List Of Insurance Prices For Cars

List Of Insurance Prices For Cars

What is Car Insurance?

Car insurance is a type of insurance policy that is designed to protect drivers and their vehicles from financial losses that may arise from an accident or other incident. The insurance company will pay for the repair or replacement of the vehicle, as well as any medical costs that may be incurred. Car insurance is mandatory in most states, and is often required by law. The cost of car insurance will vary based on the type of vehicle, the driver's age, driving record, and other factors.

What Factors Affect Car Insurance Prices?

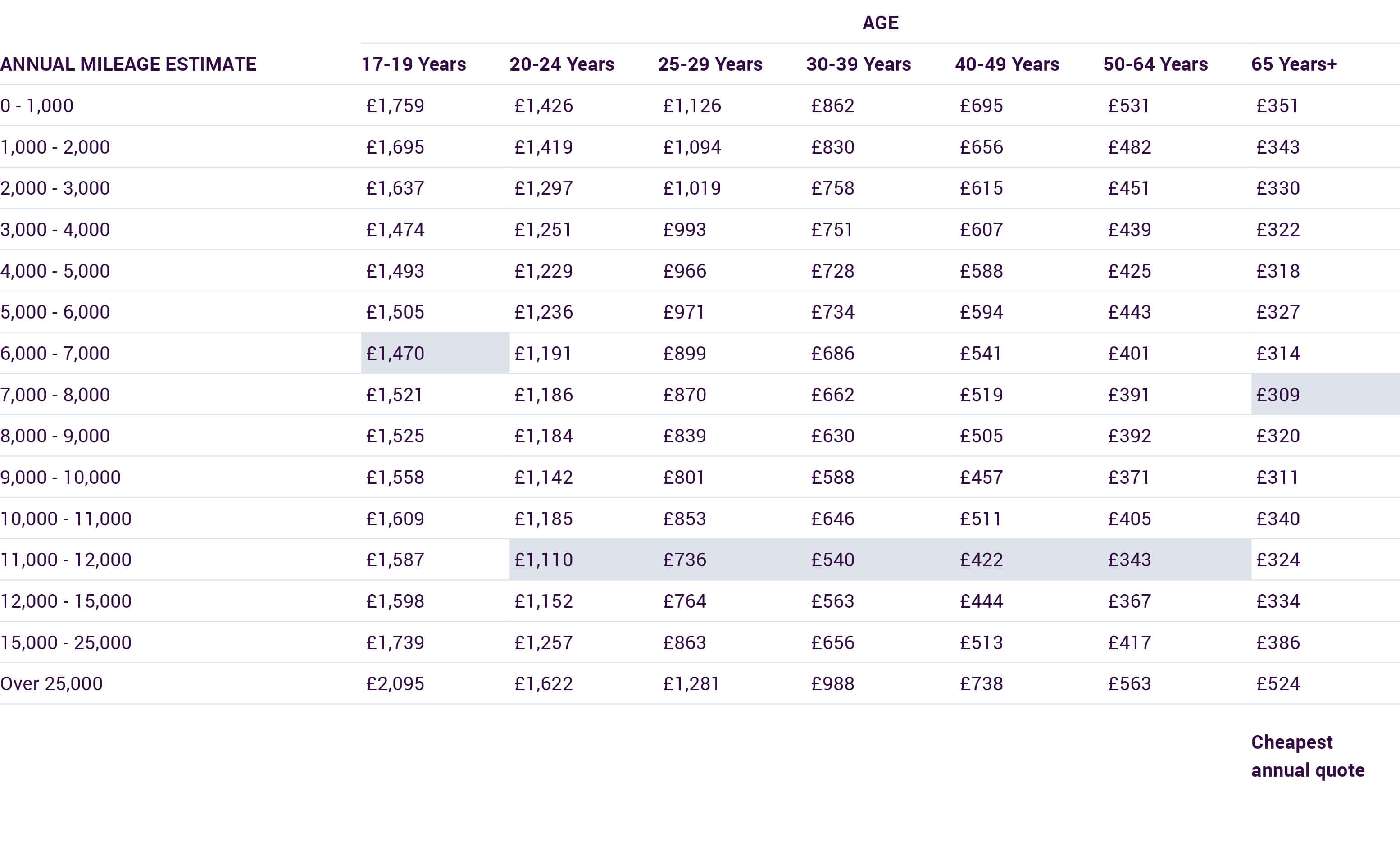

Car insurance rates are based on a variety of factors, including the type of vehicle, the driver's age, driving record, credit score, and other factors. Generally, younger drivers and drivers with poor credit scores will pay higher rates than those with good credit and no claims history. Additionally, drivers of luxury vehicles, such as sports cars, will typically pay higher premiums than drivers of more economical vehicles. The type of coverage purchased also affects insurance premiums.

What Are Some Examples of Car Insurance Prices?

Car insurance prices vary greatly, depending on the factors mentioned above. For example, a young driver with a good driving record may pay as little as $500 per year for basic liability coverage. On the other hand, a driver in their 30s with a poor driving record may pay upwards of $2,500 per year. Luxury vehicles may cost more than $5,000 per year to insure, while more economical vehicles may cost less than $1,000.

How Can Drivers Reduce Their Insurance Prices?

There are several ways to reduce car insurance premiums. Drivers can shop around for the best rates, or compare quotes from multiple insurance companies. It is also important to maintain a good driving record, as this can have a positive effect on premiums. Additionally, drivers may qualify for discounts for bundling their car insurance with other policies, such as home or life insurance.

What Are the Benefits of Car Insurance?

Car insurance is important for any driver, as it provides financial protection in the event of an accident or other incident. In addition to providing financial protection, it also provides peace of mind knowing that if something unexpected happens, you have the coverage necessary to handle the situation. Additionally, car insurance is required by law in most states, and not having it can result in serious penalties.

Conclusion

Car insurance is an important part of being a responsible driver. Knowing the various factors that affect insurance premiums, and taking steps to reduce them, can help drivers save money on their car insurance. Shopping around for the best rates and comparing quotes from multiple companies can also help drivers get the best coverage for their needs. By understanding the importance of car insurance and taking steps to reduce premiums, drivers can save money and have the peace of mind that comes with being adequately insured.

What's the average cost of car insurance in the US? - Business Insider

What's the average cost of car insurance in the US? - Business Insider

Car Insurance Costs by State | Money

Why are low mileage drivers charged more?

This is When to Buy Car Insurance to Save up to 50% | NimbleFins