Direct Line Car Insurance Motor Claims

Thursday, January 11, 2024

Edit

Making a Direct Line Car Insurance Motor Claim

Making an insurance claim is never easy and the process can be quite daunting. But with Direct Line Car Insurance, they make it their mission to provide the quickest and most efficient process possible when it comes to making a claim on your car insurance. With all the stress and upheaval of an accident, the last thing you need is a lengthy and drawn out claims process. Fortunately, with Direct Line’s simple and straightforward claims process, you can get the ball rolling on your car insurance claim quickly and easily.

How to Make a Direct Line Car Insurance Motor Claim

The first step to making a claim with Direct Line is to contact them. You can do this over the phone, online, or through their app. You will then be asked to provide some details about the incident, such as the date and time of the accident, the location, and the details of any vehicles or people involved. You will be asked for your policy number, so make sure you have this to hand when you call.

Once you have provided the details of your claim, Direct Line will advise you on the next steps. This could include having your car inspected by an approved repairer, having a loss adjuster visit to assess the damage, or simply providing you with a claim form to complete. They will also provide you with an immediate decision on whether your claim is accepted and the amount of your excess.

Repairs and Replacement Vehicles

If your car needs to be repaired, Direct Line will arrange for it to be taken to an approved repairer, who will assess the damage and provide a quote for the repairs. Direct Line will then arrange for the repairs to be completed and will pay the bill directly. If your car needs to be written off, Direct Line will arrange for a settlement payment to be made to you.

If you need a replacement vehicle while your car is being repaired, Direct Line will arrange for a hire car to be delivered to you. This hire car can be for up to 14 days and is provided free of charge.

Excess Payment

If you have to pay an excess on your claim, Direct Line will provide you with a payment plan to ensure that the excess is paid in manageable amounts. This payment plan is interest free and will be spread over a number of months. The amount of the excess depends on the type of cover you have and the circumstances of the incident.

Fraudulent Claims

Direct Line takes fraudulent claims very seriously and has a zero-tolerance policy for any fraudulent activity. If you are found to be making a fraudulent claim, your policy will be cancelled and any payments that have been made will be reclaimed.

Conclusion

Making a claim on your Direct Line Car Insurance policy is a straightforward process. All you need to do is call them, provide details of the incident, and they will advise you on the next steps. Direct Line will then arrange for any necessary repairs or replacements to be made and will also provide a payment plan if you need to pay an excess. Make sure you are aware of the consequences of making a fraudulent claim, as this will not be tolerated by Direct Line.

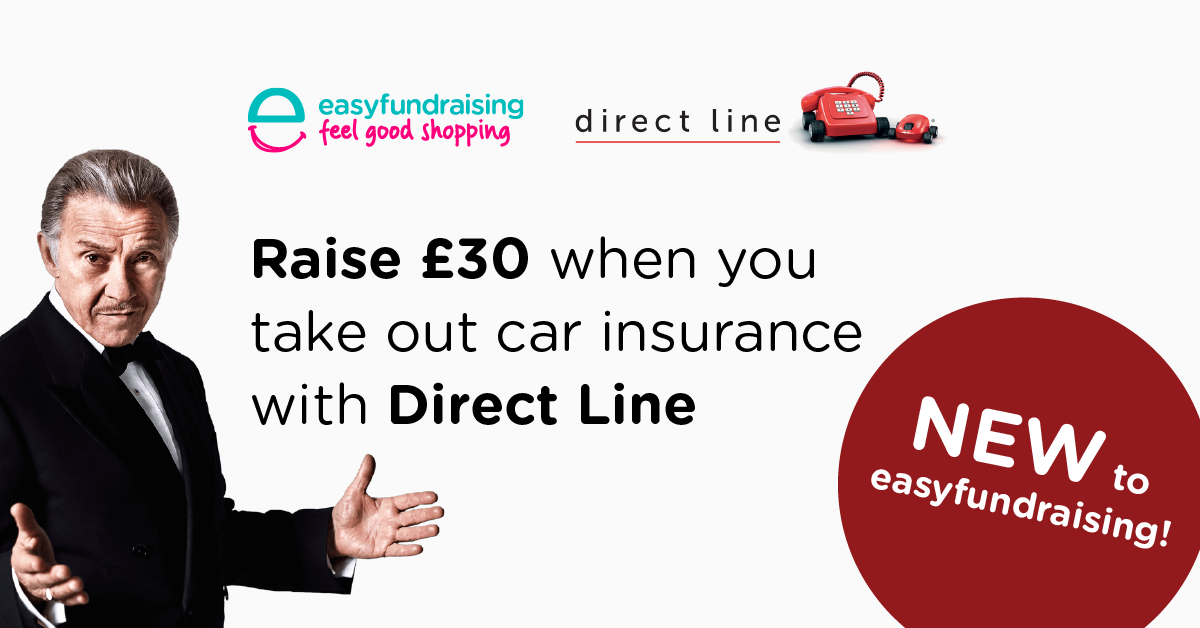

Car Insurance deals | Fundraising | Easyfundraising

Direct Line Logo / Insurance / Logonoid.com

Direct Line Insurance ask if I want to renew - Mr Daz

Online Direct Car Insurance|affordable cheap auto,car insurance quotes

Direct Line offers, deals and discounts | easyfundraising