Auto Insurance Policy A Standard Non stacking Policy

Everything You Need To Know About Standard Non-Stacking Auto Insurance Policies

What is a Non-Stacking Auto Insurance Policy?

When shopping for auto insurance, one of the many types of policies you may come across is a “non-stacking” auto insurance policy. But what does that mean?

A non-stacking auto insurance policy is one that does not allow you to increase the amount of coverage you have. In other words, you are limited to the amount of coverage you have purchased, and you are not able to increase it by adding additional policies or riders to your existing policy.

For example, if you have purchased auto insurance with a coverage limit of $100,000, then you are not able to increase that by adding another policy or rider to your existing policy.

What Are The Advantages of a Non-Stacking Auto Insurance Policy?

The main advantage of a non-stacking auto insurance policy is that it allows you to keep your costs down. When you purchase a non-stacking policy, you are limited to the amount of coverage that you have purchased. As a result, you are not paying for more coverage than you need, which can help to keep your premiums lower.

In addition, non-stacking auto insurance policies are easier to manage. Since you are limited to the amount of coverage you have purchased, you don’t have to worry about making sure you have the right amount of coverage for your needs. This makes it easier to keep track of your policy and manage your coverage.

What Are The Disadvantages of a Non-Stacking Auto Insurance Policy?

The main disadvantage of a non-stacking auto insurance policy is that you may not have enough coverage to cover all of your needs. For example, if you have an accident that is more expensive than your coverage limit, then you may be responsible for paying the difference out of pocket.

In addition, non-stacking auto insurance policies may not provide the best value for your money. Since you are limited to the coverage that you have purchased, you may not be getting the best value for your money. This means that you may be paying more for coverage than you need.

When Should You Consider a Non-Stacking Auto Insurance Policy?

Non-stacking auto insurance policies are best for those who want to keep their costs down and don’t need a lot of coverage. If you are a safe driver with no accidents or tickets on your record, then a non-stacking policy may be the right choice for you.

However, if you are a higher-risk driver with multiple accidents or tickets on your record, then a non-stacking policy may not be the best choice. In this case, you may want to consider a stacking policy, which allows you to increase your coverage by adding additional policies or riders to your existing policy.

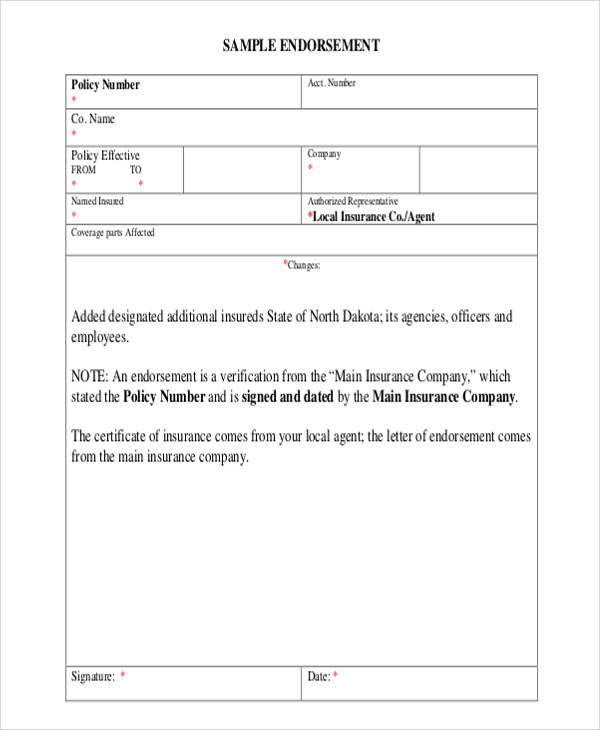

How to Read Your Insurance Policy | Deuterman Law Group

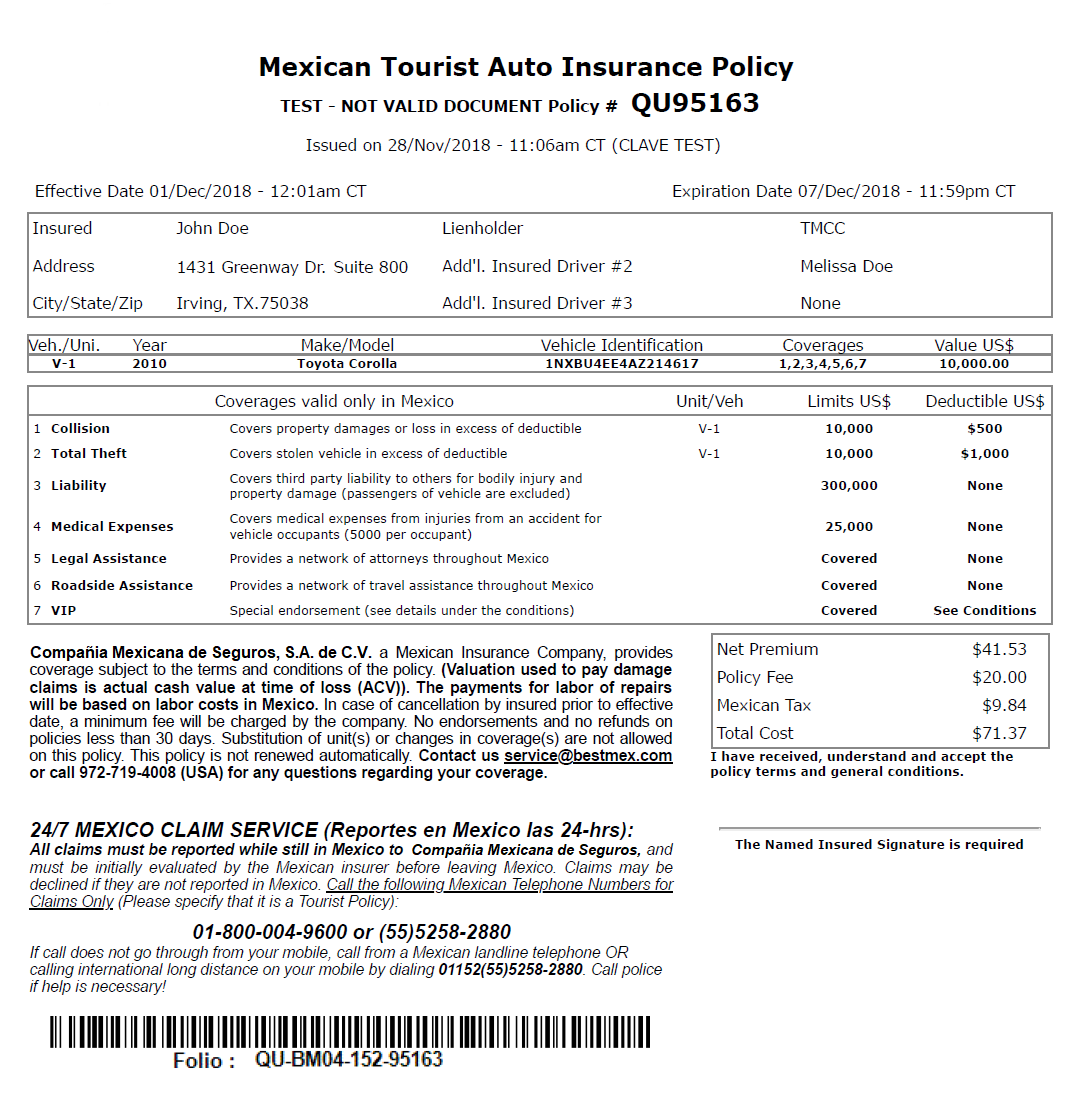

Car Insurance Policy Document : Vehicle Insurance Policy Format

Car Insurance Policy Sample Pdf India

Comprehensive Auto Insurance Policies - OHS Body Shop

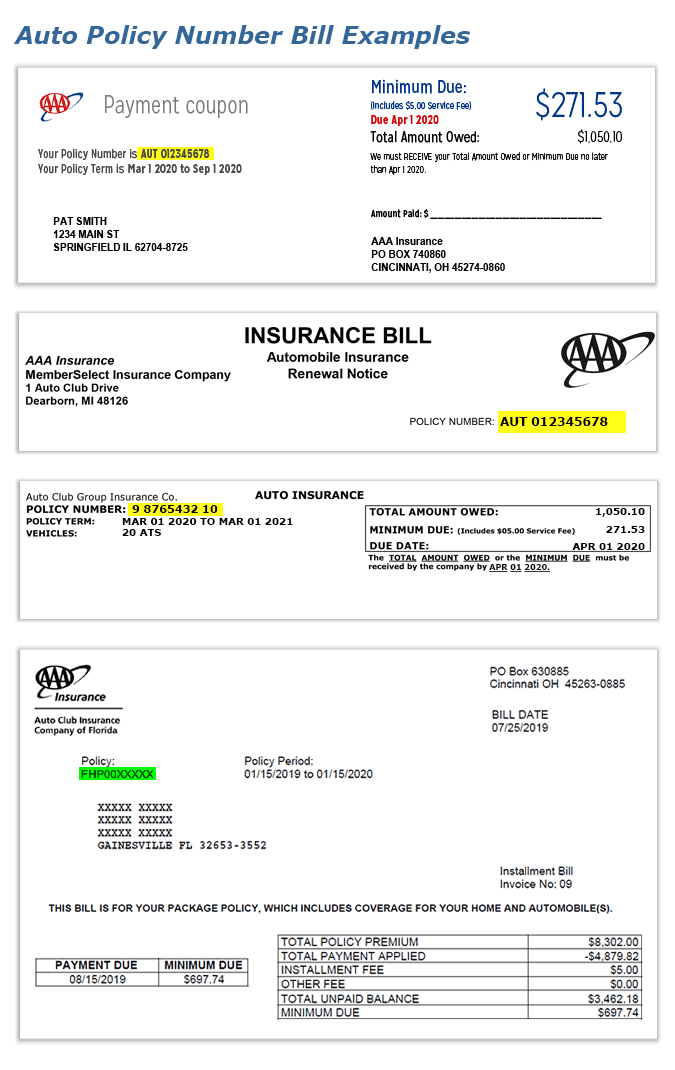

AAA - Find Your Auto Insurance Policy Number