Virginia Car Insurance After Dui

Virginia Car Insurance After DUI

If you have been convicted of driving under the influence (DUI) in Virginia, your car insurance premiums are likely to rise significantly. In addition, your insurance company may cancel your policy or deny you coverage altogether. Understanding the effects of a DUI on your insurance helps you make the best decisions for your car insurance needs.

Car Insurance in Virginia

In Virginia, all drivers are required to have liability insurance coverage. This coverage is designed to pay for damages to other people, property, or vehicles if you are found to be at fault in an accident. Liability insurance is typically required to register a vehicle in Virginia and must be maintained as long as the vehicle is driven in the state. Drivers may also opt to purchase additional coverage, such as physical damage coverage, medical payments, and uninsured motorist coverage.

The Effects of DUI on Car Insurance

When a driver is convicted of DUI in Virginia, the conviction is reported to the Virginia Department of Motor Vehicles (DMV). The DMV will then notify the driver's insurance company of the conviction. The insurance company may then cancel the driver's policy or increase the premiums. The insurance company may also deny the driver coverage altogether. If the insurance company does not cancel the policy, the driver may face increased premiums for several years.

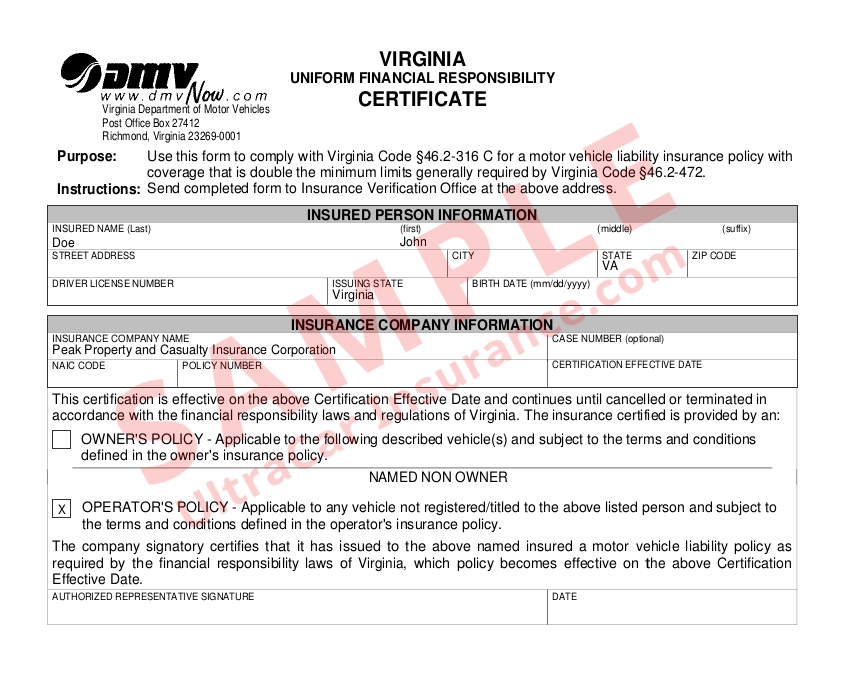

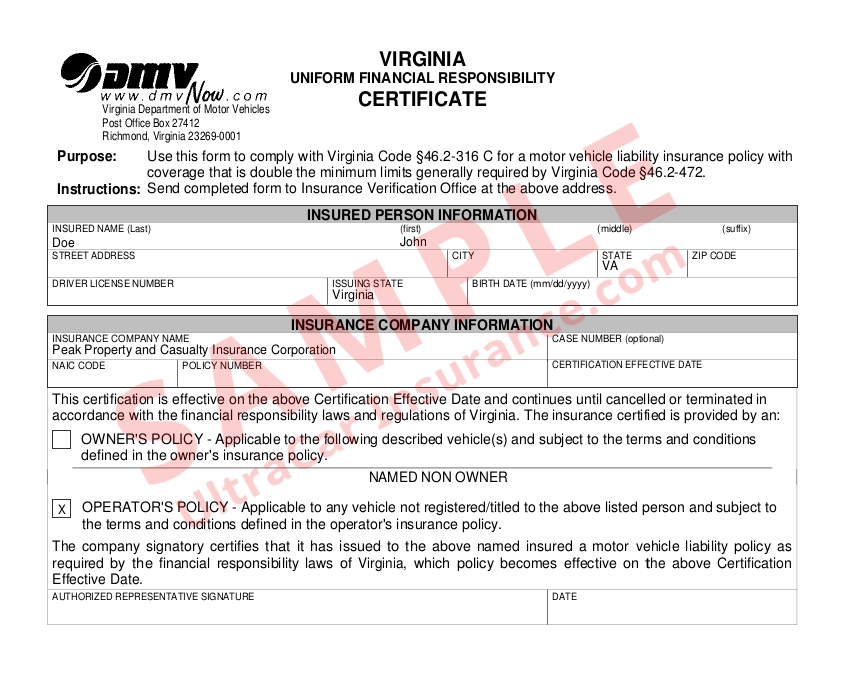

How to Get Car Insurance After DUI

If your insurance company cancels your policy or denies you coverage due to a DUI conviction, you may need to look for a new insurance provider. In this case, it is important to shop around to find the best coverage and premiums. You may also be able to find a company that specializes in providing car insurance to drivers with DUI convictions. If you cannot find an insurance company willing to insure you, you may have to apply for the Virginia Automobile Insurance Plan (VAIP). This plan is designed to provide coverage to drivers who are unable to obtain insurance from other companies.

Cost of Insurance After DUI

The cost of car insurance in Virginia after a DUI conviction varies depending on the insurance provider and the type of coverage purchased. Generally, drivers with DUI convictions can expect to pay more for car insurance than drivers with no convictions. Additionally, drivers may be required to purchase higher levels of coverage than they would otherwise. It is important to shop around and compare rates to find the best coverage and premiums available.

Conclusion

Drivers convicted of DUI in Virginia may face increased car insurance premiums or cancellation of their policy. It is important to understand the effects of a DUI on your insurance and shop around to find the best coverage and premiums available. Additionally, drivers may be able to find a company that specializes in providing car insurance to drivers with DUI convictions. By understanding the effects of a DUI on your car insurance, you can make the best decisions for your car insurance needs.

Virginia SR22 FR44 Insurance | Low SR22 FR44 & Non Owner Rates

List Of Car Insurance Companies In Virginia | vacarinsurance.net

Virginia Dept Of Insurance - chintzdesign

Can You Be Sued in Virginia if You Have Automobile Insurance | BenGlassLaw

(2022) Virginia DUI Penalty - What to Know When Charged With a DUI in VA