3rd Party Insurance Price Woolworths

Woolworths 3rd Party Insurance Prices and Policies

What is Woolworths 3rd Party Insurance?

Woolworths 3rd Party Insurance is a type of car insurance specifically designed to cover the cost of damage caused to other people’s property, or bodily injury caused to another person, as a result of a car accident. Unlike comprehensive car insurance, 3rd Party Insurance does not cover the cost of repairing or replacing your own vehicle. Woolworths 3rd Party Insurance is a great option if you’re looking to save money on car insurance.

What Does Woolworths 3rd Party Insurance Cover?

Woolworths 3rd Party Insurance covers the cost of damage caused to other people’s property or bodily injury caused to another person, as a result of a car accident. This includes damage to another person’s car, any property that may have been damaged (such as a fence) and medical expenses incurred as a result of the accident. It also includes legal liability for any injury or damage you may have caused to other people or property. Woolworths 3rd Party Insurance does not cover the cost of repairing or replacing your own vehicle.

How Much Does Woolworths 3rd Party Insurance Cost?

The cost of Woolworths 3rd Party Insurance will vary depending on a number of factors, such as the type of car you drive and your driving history. However, Woolworths 3rd Party Insurance is generally much cheaper than comprehensive car insurance. Woolworths 3rd Party Insurance typically ranges from $50 to $300, depending on your individual circumstances. You can get a quote for Woolworths 3rd Party Insurance here.

What Are the Benefits of Woolworths 3rd Party Insurance?

The main benefit of Woolworths 3rd Party Insurance is the cost savings compared to comprehensive car insurance. Woolworths 3rd Party Insurance also offers a range of other benefits, such as 24/7 emergency roadside assistance and a repair guarantee, as well as a range of optional extras such as rental car cover, windscreen cover and no claims discount.

How Do I Get Woolworths 3rd Party Insurance?

Getting Woolworths 3rd Party Insurance is easy. All you need to do is visit the Woolworths website and fill out an online application form. Once you’ve submitted your application, you’ll receive a quote for Woolworths 3rd Party Insurance in your inbox within minutes. You can then accept or reject the quote, and make payment for your policy.

What is Excess and How Does it Work?

Excess is the amount of money you will need to pay out of your own pocket if you make a claim on your Woolworths 3rd Party Insurance policy. The amount of Excess you will need to pay varies depending on your individual circumstances, but typically ranges from $100 to $500. It’s important to remember that the higher the Excess, the lower the premium you will pay for your Woolworths 3rd Party Insurance policy.

Third Party Property Car Insurance | iSelect

Car insurance - Woolworths $100 price beat - OzBargain Forums

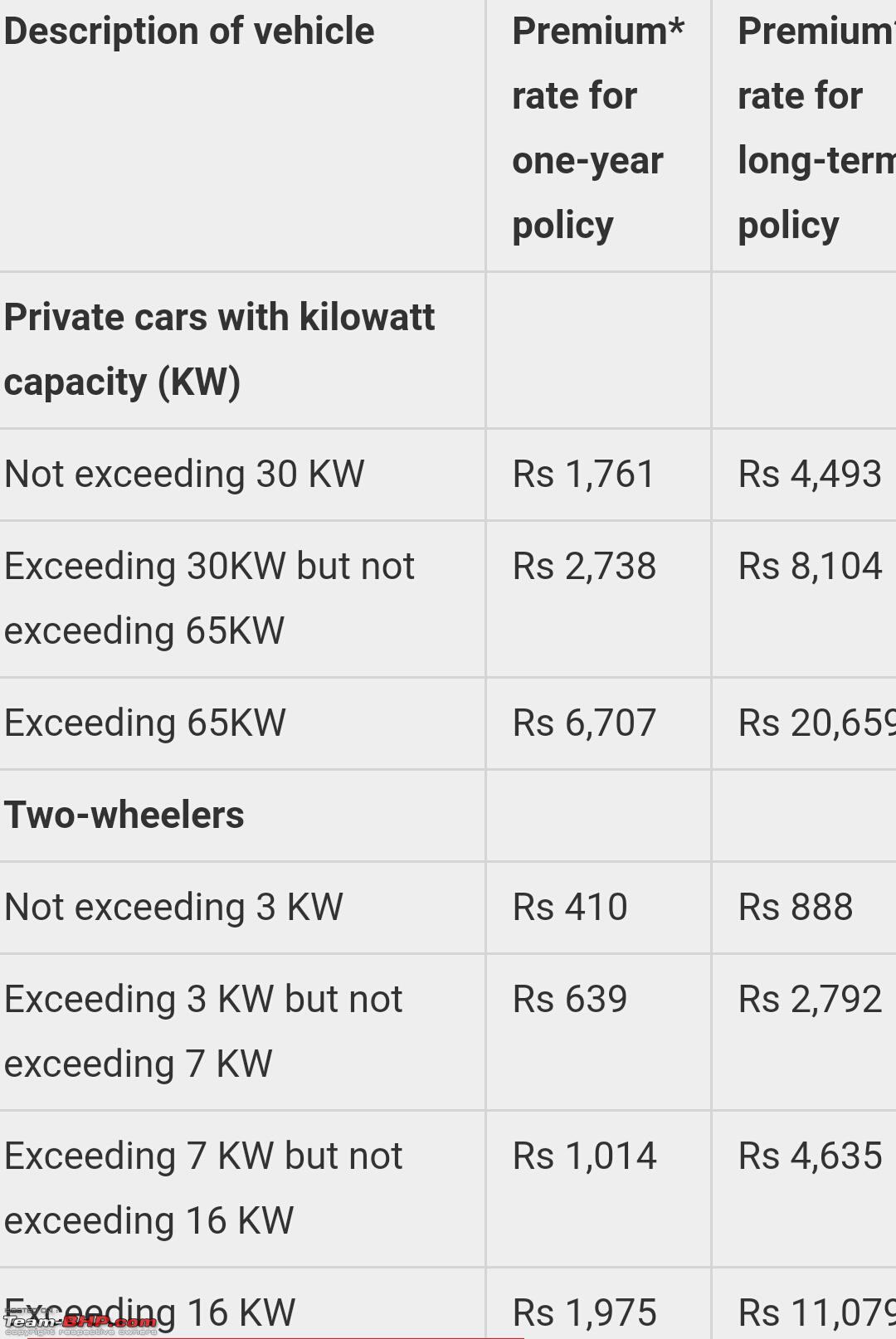

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Third Party Vs Comprehensive Car Insurance Policy | Which is Better

What is Third Party Insurance Policy and its Protection