Does Car Insurance Go Down At 25

Monday, October 9, 2023

Edit

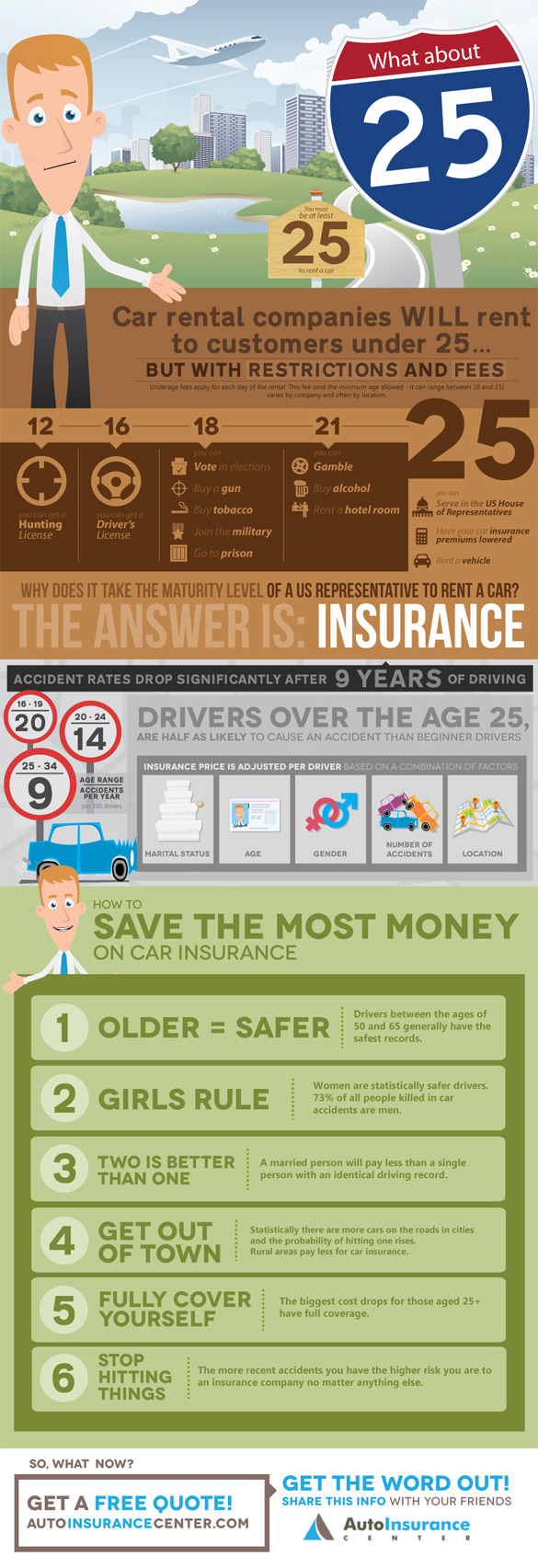

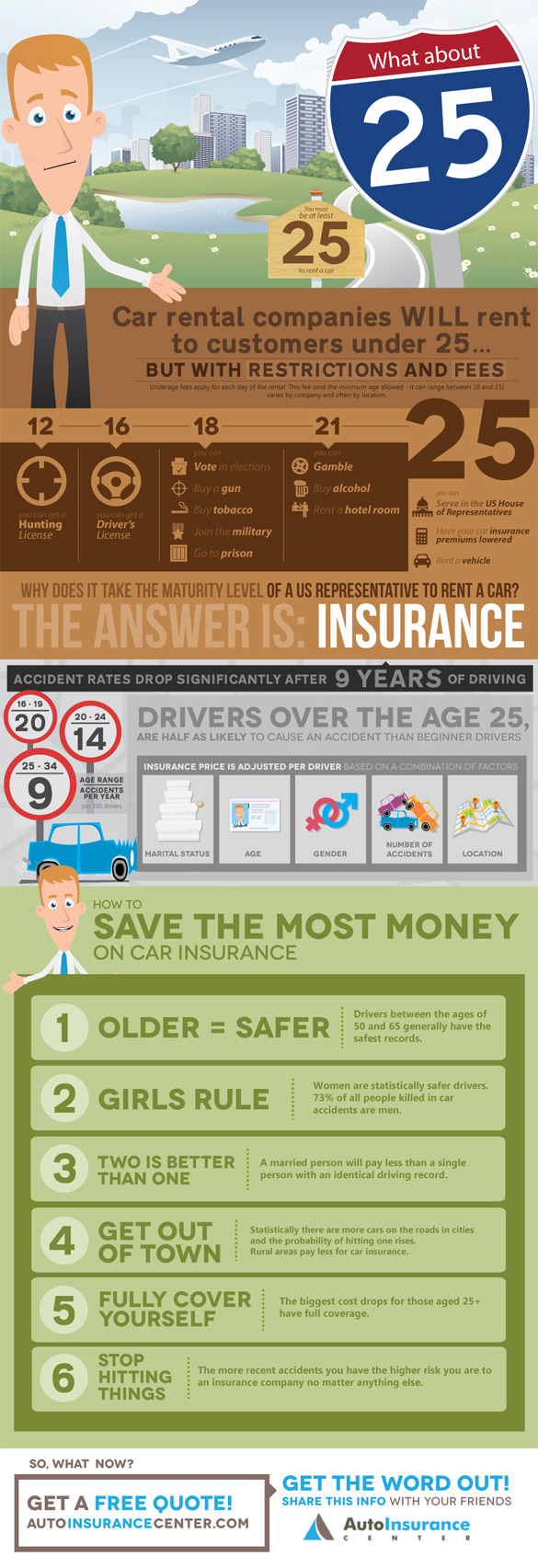

Does Car Insurance Go Down At 25?

Turning 25 is a Milestone

Turning 25 is a major milestone in life, as it marks the transition into full-fledged adulthood. Turning 25 can also be a major financial milestone, as it is often the age when car insurance rates begin to decrease. In fact, the average driver can save up to 25% on car insurance when they turn 25, making it a great time to shop around for a better rate.

Why Does Car Insurance Go Down At 25?

The main reason why car insurance rates go down when a driver turns 25 is because of the decrease in risk associated with younger drivers. Statistically, drivers aged 25 and older are less likely to be involved in an accident and are seen as being more responsible behind the wheel. As such, insurance companies are willing to offer lower rates to this age group.

Factors That Impact Car Insurance Rates

While age is a major factor when it comes to car insurance rates, it is important to note that other factors will also come into play. For example, the type of car that a driver drives will have an impact on the insurance rate. Generally, cars that are more expensive to repair and maintain will come with higher premiums. Additionally, the driving record of a driver will also have an impact on their insurance rate. Drivers with a history of moving violations or accidents will typically pay higher rates than those with a clean record.

Getting the Best Car Insurance Rates

When it comes to getting the best car insurance rates, it pays to shop around and compare quotes. Different insurance companies will offer different rates depending on the driver's age and driving record. Additionally, bundling car insurance with other policies, such as home or renters insurance, can also result in lower rates. It is also important to keep in mind that rates can vary from state to state, so it pays to compare quotes from different insurers in the same state.

How to Save Even More

In addition to getting the best car insurance rates, there are other ways to save on car insurance. Taking a defensive driving course, for example, can help to lower rates. Additionally, paying for the policy in full can often result in a discount, as can opting for a higher deductible. Finally, opting for a policy with less coverage can also help to lower rates. It is important to note, however, that reducing coverage can leave a driver exposed to greater financial risk in the event of an accident.

The Bottom Line

Turning 25 can be a major financial milestone, as it is often the age when car insurance rates begin to decrease. While age is a major factor when it comes to determining car insurance rates, other factors, such as the type of car driven and the driving record of the driver, will also come into play. Shopping around and comparing quotes can help drivers to get the best car insurance rates. Additionally, there are other ways to save on car insurance, such as taking a defensive driving course, opting for a higher deductible, and reducing coverage.

Infographic: Why Does Insurance Drop When You’re 25? : Automotive Addicts

Does Car Insurance Go Down at 25? | Policy Advice

Car Insurance Price Drop At 25 - hrvstdesign

Does Insurance Go Down Every Year – Haibae Insurance Class

What Age Will My Car Insurance Go Down