Average Insurance For Mercedes A Class

Sunday, November 5, 2023

Edit

Average Insurance For Mercedes A Class

The Average Cost of Insurance for a Mercedes A Class

The Mercedes A Class comes with a variety of features and benefits, but the cost of insurance can be a major concern for many drivers. The cost of insurance for a Mercedes A Class will depend on a variety of factors including the vehicle’s age, its features, and the driver’s personal history. It is important to compare different insurance companies before purchasing a policy to find the best rates.

Factors that Affect Insurance Costs for a Mercedes A Class

When it comes to insuring a Mercedes A Class, there are a number of factors that will affect the cost of the policy. The vehicle’s age is one of the most important factors that insurance companies consider when determining the cost of a policy. Vehicles that are older than five years tend to have higher insurance premiums. This is because older vehicles are more likely to be involved in an accident than newer vehicles.

The location of the vehicle is also important. Insurance companies consider the frequency of accidents in an area when determining the cost of a policy. Areas with higher rates of accidents tend to have higher insurance rates.

The features of the vehicle are also important. Vehicles that have high-end features such as navigation systems and back-up cameras tend to have higher insurance premiums. The features of the vehicle can also affect the cost of repairs, which can increase the cost of a policy.

Finally, the driver’s personal history will also affect the cost of insurance. Drivers with a history of accidents or violations will have higher insurance premiums than drivers with clean records. Insurance companies consider a driver’s age, gender, and credit score when determining the cost of a policy.

Average Cost of Insurance for a Mercedes A Class

The average cost of insurance for a Mercedes A Class is around $1,500 per year. This cost will vary based on the factors mentioned above. For example, drivers with clean records may be able to find policies for less than $1,000 per year. On the other hand, drivers with a history of accidents or violations may find policies for more than $2,000 per year.

It is important to compare different insurance companies before purchasing a policy. Different companies will have different rates for the same vehicle. It is also important to consider the features of the policy such as the deductible, the coverage limits, and the types of discounts available.

Tips for Saving Money on Insurance for a Mercedes A Class

There are a few steps that drivers can take to save money on insurance for a Mercedes A Class. The first step is to compare different companies to find the best rates. Drivers should also consider raising their deductible, as this can help to reduce the cost of the policy.

Drivers should also consider taking advantage of any discounts that are available. Many insurance companies offer discounts for safe driving, good student discounts, and discounts for bundling policies. Drivers should also consider taking a defensive driving course, as this can help to reduce the cost of the policy.

Finally, drivers should consider installing an anti-theft device in the vehicle. This can help to reduce the cost of the policy, as it will make the vehicle less attractive to thieves.

Conclusion

Insuring a Mercedes A Class can be expensive, but there are a few steps that drivers can take to save money. Drivers should compare different companies to find the best rates. Drivers should also consider raising their deductible, taking advantage of any discounts available, and installing an anti-theft device in the vehicle. By taking these steps, drivers can save money on insurance for their Mercedes A Class.

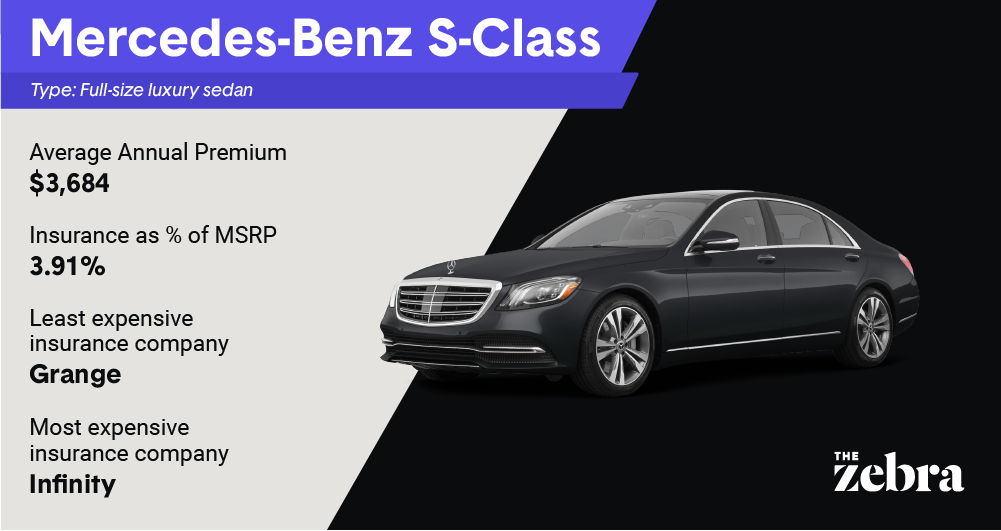

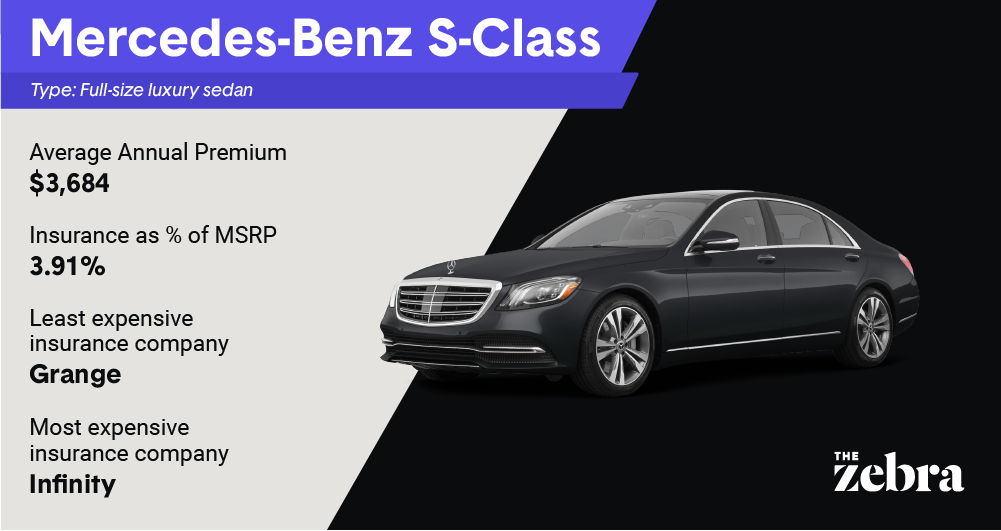

The 10 Most Expensive Cars to Insure in 2022 | The Zebra

2017 17 MERCEDES-BENZ A CLASS 1.6 A 180 AMG LINE PREMIUM 5D 121 BHP

Mercedes Benz Financial: Mercedes Insurance Uk

Fact Checked Insurance Review: What you need to know about car

UK's Best Car Insurance Providers | mustard.co.uk