Car Insurance Cost Per Month

How Much Does Car Insurance Cost Per Month?

Car insurance is a necessary expense for any driver. It's important to understand exactly what you're getting when you purchase car insurance and how much it will cost you each month. Knowing the cost of car insurance per month can help you budget accordingly and avoid any surprise expenses.

What Factors Affect the Cost of Car Insurance?

The cost of car insurance varies depending on a variety of factors. Generally, the cost will be higher for drivers with poor driving records, younger drivers, and those living in areas with a high concentration of car accidents. Insurance companies also take into account the make and model of the vehicle, its age, and its safety features. Other factors, such as credit score and gender, may also be considered.

How Much Does Car Insurance Cost on Average?

The average cost of car insurance per month in the United States is around $135. However, this amount can vary significantly depending on the factors mentioned above. Drivers with good driving records and safe vehicles can expect to pay less, while drivers with poor driving records or riskier vehicles can expect to pay more.

What Are the Different Types of Car Insurance?

When purchasing car insurance, it's important to understand the different types of coverage available. The most common types of car insurance are liability coverage, collision coverage, comprehensive coverage, and personal injury protection. Liability coverage covers damage to other vehicles and property, while collision and comprehensive coverage cover damage to your own vehicle. Personal injury protection covers medical costs for you or your passengers in the event of an accident.

What Is the Cheapest Car Insurance?

The cheapest car insurance is not necessarily the best option. It's important to shop around and compare rates from different insurance providers to find the best coverage and the best price. Some insurance companies offer discounts for certain drivers, such as those with good driving records or those who bundle multiple policies. Additionally, some states require certain minimum amounts of coverage, so it's important to understand the laws in your area.

How Can I Save Money on Car Insurance?

There are several ways to save money on car insurance. Increasing your deductible is one of the easiest ways to lower your monthly premiums. Additionally, some insurance companies offer discounts for drivers who take defensive driving courses or for those who install safety features, such as anti-theft devices or automatic seatbelts, in their vehicles. Finally, shopping around and comparing rates from different insurance companies can help you find the best deal.

Average Price Of Car Insurance Per Month - designby4d

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

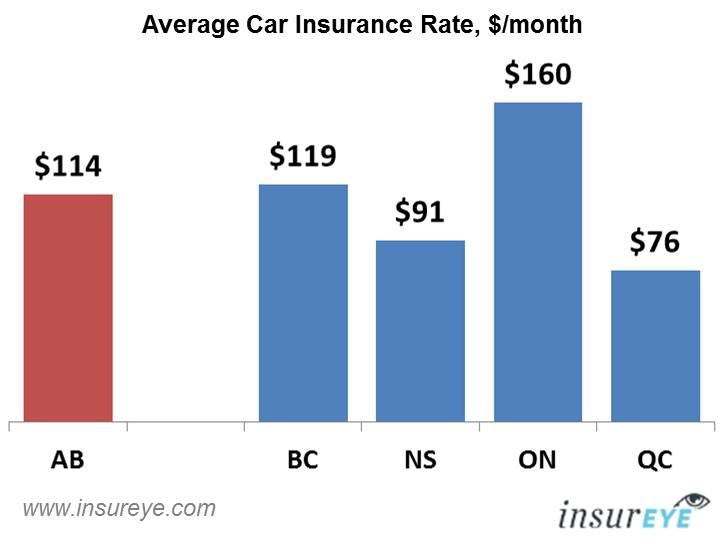

Car Insurance Alberta | Average Rate is $114 per month

Average Cost of Car Insurance (2019) | Average Cost of Insurance

How Much Is Car Insurance Per Month ~ news word