Classic Car Insurance Uk Rules

Classic Car Insurance Uk Rules

What is classic car insurance?

Classic car insurance, also known as antique car insurance, is an insurance policy designed to protect classic cars. It is often a more complex form of insurance than regular vehicle insurance, as it has special considerations that are not taken into account with regular car insurance policies. Classic car insurance policies are designed to offer a higher level of protection for antique cars, as they are often worth more than regular vehicles. Classic car insurance policies usually include higher levels of coverage than standard car insurance policies, and they may offer specialized coverage for classic car owners.

Who needs classic car insurance?

Classic car insurance is typically used by individuals who own antique or classic cars. These cars are often worth more than regular vehicles, and therefore require higher levels of protection. Classic car insurance is also used by individuals who are restoring classic cars. These individuals may need a specialized type of insurance that is designed to protect their investment in the classic car.

What are the classic car insurance UK rules?

The classic car insurance UK rules vary from one insurer to the next. Generally speaking, classic car insurance policies provide higher levels of coverage than standard car insurance policies. They may also offer specialized coverage such as coverage for car shows, or coverage for vintage parts and accessories. Classic car insurance policies may also offer discounts for drivers who maintain their classic cars in good condition. Additionally, many classic car insurance policies provide coverage for towing and storage in the event of a breakdown.

What is the minimum coverage required?

The minimum coverage required for classic car insurance in the UK is third party only. This is the bare minimum coverage required by law, and it provides financial protection for the third party in the event of an accident. However, it does not provide any financial protection for the insured individual or the classic car. As such, it is recommended that classic car owners opt for more comprehensive coverage than the minimum required by law.

What other coverage options are available?

In addition to third party only coverage, classic car insurance policies may also include other coverage options such as comprehensive coverage, fire and theft coverage, and personal injury coverage. Comprehensive coverage provides protection for all aspects of the classic car, including damage caused by an accident, fire, theft, or vandalism. Fire and theft coverage provides protection against damage caused by fire or theft. Personal injury coverage provides financial protection in the event of an injury or death caused by an accident involving the classic car.

Conclusion

Classic car insurance is an important form of insurance for classic car owners. It provides higher levels of coverage than standard car insurance policies, and it may offer specialized coverage for classic car owners. The classic car insurance UK rules vary from one insurer to the next, and it is important for classic car owners to understand the minimum coverage requirements. Additionally, classic car owners may opt for more comprehensive coverage than the minimum required by law, in order to ensure that their classic car is properly protected.

Why Choose Classic Car Insurance? | Visual.ly

Vital tips to get Classic Car Insurance | Classic car insurance, Car

Fantastic Images Looking for Classic Car Insurance? Contact Hagerty

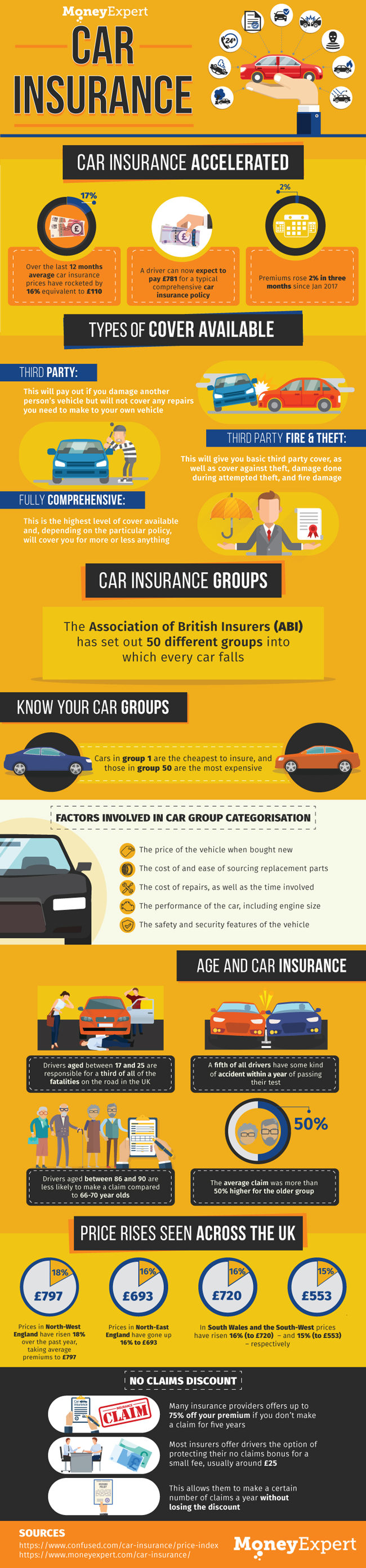

Infographic: Car Insurance Explained

Classic Car Insurance | Creative Ads and more...