Auto And Home Owner Insurance Ratings In Missouri

Thursday, December 28, 2023

Edit

Auto and Home Owner Insurance Ratings in Missouri

What is an Insurance Rating?

An insurance rating is a numerical score indicating the financial stability and creditworthiness of an insurance company. It is a rating system developed by independent, third-party rating agencies like A.M. Best and Standard & Poor's. Insurance ratings are designed to measure the financial stability of a company and help consumers make informed decisions when shopping for insurance.

The rating of an insurance company is based on a variety of factors including the company's financial stability, management, underwriting practices, and overall creditworthiness. An insurance company's rating is a reflection of how well-prepared it is to handle unexpected losses and how likely it is to be able to pay claims.

Auto and Home Insurance Ratings in Missouri

Missouri has many insurance companies that are rated by A.M. Best and Standard & Poor's. The highest rating an insurance company can receive is an A++ or AAA, while the lowest rating is a D. The state of Missouri has some of the highest rated insurance companies in the nation, with many receiving an A or A+ rating.

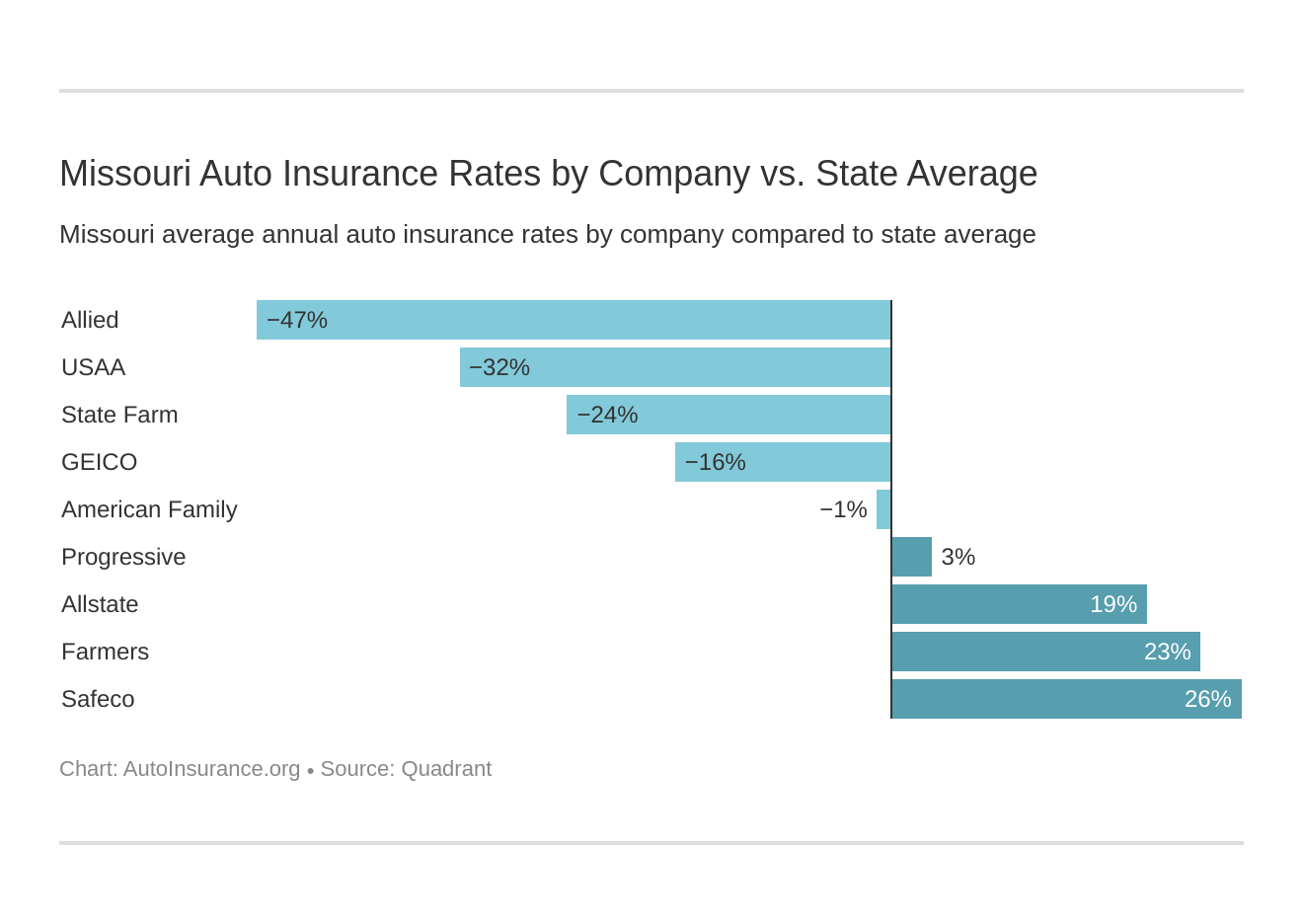

Some of the highest rated insurance companies in Missouri are USAA, State Farm, Allstate, GEICO, and Progressive. All of these companies have an A+ rating from A.M. Best, which is the highest rating that can be achieved.

State Farm has been rated by A.M. Best for over 50 years, and is one of the most established and respected insurance companies in the state of Missouri. USAA also has a strong presence in the state of Missouri, and has consistently been rated as one of the best insurance companies in the nation.

Why Do Insurance Companies Receive Different Ratings?

Insurance companies receive different ratings based on a variety of factors. These include their financial stability, management, underwriting practices, and overall creditworthiness. Insurance companies that are highly rated are considered to be more financially stable and less likely to go out of business, which is important for consumers looking for coverage.

Insurance companies that are rated poorly may not be able to pay out claims, or may take a long time to do so. This can leave consumers in a difficult situation, as they could be left without the coverage they need. Insurance companies that are rated highly are more likely to be able to pay out claims in a timely manner, which can give consumers peace of mind.

How to Find an Insurance Company With a Good Rating in Missouri

Consumers in Missouri can find insurance companies with good ratings by doing an online search. Many websites will provide ratings for insurance companies in Missouri, including A.M. Best and Standard & Poor's. Consumers should compare the ratings of different insurance companies to make sure they are getting the best coverage for their needs.

Consumers should also consider the customer service they will receive from the insurance company they choose. Reviews from other customers can provide a good indication of how well an insurance company will handle claims and customer service.

Conclusion

Consumers in Missouri should take the time to research and compare insurance companies and their ratings. Doing so can help them make an informed decision when shopping for auto and home insurance and ensure they get the best coverage for their needs. Checking ratings from A.M. Best and Standard & Poor's can provide a good indication of an insurance company's financial stability and creditworthiness.

Get Cheap Auto Insurance in Missouri | QuoteWizard

Missouri Auto Insurance [Quotes + Definitive Coverage Guide

Best Home Insurance Rates in Missouri | QuoteWizard

Home Insurance Company Reviews – Haibae Insurance Class

Insurance Company: Auto Insurance Company Reviews And Ratings