How To Insure My Car For A Month

Friday, February 9, 2024

Edit

How To Insure My Car For A Month

Why Would I Need To Insure My Car For A Month?

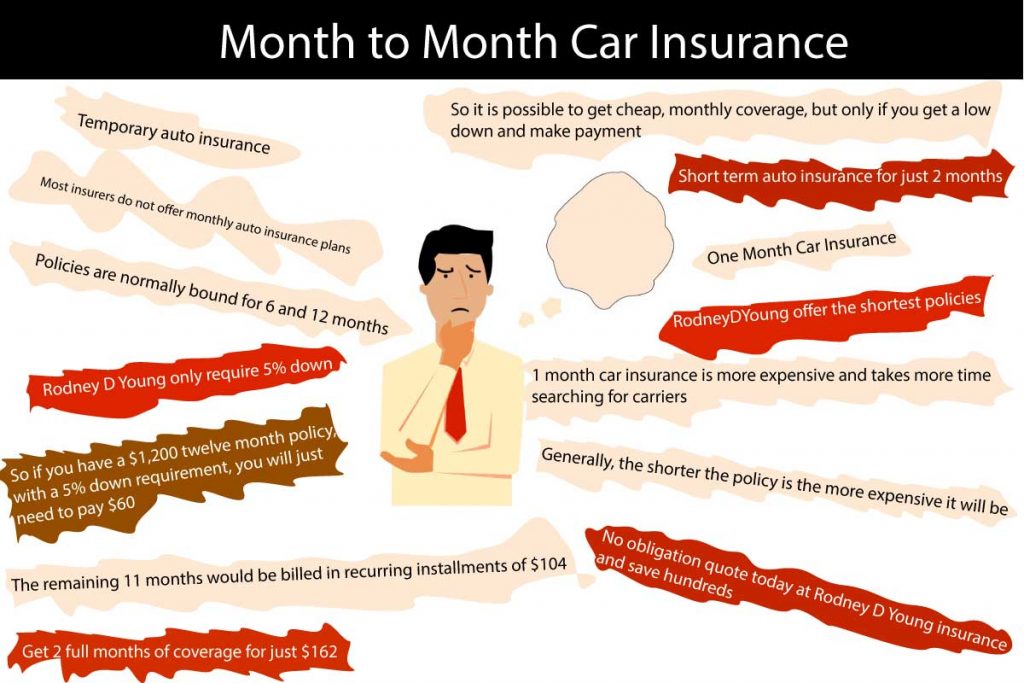

There are a number of situations where you may need to insure your car for a month. You may be travelling and need to insure your car for just the period of your journey. You may have just bought a car and need a month's cover until your annual policy kicks in. Or, you may have a gap in your existing insurance policy and need a month's cover to bridge the gap. Whatever the reason, it is possible to get short-term, monthly insurance for your car.

How Do I Find A Short-Term Insurance Policy?

The best way to find a short-term policy for your car is to shop around online. There are a number of companies offering short-term car insurance policies, so it is worth taking the time to compare the different policies and prices to make sure you get the best deal. You should also check that the policy offers the level of cover you need, as some policies may have restrictions or exclusions which you should be aware of.

What Should I Look For In A Short-Term Insurance Policy?

When looking for a short-term insurance policy, you should make sure that the policy covers you for the period you require. Some policies may be for a minimum of 28 days, so if you only need cover for a shorter period you should check this before signing up. You should also check the level of cover you are getting and make sure that it is adequate for your needs.

You should also check what the policy covers, as some policies may have restrictions or exclusions which you need to be aware of. For example, some policies may not cover certain types of damage or loss, or may not cover you for driving a particular type of vehicle.

What Documents Do I Need To Provide?

When signing up for a short-term insurance policy, you will need to provide some documents to prove your identity and the vehicle you are insuring. You will usually need to provide documents such as your driving licence, proof of address, and the vehicle registration document. You may also need to provide evidence of any no-claims bonus you have.

Can I Get A Discount On My Short-Term Insurance?

Some insurers may offer discounts for short-term insurance policies, so it is worth checking with your insurer to see if you are eligible for any discounts. You may also be able to get a discount if you have an existing policy with the insurer, or if you have a good driving record.

What Is The Cost Of Short-Term Insurance?

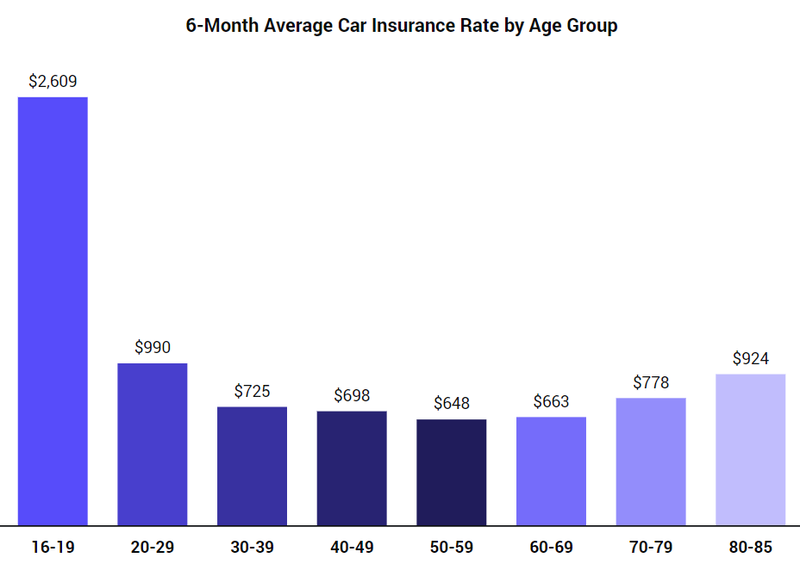

The cost of short-term insurance will vary depending on the insurer and the type of policy you choose. Generally, you can expect to pay more for a short-term policy than for an annual policy as the insurer is taking on more risk. However, the cost of short-term insurance can be cheaper than the cost of paying for repairs or car hire if you have an accident.

Cheapest Way To Insure A Car For A Month - Car Retro

CreelAutomotive.com – An Automotive Blog

Month to Month Car Insurance | Just at Rodney D Young

How Much Is It For Car Insurance Per Month - Car Retro

Social Media