Insurance For A Rebuilt Title

Insurance for a Rebuilt Title: What to Know

What is a Rebuilt Title?

A rebuilt title is awarded to vehicles that have been salvaged, rebuilt, and then inspected to be deemed safe and ready to be driven. Generally, this type of title is granted when a vehicle has been damaged in a severe accident, flood, or fire and then has been repaired and inspected. Many states will accept these vehicles and award a rebuilt title once the repairs have been made and the vehicle has passed an inspection.

Can You Get Insurance on a Rebuilt Title?

Yes. Insurance companies will insure vehicles with a rebuilt title, though coverage is likely to be more expensive than normal. Some insurers may even refuse to cover the vehicle, so shop around to find the best deal. Be sure to read the policy carefully, as some may not cover certain types of damage or accidents. Be sure to ask about any exclusions that may apply to the policy.

What Types of Insurance Are Available?

The types of insurance available for a rebuilt title vehicle are the same as for any other car. Liability coverage is the most basic type of coverage and is required by law in most states. It covers the cost of any property damage or bodily injury resulting from an accident for which you are liable. Collision and comprehensive coverage are optional and cover the costs related to damage to the car itself. Uninsured/underinsured motorist coverage is also available and covers the costs of medical bills or damage to your vehicle if you are hit by someone without insurance.

What Additional Costs Should I Expect?

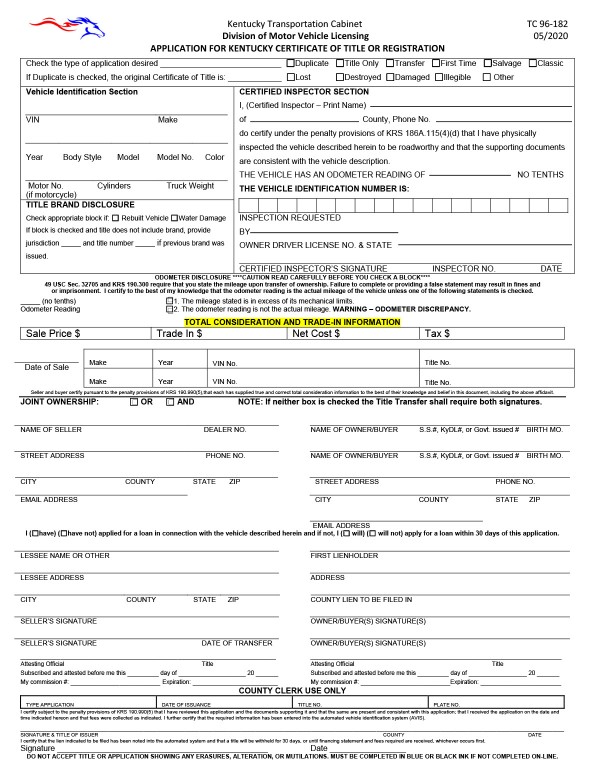

In addition to the cost of insurance itself, there may be additional costs associated with a rebuilt title vehicle. These can include higher registration fees and taxes, as well as higher inspection fees. Depending on the state, there may also be additional fees for a salvage inspection or for a rebuilt title. Be sure to research the costs associated with your vehicle before purchasing.

What Other Considerations Should I Make?

When considering a rebuilt title vehicle, it is important to be aware of the potential risks. These vehicles may have hidden damage that was not repaired correctly and could lead to problems down the road. It is also important to carefully research the vehicle's history and to get a full inspection and appraisal before purchasing. Finally, be sure to research the costs associated with the vehicle and any additional insurance coverage that may be required.

In Summary

A rebuilt title is awarded to vehicles that have been salvaged, rebuilt, and inspected to be deemed safe to drive. Insurance companies will insure these vehicles, though coverage is likely to be more expensive than normal. Be sure to research the costs associated with the vehicle, any additional insurance coverage that may be required, and the vehicle's history before purchasing.

flowerdesignersnyc: What Is A Rebuilt Car Title

美國加拿大購車注意要點及車輛歷史報告 - 璟上國際有限公司

Rebuilt Title Cars For Sale In Ky / Salvage Cars For Sale - For more

Where to sign title when selling car california - lasopareal

Can You Get Insurance On A Rebuilt Title : What Is Rebuilt Title Car