Low Cost Car Insurance Florida

Low Cost Car Insurance in Florida – Enjoy the Benefits

Florida is considered a major hub for car insurance. With so many people living in the state, it isn’t surprising that car insurance companies are competing to offer the best coverage and the lowest cost car insurance. The Sunshine State offers many options for low cost car insurance that can save you money while still providing you with the protection you need.

Benefits of Low Cost Car Insurance in Florida

Low cost car insurance in Florida offers a variety of benefits to drivers. First and foremost, it allows you to save money on your car insurance premiums. In addition, it offers you the protection and peace of mind that you need to keep yourself and your vehicle safe. Here are some additional benefits of low cost car insurance in Florida:

- Lower premiums than other states

- Wide range of coverage options

- Affordable deductibles

- Discounts for multiple policies and good drivers

- Flexible payment plans

Finding Low Cost Car Insurance in Florida

Finding low cost car insurance in Florida is fairly easy. Most companies offer competitive rates, so you can shop around to find the best deal. You should also take the time to compare different coverage options to find the one that best suits your needs. Additionally, you should be sure to ask about any discounts or incentives that may be available.

Tips for Finding Low Cost Car Insurance in Florida

When looking for low cost car insurance in Florida, there are a few things you can do to make sure you get the best deal. Here are some tips to keep in mind:

- Shop around and compare multiple quotes from different companies

- Look for discounts for multiple policies, good drivers, and other factors

- Consider raising your deductible

- Pay in full or look for flexible payment plans

- Ask about any special incentives or discounts

Conclusion

Low cost car insurance in Florida is a great option for drivers who want to save money on their premiums while still getting the protection they need. By making sure you shop around and compare quotes, you can find the best coverage at the lowest cost. Additionally, you should be sure to look for any discounts or incentives that may be available to help you save even more.

Who Has the Cheapest Auto Insurance Quotes in Florida? (2019

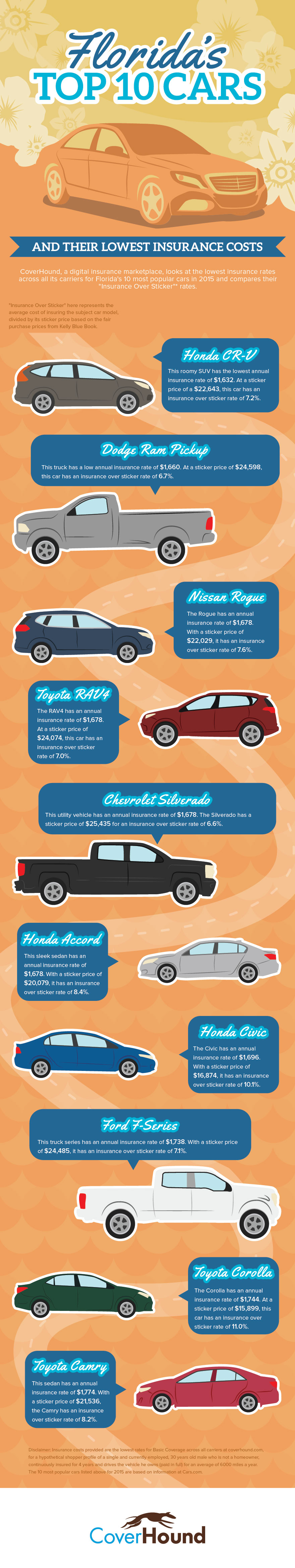

Florida's Top 10 Cars and Their Lowest Insurance Costs (Infographic

The Cheapest Car Insurance Info: Low Cost Car Insurance

Who Has the Cheapest Auto Insurance Quotes in Florida?