Cost Of State Farm Car Insurance

The Cost of State Farm Car Insurance

Understanding Car Insurance

When you decide to purchase a car, one of the first steps you need to take is to buy car insurance. Car insurance is important in the event of an accident, as it can cover the cost of repairs and medical bills. Car insurance can also protect you in the event of theft, vandalism, or a natural disaster. However, insurance premiums can vary greatly depending on the type of coverage you choose and the company you use. State Farm is one of the largest and most trusted car insurance companies in the world.

What Is State Farm Car Insurance?

State Farm car insurance is a type of coverage offered by the State Farm insurance company. State Farm offers a wide range of coverage options, from basic liability coverage to comprehensive coverage. Depending on the type of coverage you choose, State Farm can provide financial protection for medical bills, repairs, and even replacement vehicles. State Farm also offers discounts for safe drivers, as well as discounts for multiple policies.

How Much Does State Farm Car Insurance Cost?

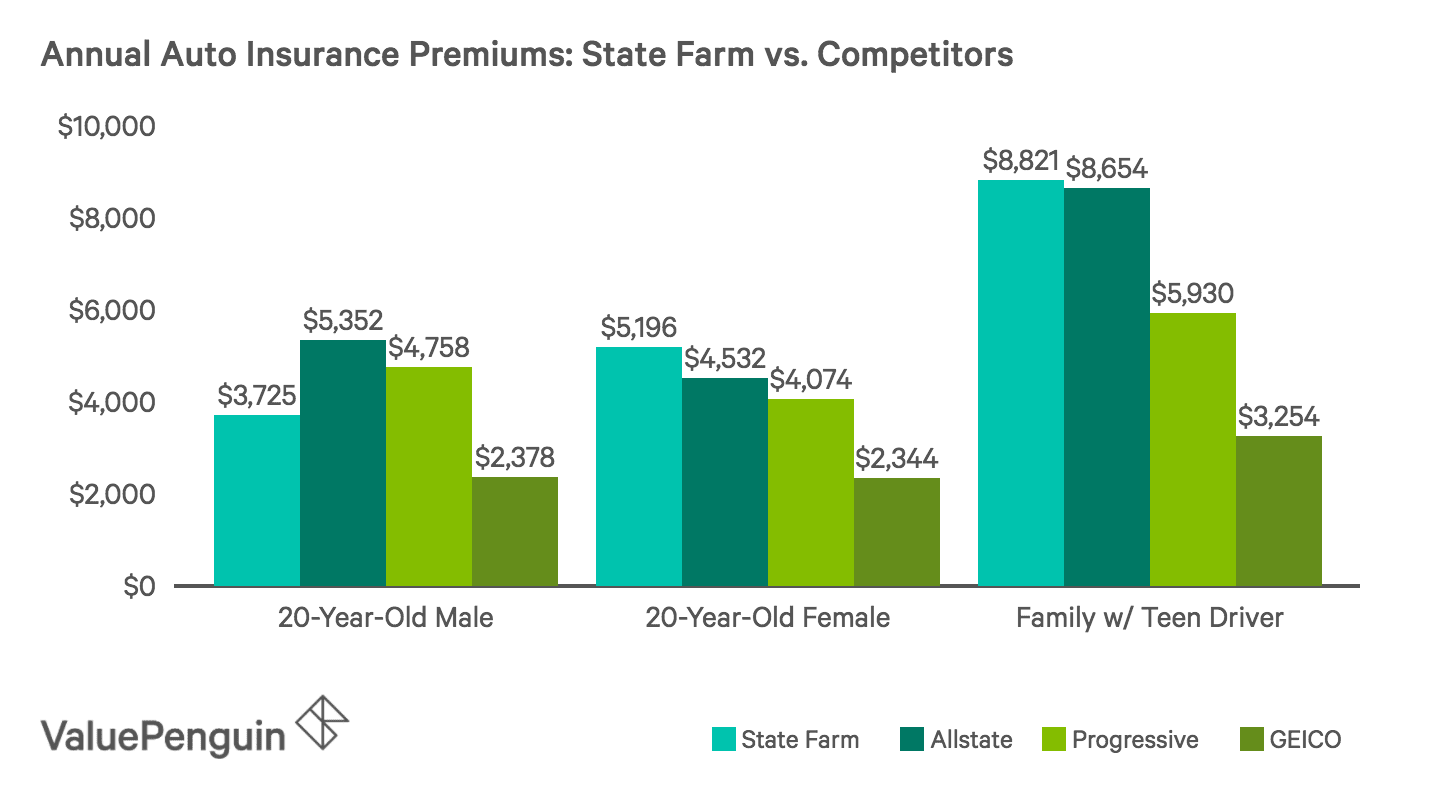

The cost of State Farm car insurance will vary depending on the type of coverage you choose, your driving record, and other factors. Generally, the cost of State Farm car insurance will be higher than other insurance companies. That said, State Farm offers competitive rates and discounts that can make it a competitive choice. Generally, the average cost of State Farm car insurance is around $1,500 per year.

Factors That Affect the Cost of State Farm Car Insurance

A variety of factors can affect the cost of your State Farm car insurance. These include your age, the type of vehicle you drive, the amount of coverage you choose, and your driving record. For example, drivers who have a history of accidents or tickets may pay higher premiums. Additionally, drivers with poor credit scores may also be charged higher rates.

How to Lower the Cost of State Farm Car Insurance

If you're looking for ways to reduce the cost of your State Farm car insurance, there are a few options available. One way to lower your premiums is to choose a higher deductible. A higher deductible means you will have to pay more out of pocket in the event of an accident, but it can also reduce your monthly premiums. Additionally, you can take advantage of State Farm's discounts, such as their multi-policy discounts and safe driver discounts.

Conclusion

State Farm is one of the most popular and trusted car insurance companies in the world. The cost of State Farm car insurance will vary depending on the type of coverage you choose, your driving record, and other factors. However, State Farm offers competitive rates and discounts that can help make their coverage more affordable. Additionally, you can lower your premiums by choosing a higher deductible or taking advantage of discounts.

State Farm Insurance: Rates, Consumer Ratings & Discounts

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

State Farm Auto & Home Insurance Review: Quality Service and Lots of

Comparing State Farm vs. Geico vs. Progressive vs. Allstate vs. Farmers

How to Tell How Much Car Insurance You Are Entitled To After a Car