Cheap Car Insurance Over 50s

Cheap Car Insurance For Over 50s

The Benefits of Cheap Car Insurance For Over 50s

As you get older, car insurance premiums can go up significantly. This is because insurers see older drivers as more of a risk than younger drivers. However, there are ways to get cheap car insurance for over 50s, and it’s worth taking the time to shop around to get the best deal. Here are some of the benefits of getting cheap car insurance for over 50s.

Cover for Older Cars

One of the advantages of cheap car insurance for over 50s is that it can provide cover for older cars. This can be a great way to save money as older cars tend to be more expensive to insure. Most insurers will offer discounts for older cars, so it’s worth comparing policies to find the best deal.

Lower Premiums

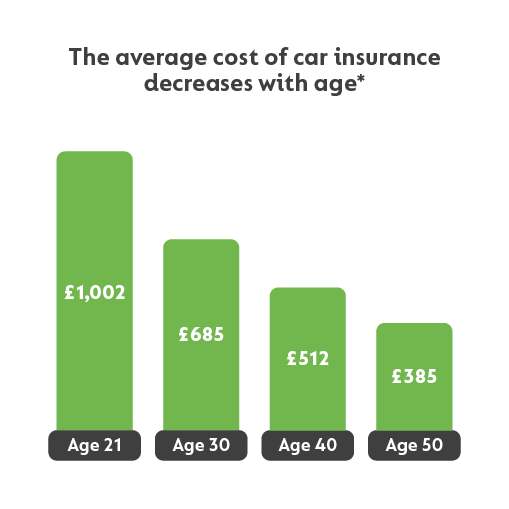

Another benefit of getting cheap car insurance for over 50s is that the premiums are generally lower than for younger drivers. This is because insurers view older drivers as being safer on the roads and less likely to be involved in an accident. The savings can be significant and can help to reduce the cost of running a car.

Discounts for Good Driving Records

As well as being safer drivers, older drivers often have good driving records. This can be taken into account when looking for cheap car insurance for over 50s, and many insurers will offer discounts for drivers with a clean driving record. It’s worth checking with your insurer to see if they offer any such discounts.

No-Claims Bonus

Another way to get cheap car insurance for over 50s is to take advantage of any no-claims bonus that you may be entitled to. This can be a great way to save money as insurers will often reward drivers who have not made a claim in a certain period of time. It’s worth checking with your insurer to see if they offer any such discounts.

Conclusion

Cheap car insurance for over 50s is available, and it’s worth taking the time to shop around to get the best deal. There are several benefits to getting cheap car insurance for over 50s, such as cover for older cars, lower premiums, discounts for good driving records, and no-claims bonuses. It’s worth checking with your insurer to see what discounts are available.

Cheap Car Insurance Over 50S Uk - Car Insurance Get A Quote From 195

Compare Over 50s Car Insurance Quotes at GoCompare

30 Lovely Car Insurance Quotes for Over 50s

5 Keys to Cheap Car Insurance - NerdWallet

Find cheap car insurance in 8 easy steps • InsureMeta | Cheap car