Does My Insurance Cover Turo Cars

Does My Insurance Cover Turo Cars?

What is Turo?

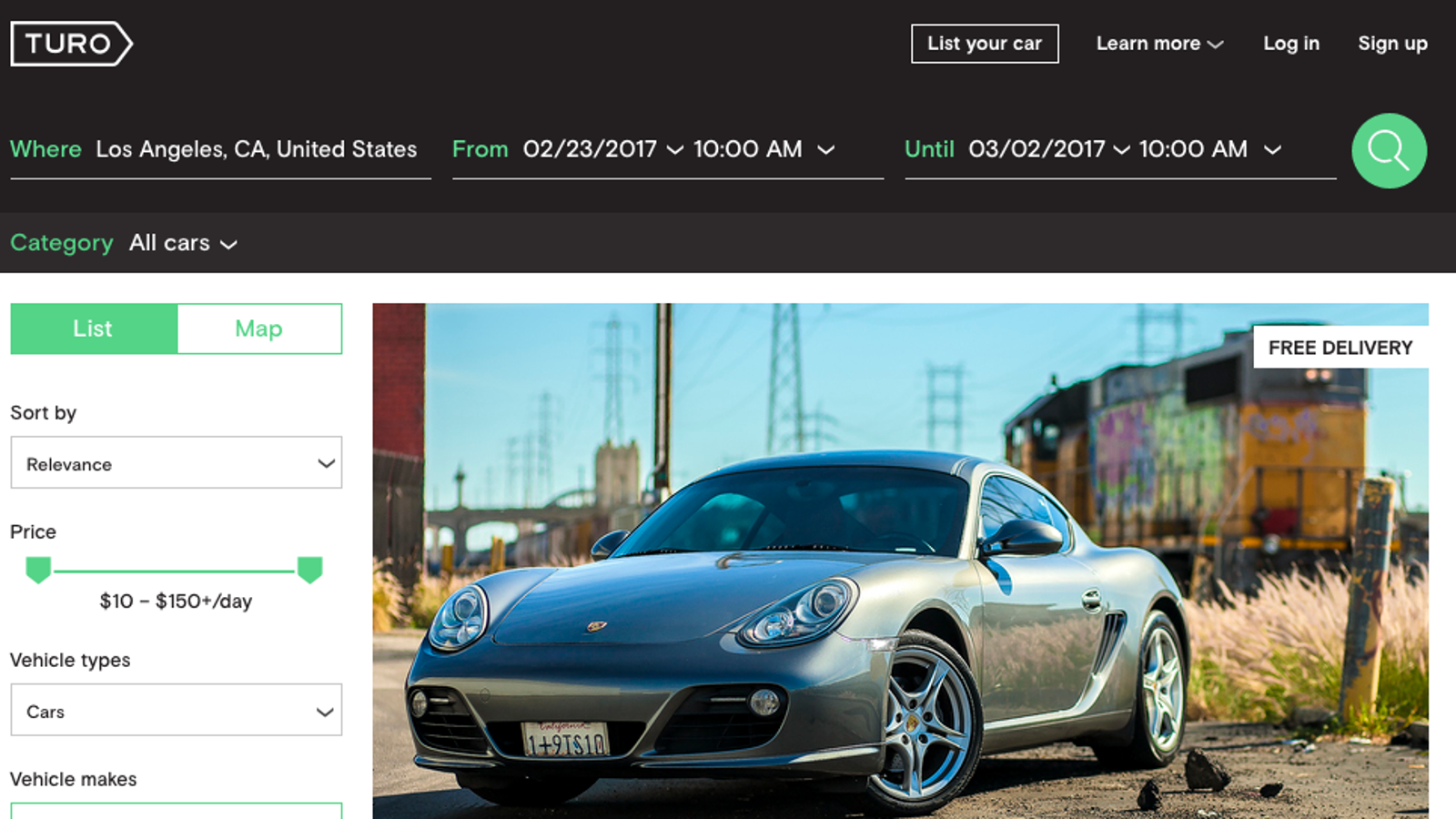

Turo is a peer-to-peer car sharing platform which allows you to rent out and borrow cars from people all around the world. Through Turo, you can rent a car from a local owner, or you can even rent out your own car to people who need it. Turo is a great way to make money from your car, or to save money on transportation costs when you’re traveling.

What is Turo Insurance?

Turo provides two types of insurance for car owners and renters. The first is their “Host Protection Insurance” which is designed to provide coverage for the car owner in the event of an accident or theft. Turo also provides “Renter Protection Insurance” which covers the renter in the event of an accident. Both types of insurance are provided through their partner, Allianz.

Does My Insurance Cover Turo?

The answer to this question depends on your current insurance coverage. If you are renting out a car through Turo, it is likely that your regular car insurance policy will not cover you for any losses or damages that may occur. Most auto insurance policies only cover the car for its intended use, which does not include renting it out to other people. However, if you are renting a car from a Turo owner, it is likely that their insurance policy will cover you in the event of an accident.

What if I Don’t Have Insurance?

If you do not have any insurance coverage, you may still be able to rent a car through Turo. Turo provides both Host Protection Insurance and Renter Protection Insurance. Host Protection Insurance is designed to provide coverage for the car owner in the event of an accident or theft. Renter Protection Insurance covers the renter in the event of an accident.

How Much Does Turo Insurance Cost?

Turo's insurance policies are offered on a per-trip basis and the cost varies depending on the type of vehicle, the length of the rental, and the age of the driver. Host Protection Insurance typically ranges from $14 to $50 per trip depending on the type of vehicle and the length of the rental. Renter Protection Insurance is typically around $15 per rental, although this can vary based on the type of vehicle and the length of the rental.

Conclusion

Turo is a great way to make money from your car, or to save money on transportation costs when you’re traveling. If you are renting out a car through Turo, it is likely that your regular car insurance policy will not cover you for any losses or damages that may occur. However, Turo offers Host Protection Insurance and Renter Protection Insurance, which can provide coverage for car owners and renters in the event of an accident. The cost of Turo's insurance policies varies depending on the type of vehicle and the length of the rental, but typically ranges from $14 to $50 per trip.

Is Renting a Car on Turo a Good Deal? My Experience & Review

Does USAA cover Turo Rental? (Hint: Yes, but...)

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo

How Insurance Works When You Rent Out Your Car On Turo

How Does Turo Insurance Work : Host Tips How Insurance Works On Turo