Gap Insurance For Used Cars

Gap Insurance For Used Cars: An Essential Investment

What Is Gap Insurance?

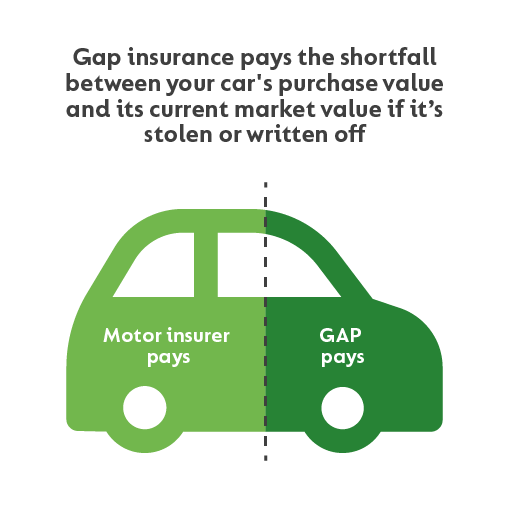

Gap insurance is an insurance policy that covers the difference between what your automobile is worth and what you owe on it if it is totaled or stolen. It is especially important for those who have financed their used cars, as the amount that you owe may be more than the car is worth in the event of an accident or theft. Gap insurance is a must for those who have purchased a used car, as it gives you peace of mind that you won’t be stuck with a loan you can’t pay off if something unexpected happens.

Why Is Gap Insurance Important for Used Cars?

Gap insurance is especially important for those who have purchased a used car, as the depreciation rate for cars is a lot steeper than it is for new cars. This means that if you purchase a used car and it is totaled or stolen, you could end up owing more than its current market value. This is where gap insurance comes in; it will cover the difference between what you owe and the current market value of your car.

Things to Consider When Buying Gap Insurance

When shopping for gap insurance, there are a few things you should consider. First and foremost, you should check with your lender to see if they offer gap insurance. Many lenders do offer gap insurance, so it is important to check with them to see if it is a part of your loan package. If not, you can always look into purchasing gap insurance from a third-party provider.

The Benefits of Gap Insurance for Used Cars

Gap insurance offers a variety of benefits for used car owners. First, it protects you from having to pay off your loan if your car is totaled or stolen. This means that if something unexpected happens to your car, you won’t have to worry about being stuck with a loan you can’t pay off. Additionally, gap insurance may also cover the cost of a rental car if your car is in the shop for repairs, as well as any other expenses related to the accident or theft.

When Should You Purchase Gap Insurance?

Ideally, you should purchase gap insurance when you purchase your used car. This is because gap insurance is most beneficial when the gap between what you owe and the current market value of your car is the greatest. However, if you didn’t purchase gap insurance when you purchased your car, you can still purchase it at any time. It is important to note, however, that the cost of gap insurance may increase if you wait to purchase it after you have already taken out your loan.

Conclusion

Gap insurance is an essential investment for those who have purchased a used car. It offers peace of mind that you won’t be stuck with a loan you can’t pay off if your car is totaled or stolen. Additionally, gap insurance may also cover the cost of a rental car if your car is in the shop for repairs, as well as any other expenses related to the accident or theft. It is important to purchase gap insurance when you purchase your used car, as it is most beneficial when the gap between what you owe and the current market value of your car is the greatest.

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

How Does Gap Insurance Work? | RamseySolutions.com

Used Car Gap Insurance: A Complete Check-List On How It Work

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?

Gap Insurance and You - Ocala Insurance Agency