Car Insurance Cover Note Victoria

What is a Car Insurance Cover Note in Victoria?

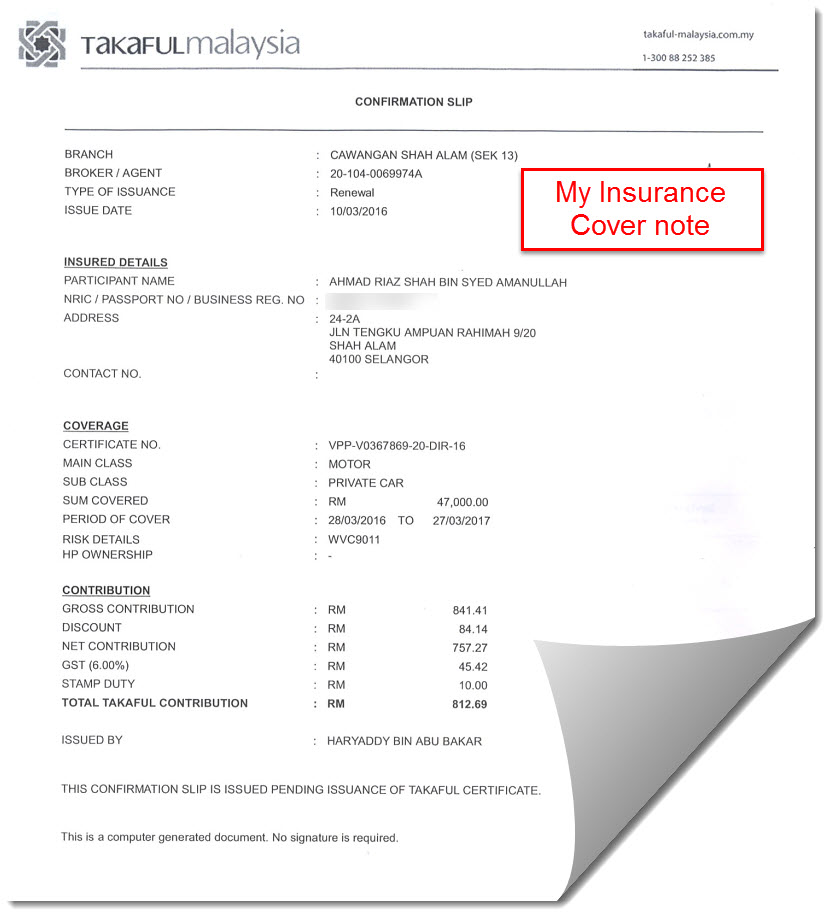

A car insurance cover note is an official document that provides temporary proof of car insurance cover in Victoria, Australia. It is provided by an insurance provider to a policy holder while they are waiting for their policy to be approved and issued. It is also referred to as a certificate of currency and can be used to prove to a third party that you have valid car insurance in Victoria.

A cover note is also known as an interim insurance certificate. It is not to be confused with a policy document or a renewal notice. It will usually state that the policy is subject to approval, and that the insurer is still assessing the risk. A cover note will usually be valid for a period of one month, although it can be extended if required.

When Do You Need a Car Insurance Cover Note?

A car insurance cover note is required when you are taking out a new car insurance policy in Victoria or when you are renewing an existing policy. It is also needed whenever there is an alteration to your existing policy, such as adding or removing a driver or vehicle. The cover note is proof that you are covered by car insurance while the policy is being assessed and processed.

The cover note is also important if you need to drive your vehicle before your policy comes into effect. For example, if you are buying a new car and need to drive it home before the policy is issued, you will need to show the cover note to the police to prove that you have valid insurance cover.

What Information is Included on a Car Insurance Cover Note?

A car insurance cover note will include information about the policy holder, the policy, the dates the cover note is valid for, the duration of the policy, and the amount of premium that is due. It will also include details of the insurer, their contact details, and the policy number.

It is important to note that a cover note is only valid if it is issued by an authorised insurer. If you are presented with a cover note that does not have the official logo of the insurer, it is not a valid document. It is also important to note that a cover note does not constitute a contract of insurance.

What Happens if the Policy is Not Approved?

If the policy is not approved, the cover note will become invalid and the policy holder will be required to apply for a new policy. In this situation, the cover note will be cancelled and any premiums paid will be refunded to the policy holder.

If you are having difficulty obtaining cover in Victoria, it may be worth seeking assistance from an insurance broker. They are experienced in finding the best deals for their clients and may be able to help you find the right policy for your needs.

How Can I Get a Car Insurance Cover Note?

You can apply for a car insurance cover note by contacting your insurance provider directly or by using an online comparison website. When applying online, you will need to provide information about yourself, your vehicle, and the type of cover you need. Once you have submitted your application, you will usually be sent an email with your cover note attached.

Once the cover note is issued, you can use it to show proof of insurance until your policy is approved and issued. It is important to remember that a cover note does not constitute a valid insurance policy and should not be relied upon for long-term cover.

Conclusion

A car insurance cover note is an official document that provides temporary proof of car insurance cover in Victoria. It is issued when you are taking out a new policy or when you are renewing an existing policy. It will include information about the policy holder, the policy, and the amount of premium due. It is important to note that a cover note does not constitute a valid insurance policy and should not be relied upon for long-term cover.

Insurance Policy Holder Name - Blog.Infolensa.com

Insurance Cover: Car Insurance Cover Note

Mula Crew Registration

SIMPLE TOPIC: Main Document Used in Insurance

Contoh Cover Note Insurance Kereta