Affordable Car Insurance South Carolina

Affordable Car Insurance South Carolina

Finding the Best Car Insurance in South Carolina

Finding the right car insurance in South Carolina can be a daunting task. With so many different companies offering different levels of coverage, it can be hard to know which one is right for you. Fortunately, there are some tips and tricks you can use to make sure you get the best coverage for the most affordable rates. This article will provide you with some helpful advice on finding the best car insurance in South Carolina.

Research Different Insurance Companies

The first step in finding the best car insurance in South Carolina is to research different insurance companies. There are many different insurance companies that offer car insurance in South Carolina, so it is important to compare rates and coverage options between them. You can do this by visiting each company's website and researching their policies and rates. It is also a good idea to read customer reviews to get an idea of how satisfied people are with the company's products and services. Once you have narrowed down your options, you can start looking into the specific coverage options that each company offers.

Calculate Your Risk Profile

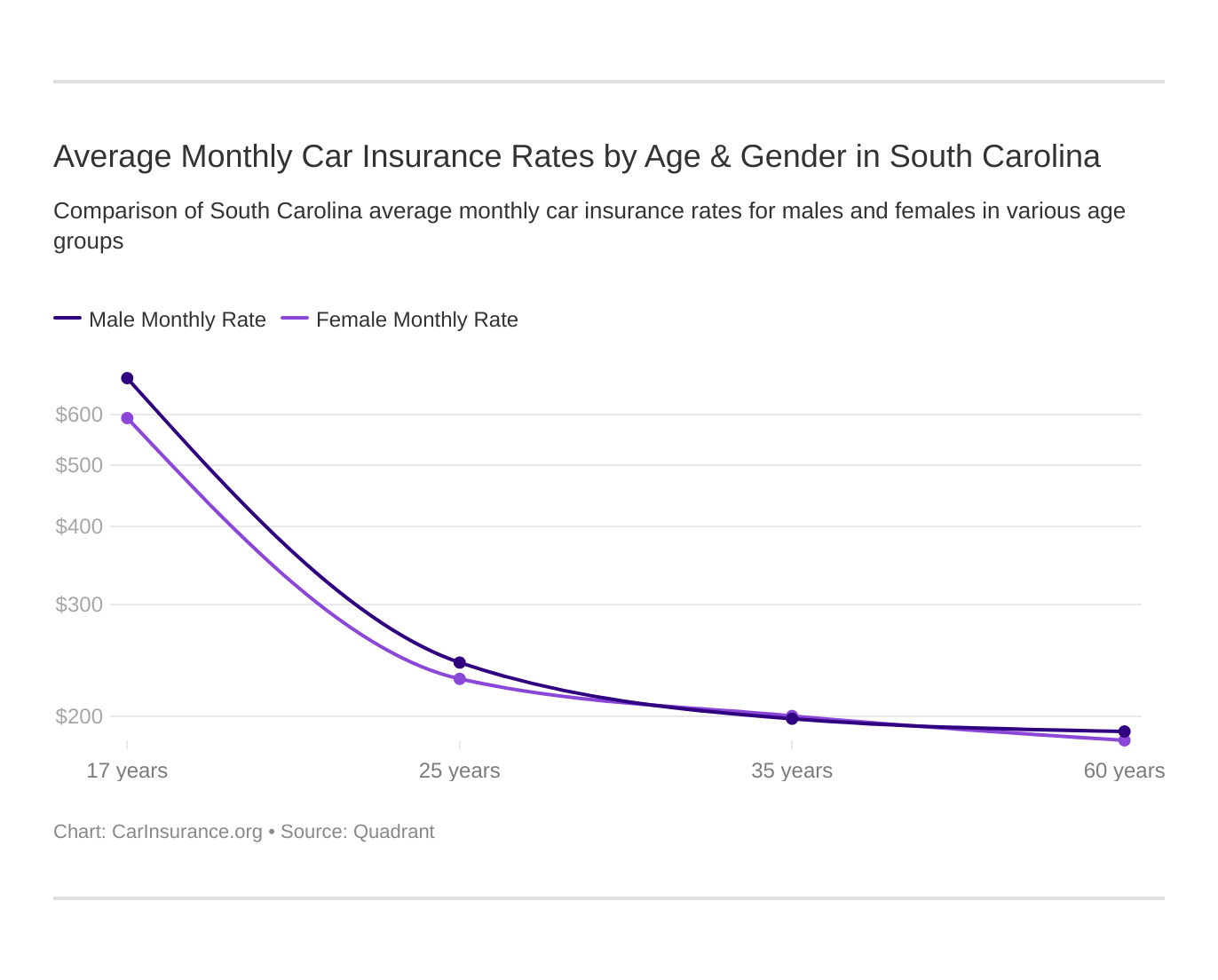

The next step in finding the best car insurance in South Carolina is to calculate your risk profile. Insurance companies use your risk profile to determine how much they will charge you for coverage. Factors such as your age, driving record, and credit score are all taken into consideration when calculating your risk profile. It is important to know what your risk profile is so that you can get the best rate possible for the coverage you need.

Shop Around for the Best Rates

Once you have calculated your risk profile, it's time to start shopping around for the best rates. Make sure you compare rates from multiple companies to get the lowest rate possible. You should also make sure to read the fine print of each policy to make sure you are getting the coverage you need at the price you are willing to pay. It is also a good idea to contact each company and ask questions about their policies and rates so that you can make an informed decision.

Find Discounts and Other Savings Opportunities

In addition to shopping around for the best rates, you should also look for discounts and other savings opportunities. Many insurance companies offer discounts for things such as safe driving, multiple policies, and loyalty. You may also be able to save money by bundling your auto insurance with other types of coverage such as homeowners or renters insurance. It is important to take advantage of any discounts or savings opportunities that may be available to you.

Choose the Right Coverage

Finally, it is important to choose the right coverage for your needs. It is important to make sure you have enough coverage to protect you in the event of an accident or other unforeseen circumstance. You should also make sure that you are not paying for coverage you don't need. Knowing what coverage you need and what you don't will help you get the best car insurance in South Carolina at the most affordable rate.

If you own a vehicle in South Carolina, then you probably know that you

Cheap Car Insurance in South Carolina 2019

South Carolina Car Insurance | The General Insurance

South Carolina Car Insurance (Rates + Companies) – CarInsurance.org

Best Auto Insurance Quote South Carolina - Insurance Shopping Experts