Car Insurance Death Of Policyholder Named Driver

Car Insurance Death of Policyholder Named Driver Explained

What is Car Insurance Death of Policyholder Named Driver?

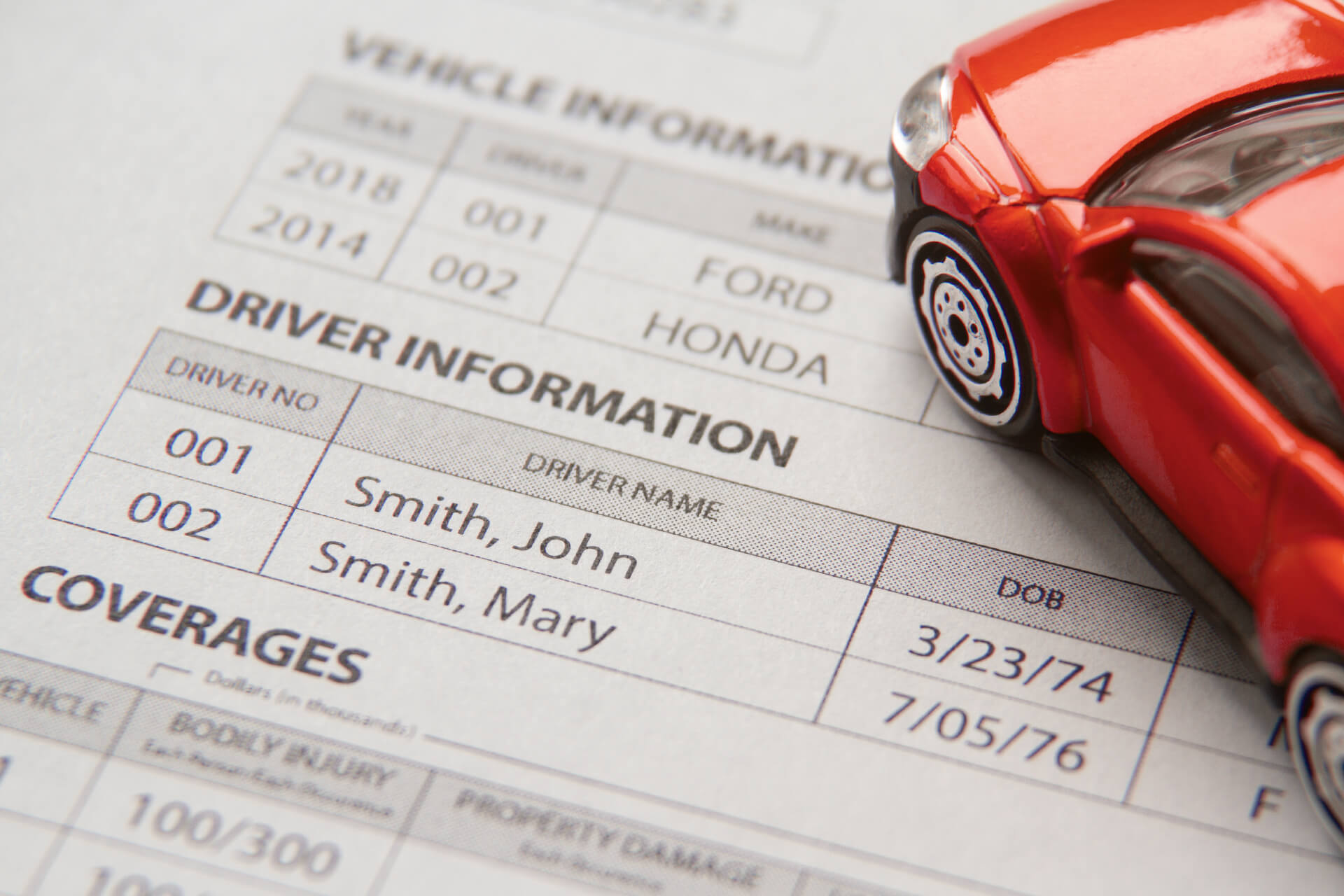

Car insurance death of policyholder named driver is a type of insurance that provides coverage for the death of a policyholder named driver on a policy. This type of insurance is designed to provide financial protection to the family of the policyholder in the event of the death of the named driver on the policy. The policyholder named driver is usually the person who is responsible for the car and is the primary driver of the vehicle. The policyholder named driver is usually the person who pays the premiums for the policy, and is responsible for any claims made under the policy.

What Does Car Insurance Death of Policyholder Named Driver Cover?

Car insurance death of policyholder named driver covers the death of the policyholder named driver and any financial costs associated with that death. This includes funeral costs, medical bills, and any other expenses related to the death of the policyholder named driver. Some policies may also include coverage for the medical bills of any passengers in the car at the time of the death of the policyholder named driver.

What are the Benefits of Car Insurance Death of Policyholder Named Driver?

The benefits of car insurance death of policyholder named driver are numerous. First and foremost, this type of insurance provides financial protection to the family of the policyholder in the event of the death of the named driver on the policy. Additionally, the policyholder named driver is usually the person who pays the premiums for the policy, and is responsible for any claims made under the policy. This means that the policyholder will not be held financially responsible for any claims made against the policy in the event of the death of the named driver.

Who is Eligible for Car Insurance Death of Policyholder Named Driver?

Any driver who is named on a policy is eligible for car insurance death of policyholder named driver. In some cases, the policyholder may be able to add additional drivers to the policy in order to get coverage for the death of the policyholder named driver. It is important to remember that only the policyholder named driver is eligible for coverage in the event of the death of the policyholder named driver.

What are the Limitations of Car Insurance Death of Policyholder Named Driver?

The limitations of car insurance death of policyholder named driver are largely dependent on the policy in question. Generally, the policy will only provide coverage for the death of the policyholder named driver and any associated expenses. Additionally, the policy may not provide coverage for any other drivers on the policy or for any other costs associated with the death of the policyholder named driver.

Conclusion

Car insurance death of policyholder named driver is an important type of insurance that can provide financial protection to the family of the policyholder in the event of the death of the named driver on the policy. This type of insurance can provide coverage for the death of the policyholder named driver and any associated expenses. However, it is important to remember that only the policyholder named driver is eligible for coverage in the event of the death of the policyholder named driver.

What Happens if the Car Insurance Policyholder Dies? - Insurance Panda

Named driver car insurance in Singapore

Page for individual images • Quoteinspector.com

#GST: What Is It? Why Is It Worrisome? What Will Be/Won't Be Taxed

How To Save On Car Insurance: Smart Ways To Lower Your Rate - PointsPanda