Az State Minimum Car Insurance

Az State Minimum Car Insurance Requirements

In the state of Arizona, drivers are required to have car insurance in order to legally drive on the roads. The state's minimum liability requirement is 15/30/10. This means that drivers must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage per accident.

What is Liability Coverage?

Liability coverage is the part of your car insurance policy that pays for other people's medical expenses and property damage if you are at fault in an accident. It does not cover your own medical expenses or damage to your own car. The minimum liability coverage required by the state of Arizona is 15/30/10. This means that your insurance company will pay up to $15,000 for one person's medical expenses, up to $30,000 for medical expenses for all people involved in an accident, and up to $10,000 for damage to property, such as another car or a fence.

Do I Need More Than the State Minimum?

The state minimum is the minimum amount of coverage you must have in order to legally drive in Arizona, but it is not necessarily enough coverage to protect you financially in the event of an accident. Consider purchasing additional coverage such as comprehensive and collision coverage, which will cover the cost of damage to your car, and uninsured/underinsured motorist coverage, which will cover your medical expenses if you are hit by a driver who does not have insurance. It is also a good idea to purchase higher limits of liability coverage, such as 100/300/50, which will provide more protection in the event of a serious accident.

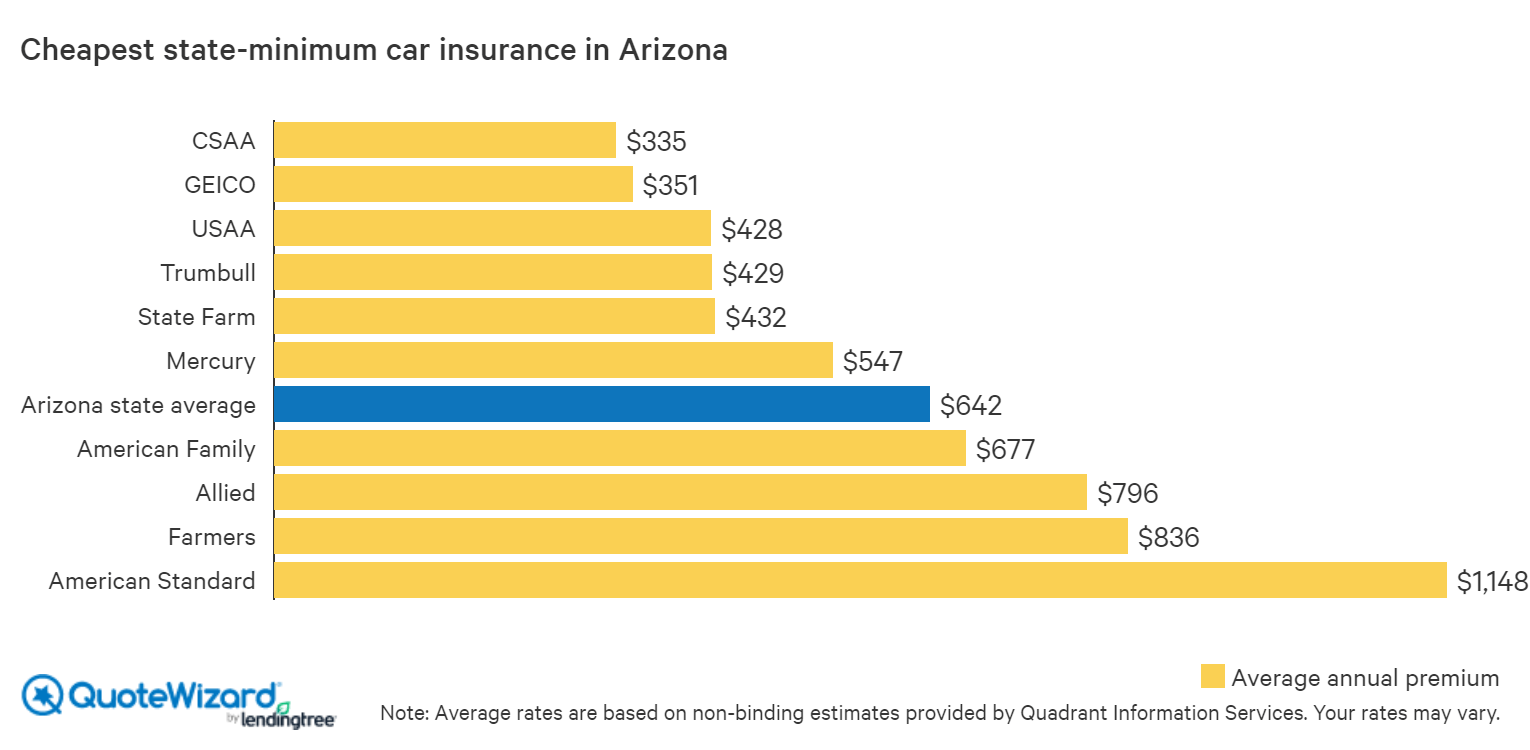

How Much Does Car Insurance Cost in Arizona?

The cost of car insurance in Arizona depends on a number of factors, including your driving record, the type of car you drive, where you live, and the type and amount of coverage you choose. Generally speaking, the more coverage you purchase, the higher your premium will be. But the extra protection you get with higher coverage limits is worth the cost. It is also important to shop around and compare quotes from different insurance companies to make sure you are getting the best rate.

Getting the Right Coverage

In Arizona, drivers must have car insurance in order to legally drive on the roads. The state requires a minimum of 15/30/10 in liability coverage, but it is a good idea to purchase more than the state minimum in order to protect yourself financially in the event of an accident. Shop around and compare quotes from different insurance companies to make sure you are getting the best rate for the coverage you need.

Car Insurance AZ - State Minimum Car Insurance - YouTube

Cheap Car Insurance in Arizona | QuoteWizard

Car Insurance Az / Auto Insurance Policy Glendale Surprise Az Car

Things You Should Know About Purchasing Car Insurance In The USA by

ABC's of Insurance in AZ: Why state minimum auto insurance is not enough