3rd Party Liability Insurance Ontario

3rd Party Liability Insurance Ontario

What is 3rd Party Liability Insurance?

3rd party liability insurance is a type of insurance policy that protects a business from claims and lawsuits brought by third parties as a result of their operations. The policy covers the cost of defending against such claims and any damages awarded. This type of insurance is essential for businesses that have the potential to cause harm to others, such as in the case of professional services. In the province of Ontario, businesses must have at least the minimum amount of 3rd party liability insurance in order to operate legally.

What Does 3rd Party Liability Insurance Cover?

3rd party liability insurance covers claims and lawsuits that result from the business’s activities. This includes claims related to negligence, errors, omissions, and other forms of liability. It also covers any damages awarded to a third party as a result of the business’s activities. In addition, the policy may include additional coverage for defense costs and legal fees associated with defending against a claim.

Who Needs 3rd Party Liability Insurance?

Any business that has the potential to cause harm to third parties, such as professional services, needs 3rd party liability insurance. This is because such businesses are responsible for any harm that results from their operations. Therefore, it is important for such businesses to have the necessary coverage in order to protect themselves from financial losses.

What Is The Minimum Amount Of 3rd Party Liability Insurance Required In Ontario?

The minimum amount of 3rd party liability insurance required in Ontario is $1,000,000. This amount is set by the government in order to ensure that businesses are able to pay for any damages they might cause to third parties. It is important to note that this minimum requirement may differ based on the type of business and the level of risk involved.

How Much Does 3rd Party Liability Insurance Cost?

The cost of 3rd party liability insurance varies depending on the type of business, the amount of coverage, and the level of risk involved. Generally speaking, the cost of such policies is relatively low, making it an affordable way to protect businesses from financial losses. The cost of the policy may also be impacted by other factors, such as the business’s history and the claims experience of the insurer.

Where Can I Get 3rd Party Liability Insurance In Ontario?

3rd party liability insurance can be obtained from a variety of sources in Ontario, including insurance brokers and insurance companies. It is important to compare different policies and quotes in order to find the best coverage and price for your business. Additionally, you may wish to consult a lawyer to ensure that the policy meets your business’s specific needs.

What Is Third-party Insurance?

How is a group insurance scheme effective? - MyAnmol Insurance

Third Party Property Car Insurance | iSelect

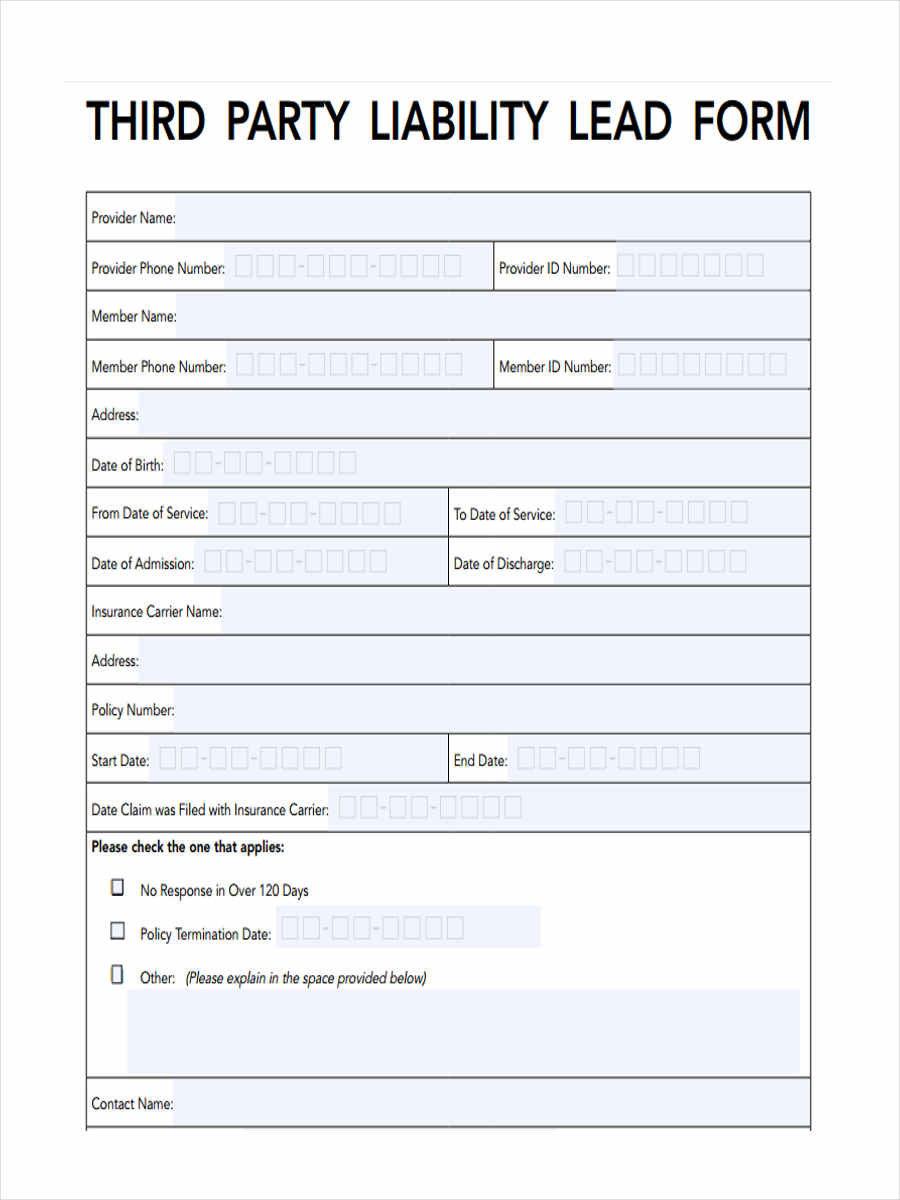

FREE 5+ Third Party Liability Forms in PDF

What is Third Party Insurance in 2020 | Third party, Insurance, Aadhar card