How Much Is Car Insurance In Michigan Per Month

How Much Is Car Insurance In Michigan Per Month?

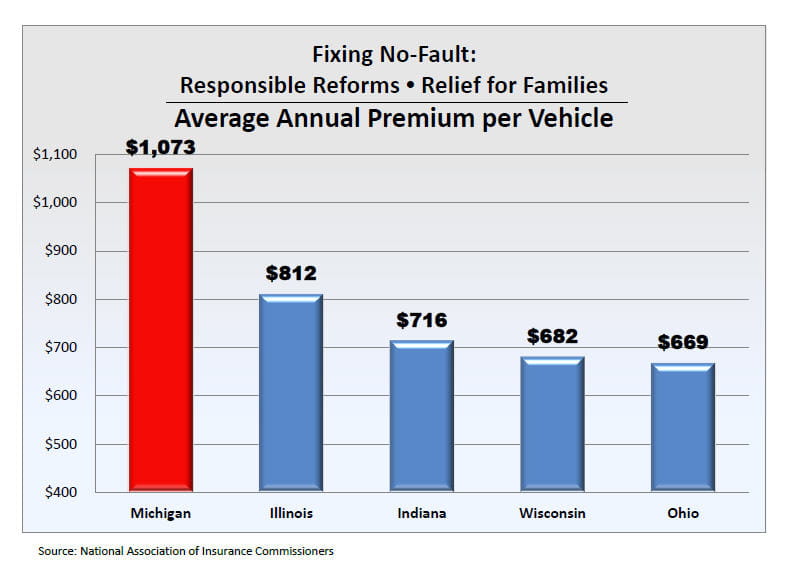

Car insurance rates in Michigan can vary greatly depending on a number of factors. Drivers in Michigan must have liability insurance as well as personal injury protection (PIP) coverage, and the amount of coverage required is determined by the state. As a result, Michigan drivers can expect to pay a higher premium than drivers in other states. However, there are some things that drivers can do to reduce their auto insurance premiums. Read on to learn how much is car insurance in Michigan per month.

Factors That Affect Car Insurance Rates in Michigan

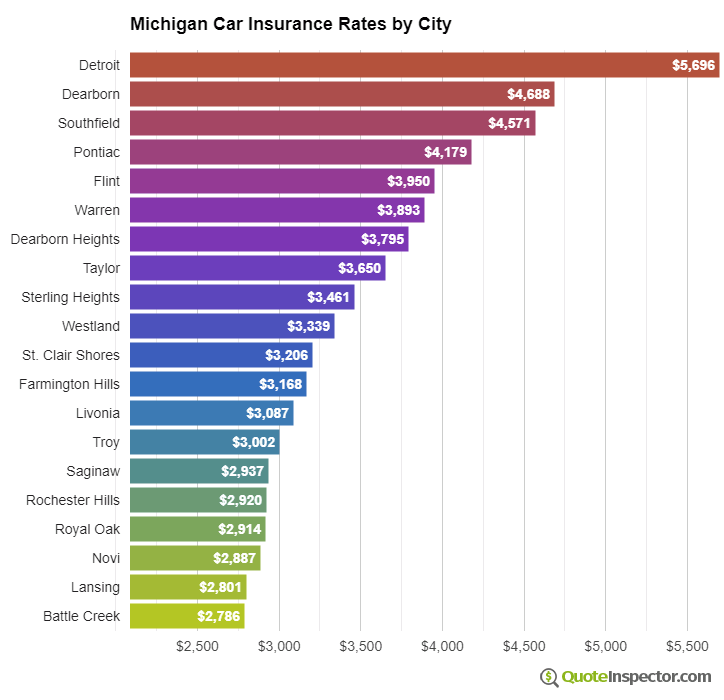

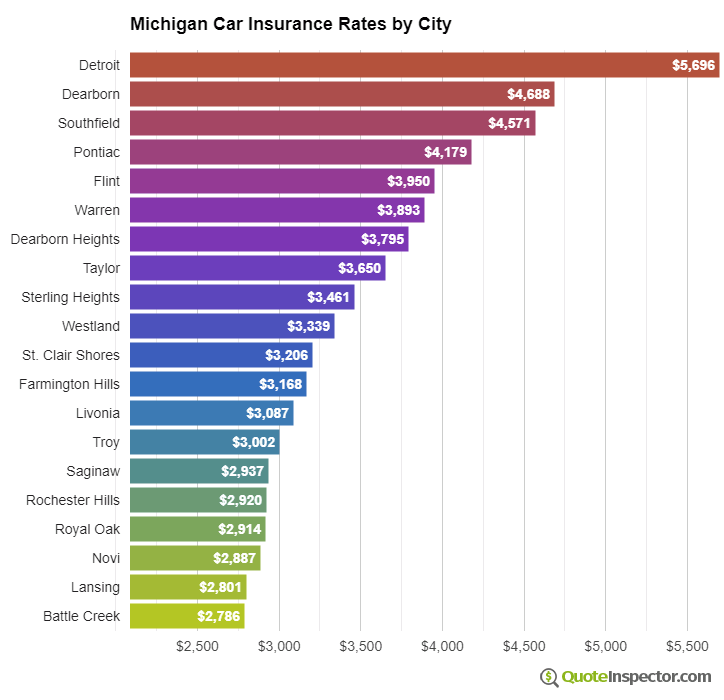

The amount of car insurance a driver pays in Michigan will depend on several factors, such as the driver’s age, driving record, and the type of vehicle being insured. Drivers with a good driving record and those who drive vehicles that are less expensive to insure will pay lower premiums. Other factors that can affect car insurance rates in Michigan include the type of coverage purchased, the deductible, and the zip code of the vehicle’s registered address. All of these factors can have a significant impact on the amount of money that a driver pays each month.

Average Cost of Car Insurance in Michigan

According to the Insurance Information Institute, the average cost of car insurance in Michigan is $1,092 per year. This translates to an average of $91 per month. This is higher than the national average, which is $889 per year, or $74 per month. However, rates in Michigan can vary widely depending on the factors mentioned above. For example, a driver with a good driving record will pay less than someone with a poor record.

Tips for Reducing Car Insurance Rates in Michigan

There are several things that drivers in Michigan can do to reduce their car insurance rates. The first is to shop around and compare rates from different insurance providers. Different companies will offer different rates, so it is important to compare rates from several providers before making a decision. Additionally, drivers should consider raising their deductible if they can afford to do so. A higher deductible will lower the monthly premium but may increase the out-of-pocket costs if the driver needs to file a claim.

Take Advantage of Discounts

Another way to reduce car insurance rates in Michigan is to take advantage of any discounts that may be available. Insurance companies may offer discounts for a variety of reasons, such as having a good driving record, taking a defensive driving course, or having multiple vehicles insured with the same company. It is important to ask the insurance company what discounts are available and make sure to take advantage of them.

Conclusion

Car insurance rates in Michigan can vary greatly depending on a number of factors. However, there are some things that drivers in Michigan can do to reduce the amount they pay each month. Shopping around and comparing rates from different insurance providers is a good way to find the best deal. Additionally, taking advantage of any discounts that may be available can help lower rates. By following these tips, drivers in Michigan can save money on their car insurance.

Michigan Car Insurance Information

Average Cost Of Car Insurance Per Month In Michigan - Car Insurance

Best Car Insurance Rates In Michigan - worlddesignjobs

Average Car Insurance in Maryland - NerdWallet

Who Has the Cheapest Auto Insurance Quotes in Michigan? - ValuePenguin