How To Add Second Driver To Car Insurance

Tuesday, December 12, 2023

Edit

How To Add A Second Driver To Your Car Insurance

What Is The Need For Adding A Second Driver To Car Insurance?

Adding a second driver to your car insurance policy is a great way to save money. Not only does it help spread the cost of the premium, but it also offers more convenience for multiple drivers in the same household. A second driver on the policy can also lower the risk of an accident and give you both more flexibility in your vehicle usage.

When you add a second driver to your policy, it also provides an extra layer of protection. If the second driver is at fault in an accident, they are covered under your policy rather than having to pay out of pocket. This can help to reduce the financial burden of an accident.

How To Add A Second Driver To Car Insurance?

Adding a second driver to your car insurance policy is a straightforward process. The first step is to contact your insurance provider and explain that you would like to add a second driver to your policy. The insurer will need to collect the details of the second driver, such as their name, age, address, and driving history.

Once the details are collected, the insurer will assess the risk of adding a second driver to the policy. The insurer may also need to check both drivers' driving records to ensure that they are considered safe drivers. Depending on the insurer, this process can take anywhere from a few days to a few weeks.

What Are The Benefits Of Adding A Second Driver To Your Policy?

Adding a second driver to your car insurance policy can offer a range of benefits. The most obvious is that it can help to reduce the cost of your premium, as you are spreading the cost across two drivers. This can be especially beneficial if the second driver is a low-risk driver as they will bring down the average risk of the policy.

Adding a second driver also offers more flexibility in terms of vehicle usage. For example, if you are away on business or holiday, the second driver can use the car without the main driver having to worry about the cost of insurance.

What Are The Risks Of Adding A Second Driver To Your Policy?

While there are many benefits to adding a second driver to your car insurance policy, there are also some risks. If the second driver has a bad driving record or is considered a high-risk driver, it can increase the cost of your premium. It can also increase the risk of an accident, as the second driver is less familiar with the car and may not follow the same safety protocols as the main driver.

It is important to consider the risk of adding a second driver carefully and make sure that both drivers are competent and responsible. If the second driver is younger than the main driver, they may be more expensive to insure.

Conclusion

Adding a second driver to your car insurance policy is a great way to save money, offer more convenience and flexibility, and provide additional protection in the event of an accident. However, it is important to consider the risks of adding a second driver and make sure that they are a responsible and safe driver. If you would like to add a second driver to your policy, contact your insurance provider to find out more.

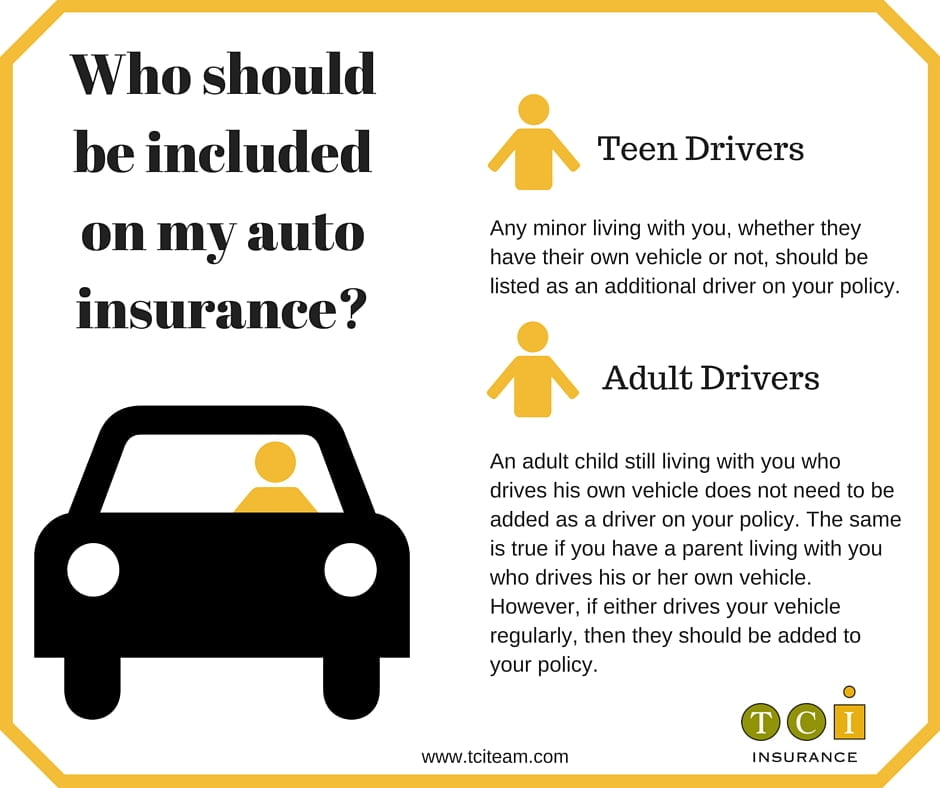

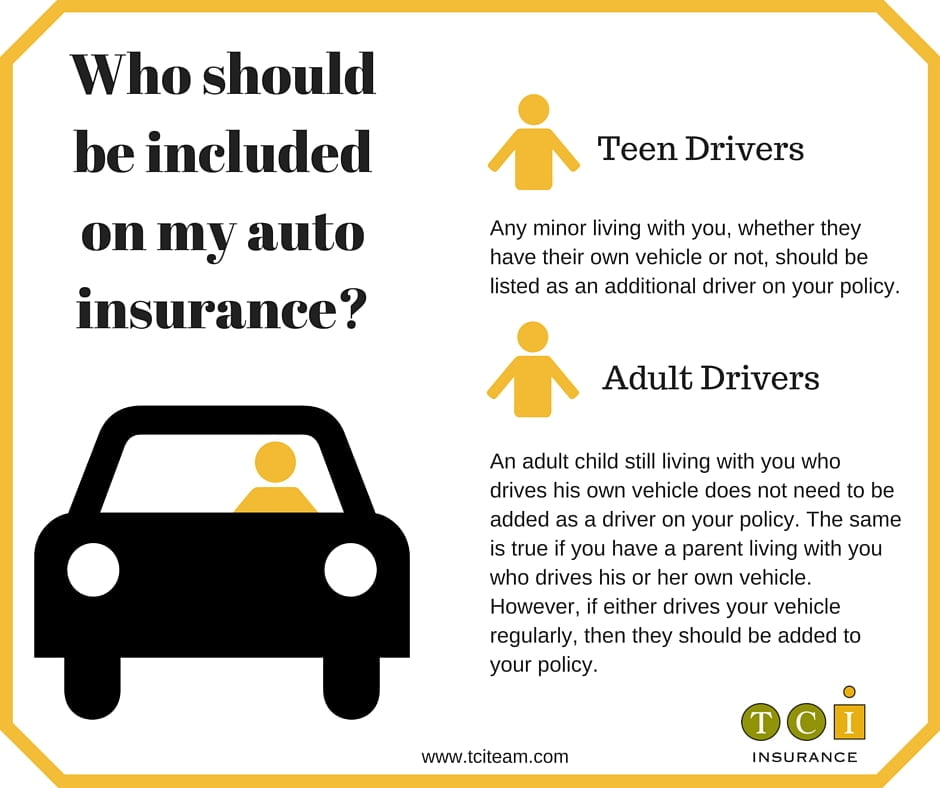

Adding Drivers - TCI Insurance

Car insurance infographic | 20 Miles North Web Design

Be Covered Adequately with Car Insurance Add on Covers - InstaBima

Page for individual images • Quoteinspector.com

Add A Learner Driver To Your Car Insurance | iSelect