Auto Insurance And Home Owners Insurance

The Benefits of Auto and Homeowners Insurance

Having insurance for your car and home is an important investment in protecting your assets. Insurance can provide peace of mind and financial protection in the event of an accident or disaster. Whether you're a first time insurance buyer or someone looking for a better deal, understanding the benefits of auto and homeowners insurance can help you make an informed decision.

Auto Insurance

Auto insurance provides coverage for you and your vehicle in the event of an accident, theft, vandalism, or other covered losses. Typically, auto insurance policies include liability coverage, which pays for the medical and repair costs of other drivers involved in an accident for which you are at fault. Other optional types of coverage include comprehensive, collision, and uninsured/underinsured motorist coverage. Comprehensive coverage pays for damage to your vehicle caused by events other than a collision, such as theft, fire, or weather. Collision coverage pays for damage to your vehicle caused by a collision with another car or object. Uninsured/underinsured motorist coverage pays for your medical or repair costs if the other driver in an accident is uninsured or underinsured.

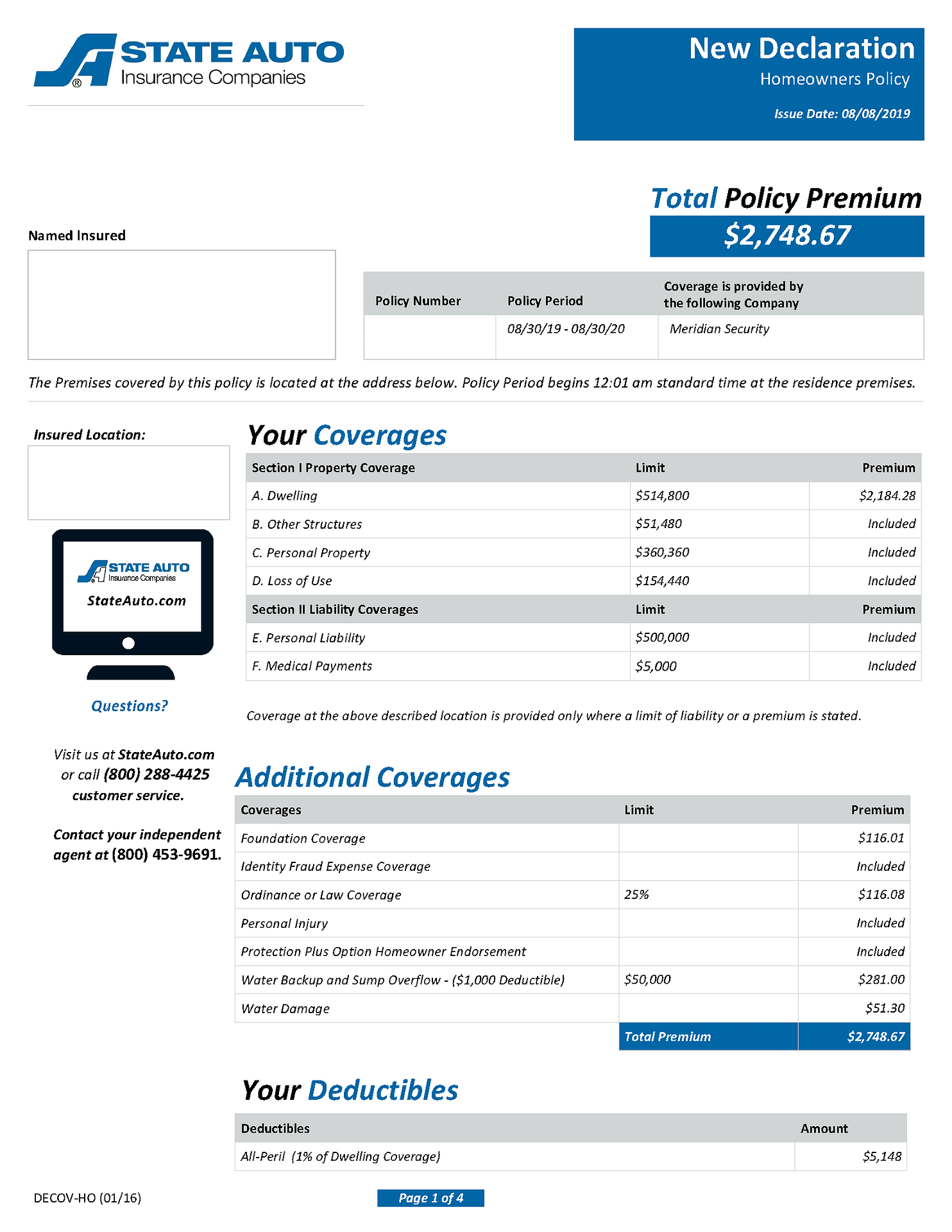

Homeowners Insurance

Homeowners insurance provides coverage for a variety of events that could cause damage to your home or property. This includes coverage for theft, fire, vandalism, and other perils. In addition, homeowners insurance also provides liability coverage to protect you from financial loss in the event of a lawsuit. Homeowners insurance policies typically also include coverage for additional living expenses if your home is damaged and you must temporarily live elsewhere.

Benefits of Auto and Homeowners Insurance

Having auto and homeowners insurance is an important part of protecting your assets. With auto insurance, you can have peace of mind knowing that you’re protected from financial loss if you’re involved in an accident. Homeowners insurance provides protection from a variety of risks, including theft, fire, and other perils. In addition, both types of insurance provide liability coverage, which can protect you from financial loss if you’re sued.

Finding the Right Coverage

When shopping for auto and homeowners insurance, it’s important to compare different policies and find the coverage that’s right for you. Make sure to read the fine print and understand the terms and conditions of the policy before signing up. Also, consider the cost of the policy and whether it’s within your budget. Finally, consider the reputation of the insurance company and make sure that it’s one that you can trust.

Conclusion

Auto and homeowners insurance are important investments in protecting your assets. Make sure to do your research and find the coverage that’s right for you. Understand the terms and conditions of the policy and make sure that the cost is within your budget. With the right coverage, you can have peace of mind knowing that you’re protected from financial loss.

The Best Ways To Choose The Very Best Car Insurance Coverage | This

4 Insurance Types | Auto | Homeowners | Renters | Health | IASTL

Td Home And Auto Insurance Number

Auto + Home Insurance Bundles - Frisco TX | JGS Advisors

Auto and Homeowners Insurance Home