Do You Have To Pay For Car Insurance Every Month

Do You Have To Pay For Car Insurance Every Month?

Understanding How Car Insurance Works

Car insurance is an important part of being a responsible driver. It is designed to protect you financially in the event of an accident or other incident, as well as to protect other drivers and pedestrians. While the specifics of car insurance policies vary from state to state, there are some general principles that apply to all policies. The most important thing to understand is that car insurance is a financial agreement between you and the insurance company.

In general, car insurance policies are paid on a monthly basis. When you purchase a policy, you agree to pay a certain amount each month for a certain period of time. The amount you pay is based on the type of coverage you choose, the risk factors associated with your vehicle, and other factors. The insurance company then provides coverage for you for the duration of the policy. If you fail to pay your premiums, the policy may be cancelled.

Factors That Affect the Cost of Car Insurance

The cost of car insurance can vary greatly from one person to the next. Factors such as the type of car you drive, your age, driving record, and even your credit score can have an impact on the cost of your car insurance. Additionally, the amount of coverage you choose, the deductible you select, and the type of policy you purchase can also affect the cost of your car insurance.

It is important to understand that the cost of car insurance may change over time. The insurance company may adjust your premiums based on changes in the risk factors associated with your vehicle or your personal circumstances. Additionally, the cost of car insurance may go up or down depending on changes in the insurance industry or the economy.

How to Save Money on Car Insurance

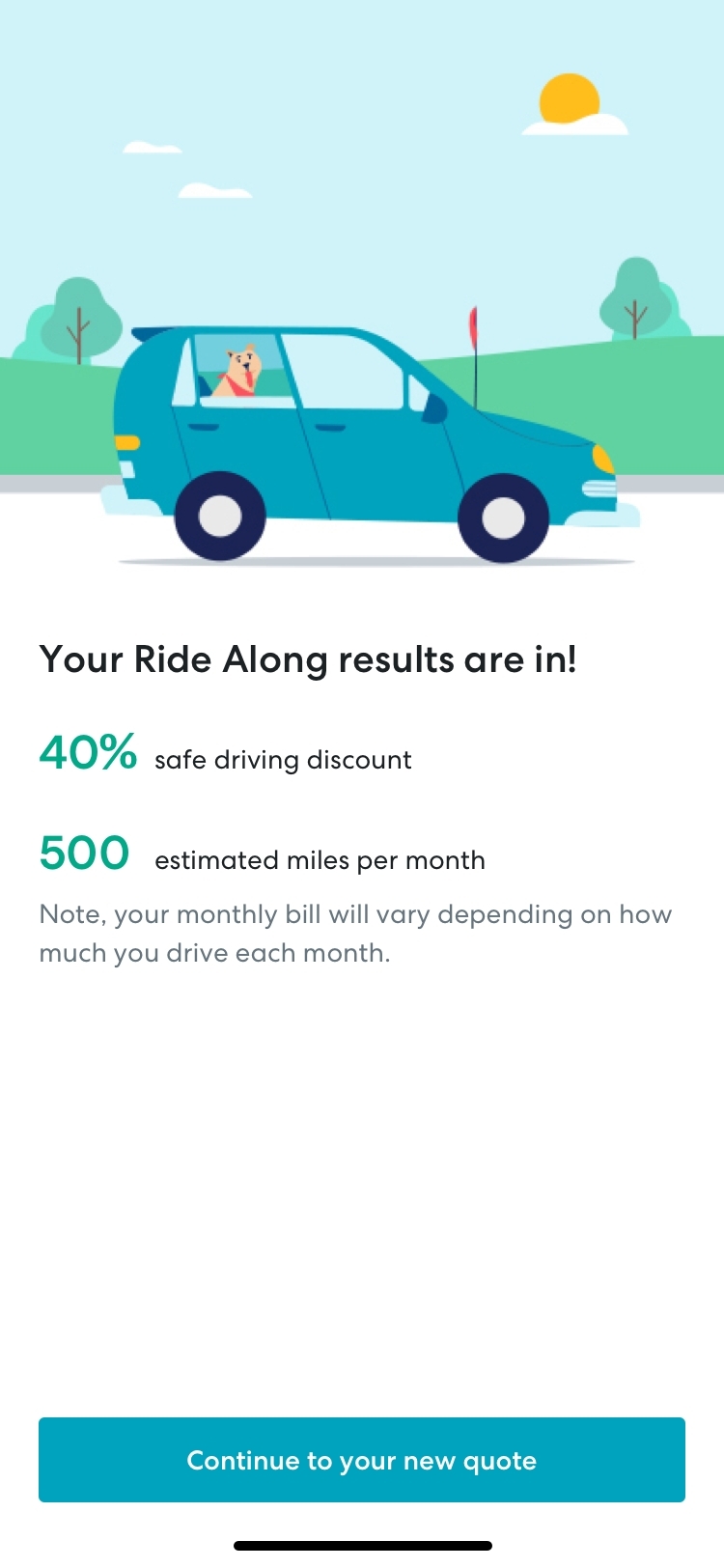

If you're looking for ways to save money on car insurance, there are a few things you can do. First, shop around and compare rates from different insurance companies. This allows you to find the best deal for the coverage you need. You can also consider increasing your deductible, which can lower your premiums. Additionally, many insurance companies offer discounts for certain things such as safe driving or taking a defensive driving course.

Finally, it is important to understand that car insurance is an ongoing expense. While it is possible to save money on car insurance, it is important to remember that you will still have to pay for it every month. To ensure that you don't overpay for your car insurance, make sure to compare rates on a regular basis and to understand the terms of your policy.

Can I Pay Car Insurance Monthly - Calameo Vehicle Insurance Info You

Can I Pay Car Insurance Monthly - Calameo Vehicle Insurance Info You

Can I Pay Car Insurance Monthly - Calameo Vehicle Insurance Info You

Do You Have To Pay Car Insurance Every Year - dewetdesign

Cheapest Car Insurance Pay - Xpose The Real