Direct Line Breakdown Cover Customer Service

Direct Line Breakdown Cover Customer Service: A Comprehensive Guide

Overview

When you are planning a long journey, you must make sure that your car is in top condition. It is essential to have a car that is reliable, safe, and efficient. This is why many motorists choose to take out breakdown cover. Direct Line Breakdown Cover is one of the most popular options on the market, providing a comprehensive range of services to keep motorists safe on the road. In this article, we will provide a comprehensive guide to Direct Line Breakdown Cover customer service.

What is Direct Line Breakdown Cover?

Direct Line Breakdown Cover is a service offered by the insurance company, Direct Line. It provides cover for a variety of breakdown scenarios, including mechanical and electrical faults, punctures, and flat batteries. This cover also includes roadside assistance and recovery of your vehicle in the event of a breakdown. The cover is available to both new and existing customers, and can be tailored to suit individual needs.

What Does Direct Line Breakdown Cover Include?

Direct Line Breakdown Cover includes a range of services to help you in the event of a breakdown. These include roadside assistance, recovery of your vehicle and passengers, onward travel assistance, and legal protection. You also have the option of adding extra cover for your home or business address, or for breakdowns that occur away from home. This includes cover for roadside repairs, as well as for towing and storage of your vehicle in the event of a breakdown.

How Can I Contact Direct Line Breakdown Cover Customer Service?

Direct Line Breakdown Cover customer service is available 24 hours a day, 7 days a week. You can contact them by phone on their customer service number. This number is available on their website and in their literature. You can also contact them by email or post if you prefer. They also have a live chat service which is available on their website.

How Can I Make a Claim?

Making a claim with Direct Line Breakdown Cover is straightforward. You will need to provide details of your breakdown, including the date, time, and location. You should also provide details of any damage or repairs that have been carried out. Once you have provided the necessary information, you will be assigned a claim number, which you can use to track the progress of your claim.

What Are the Benefits of Taking Out Direct Line Breakdown Cover?

The main benefit of taking out Direct Line Breakdown Cover is the peace of mind it provides. Knowing that you are covered in the event of a breakdown gives you the confidence to take on long journeys without worrying about the possibility of your car breaking down. Direct Line Breakdown Cover also offers a range of additional benefits, including access to their roadside assistance service and legal protection.

Direct Line Customer Service Contact Number: 0345 246 3761

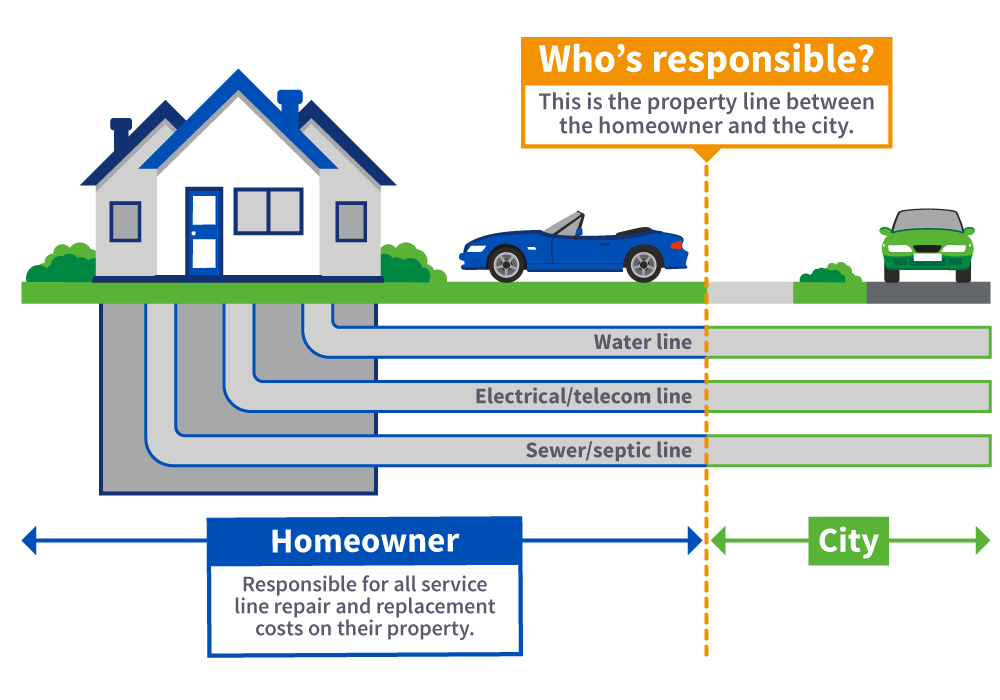

Service Line Coverage

Breakdown Service Word Cloud Stock Illustration - Illustration of

CustomerServiceChap7

Service Line Coverage | Aviva