Cheapest Home And Auto Insurance Alberta

Cheapest Home And Auto Insurance in Alberta

Save Money on Home and Auto Insurance in Alberta

Finding the cheapest home and auto insurance in Alberta is not as hard as you think. In fact, it can be surprisingly easy and affordable. Alberta is home to some of the lowest insurance rates in Canada, and the options are plentiful. There are a variety of ways to save on home and auto insurance in Alberta, and this article outlines some of the best. From discounts to bundling, there are plenty of ways to get the cheapest home and auto insurance in Alberta.

Shop Around for the Best Rates

The most important thing to do when looking for the cheapest home and auto insurance in Alberta is to shop around. There are many insurance companies in Alberta, and each offers different rates and coverage options. It’s important to compare different policies to find the one that fits your needs and budget best. You can do this by using an online comparison tool, or by contacting each insurance company directly to ask for a quote.

Take Advantage of Discounts

Another great way to save money on home and auto insurance in Alberta is to take advantage of discounts. Many insurance companies offer discounts to customers who buy multiple policies, bundle their coverage, or who have a good driving record. Additionally, there are discounts available for seniors, students, and those with a good credit score. Ask your insurance provider about any discounts that may be available to you.

Choose a Higher Deductible

Choosing a higher deductible can help you save money on your home and auto insurance in Alberta. Your deductible is the amount of money you agree to pay out-of-pocket before your insurance company pays for any damages. The higher your deductible, the lower your monthly premium will be. Of course, this means that you will have to pay more out-of-pocket before your insurance covers any damages.

Improve Your Credit Score

Having a good credit score can also help you save money on home and auto insurance in Alberta. Insurance companies use your credit score to determine your risk level and will often offer lower rates to those with a higher credit score. Improving your credit score can help you get the cheapest home and auto insurance in Alberta.

Choose a Reputable Insurance Company

Finally, be sure to choose a reputable insurance company when looking for the cheapest home and auto insurance in Alberta. Doing your research and reading reviews can help you find the best company for you. You should also look for companies that have a good track record of customer service and claims processing.

Finding the cheapest home and auto insurance in Alberta doesn’t have to be a difficult or expensive process. By taking advantage of discounts, raising your deductible, improving your credit score, and choosing a reputable insurance company, you can save money on home and auto insurance in Alberta.

Cheapest Home And Auto Insurance Alberta - Can a Canadian Citizen buy

Cheapest Home Insurance Quebec – Haibae Insurance Class

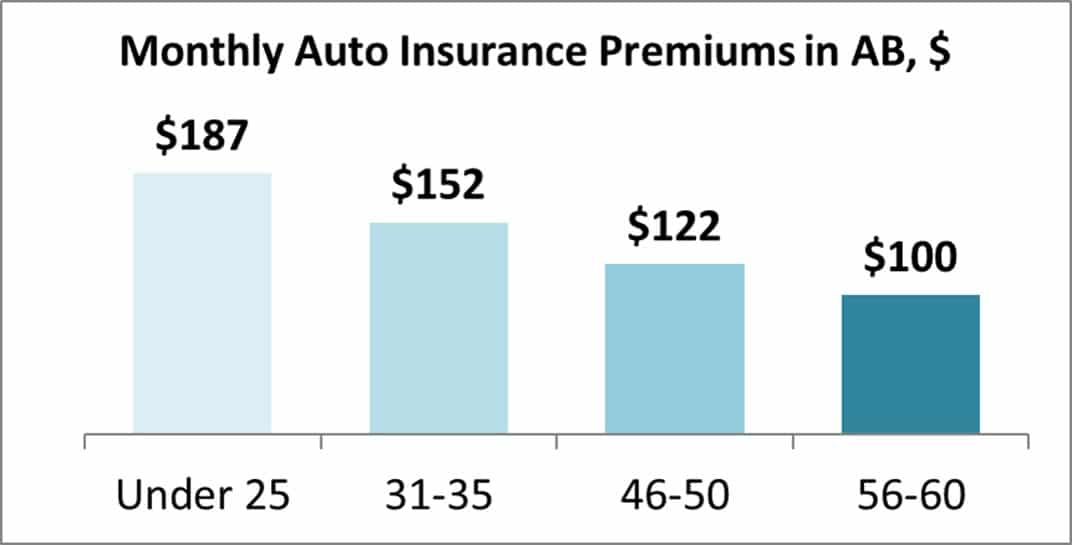

Alberta Car Insurance Costs Canadians on Average $122/month

Auto Insurance: Compare Quotes in Alberta | LowestRates.ca

Getting the Best Home & Auto Insurance | LifeBridge Financial Group