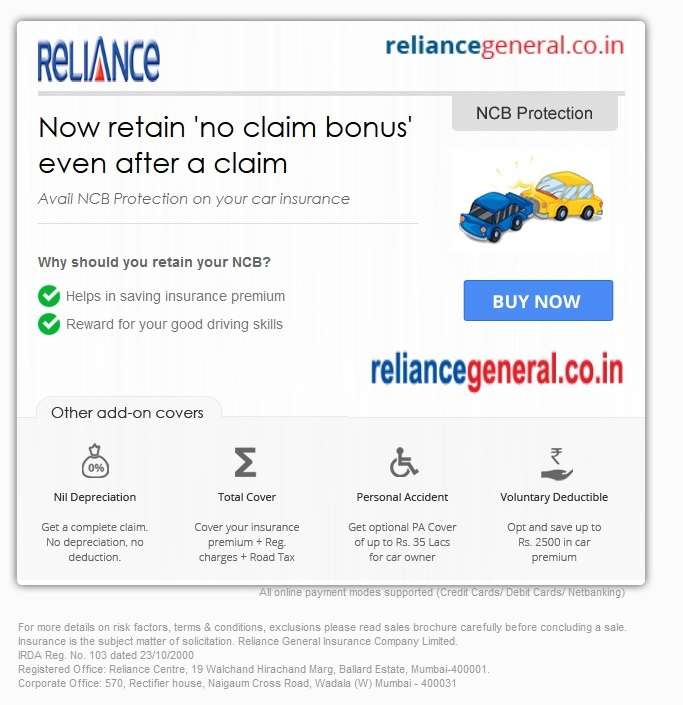

No Claim Bonus/NCB with your Motor Insurance Policy - Reliance General

What Is No Claim Bonus In Car Insurance? - indiaearns.in

Indemnity Car Insurance - Commercial Vehicle Insurance | LiabilityCover