Average Cost Of Full Coverage Insurance On Car

Average Cost Of Full Coverage Insurance On Car

Understanding Full Coverage Insurance

Having full coverage insurance on your car is important, especially if you are financing the vehicle. It’s not just the law but it’s a smart way to protect yourself and your loved ones. Full coverage is often a combination of two types of coverage, liability and comprehensive. Liability insurance covers any injuries or damage to other people and property that you may cause in an accident. Comprehensive coverage on the other hand, covers damage done to your car, regardless of who is at fault.

Comprehensive coverage may also cover any damages or losses that are caused by something other than an auto accident, such as a fire, a natural disaster, theft, or vandalism. It’s important to note that full coverage does not cover any mechanical or electrical breakdowns, or any other repair costs. Also, if you happen to be in an accident and the other party is at fault and has no insurance or not enough insurance, you may still be liable for some or all of the repair costs.

Factors That Affect Average Cost Of Full Coverage Insurance

The average cost of full coverage insurance on a car will vary depending on a few factors. The make and model of the car, its age, and the age and driving history of the driver all play a role in determining the cost of full coverage insurance. The location you live in, the amount of coverage you need, and the company you choose to insure with will also affect the cost. Insurance companies often offer discounts for certain types of vehicles, such as those that have air bags, anti-lock brakes, and other safety features.

Your credit score can also have an effect on the cost of your insurance. Most insurance companies will look at your credit score when determining your premiums. The better your credit score, the lower your premiums will be. Of course, if you have a history of at-fault accidents or claims, your premiums will be higher.

Average Cost Of Full Coverage Insurance On Car

The average cost of full coverage insurance on a car can range from as little as $300 per year for a basic policy to as much as $3,000 or more for a more extensive policy. The exact cost will depend on the factors mentioned above. It is important to shop around and compare rates from different companies to make sure you are getting the best deal. You should also consider bundling your auto insurance with other types of insurance, such as homeowners or renters, to get even more discounts.

Tips To Lower Your Insurance Cost

There are some things you can do to lower your insurance costs. To start, make sure you are taking advantage of any discounts that you may qualify for. Make sure you have safety features on your car, such as anti-lock brakes, air bags, and an alarm system. You can also increase your deductible to lower your premiums. This means that you will have to pay more out of pocket for any damages, but it can save you money in the long run.

You should also consider taking a defensive driving course, as this may help to lower your premiums. Finally, if you are a student, consider getting good grades, as some insurance companies may offer discounts for students with good grades.

Conclusion

The average cost of full coverage insurance on a car can vary greatly. It will depend on the make and model of the car, its age, the age and driving history of the driver, the location you live in, the amount of coverage you need, and the company you choose to insure with. It is important to shop around and compare rates from different companies to make sure you are getting the best deal.

There are also some things you can do to lower your insurance costs, such as taking advantage of any discounts you may qualify for, increasing your deductible, and taking a defensive driving course. By taking the time to shop around and compare rates, you can ensure that you are getting the best deal on your car insurance.

What is No-Fault Insurance and How Does it Work? | QuoteWizard

Cheap Car Insurance in North Carolina | QuoteWizard

The average cost of car insurance in the US, from coast to coast

Average Car Insurance Cost Chicago

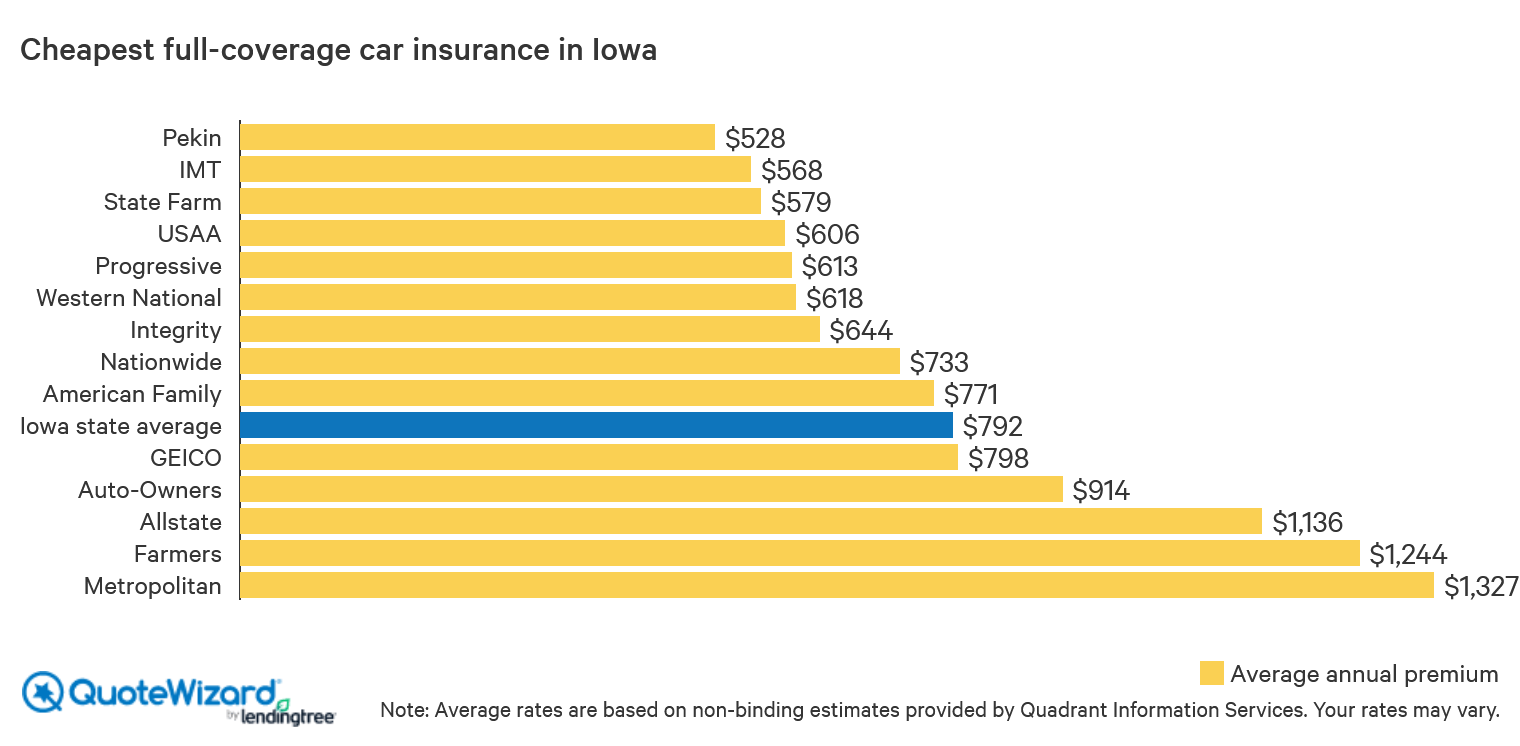

Get Cheap Auto Insurance in Iowa | QuoteWizard