Car Insurance Groups List Explained

Car Insurance Groups List Explained

What is an Insurance Group?

Car insurance groups are a way for insurance companies to categorise cars and determine the level of risk for a particular vehicle. Every car in the UK is assigned an insurance group ranging from 1 to 50, with group 1 being the cheapest to insure and group 50 being the most expensive. The group your car falls into can depend on a variety of factors, including the car's age, engine size, performance and value, as well as the cost of any repairs. It's important to remember that cars in the same group may still have different insurance premiums, as insurers take into account other factors such as your age, driving experience and even your postcode.

How Are Car Insurance Groups Determined?

The Association of British Insurers (ABI) is responsible for determining car insurance groups. Every car is assigned a group; the higher the group, the more expensive the car will be to insure. Generally, cars in lower groups are smaller, cheaper and have a lower performance than those in higher groups. The cost of repairs is also a factor in determining the group. Cars that are expensive to repair are often assigned to higher groups.

What Are the Different Insurance Groups?

Car insurance groups range from 1 to 50, with group 1 being the cheapest to insure. The group is determined by the ABI, who take into account a variety of factors such as the car's age, engine size, performance and value, as well as the cost of any repairs. Generally, cars in lower groups are smaller, cheaper and have a lower performance than those in higher groups. The table below shows the range of car insurance groups.

Insurance Groups List

Group 1: Small city cars, with low performance and value.

Group 2: Small cars with basic engines, low performance and value.

Group 3: Small family cars, with average performance and value.

Group 4: Mid-range family cars, with average performance and value.

Group 5: Large family cars, with higher performance and value.

Group 6: Executive cars, with high performance and value.

Group 7: Sports cars, with very high performance and value.

Group 8: Luxury cars, with very high performance and value.

Group 9: Prestige cars, with the highest performance and value.

Why Does Car Insurance Group Matter?

Car insurance groups can have a significant impact on the cost of your car insurance. Generally, the higher the group your car is assigned to, the more expensive it will be to insure. This is because cars in higher groups tend to be more expensive to repair and are often more powerful, which means they are more likely to be involved in an accident. It's important to remember that cars in the same group may still have different insurance premiums, as insurers take into account other factors such as your age, driving experience and even your postcode.

How Can I Find Out What Group My Car Is In?

The easiest way to find out what group your car is in is to use a car insurance comparison website such as MoneySuperMarket. You can enter the make and model of your car into the search box and the website will tell you what group your car is in. Alternatively, you can contact your car insurance provider and ask them what group your car is in.

Car Insurance Usa Usa Car Insurance Must Meet Each State's Minimum

Car Insurance Groups Explained - Insurance Groups Car Prices Table

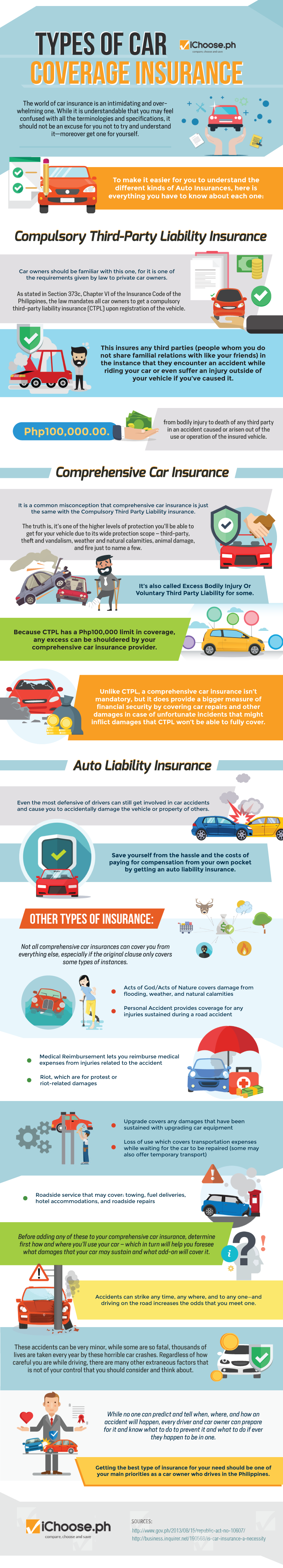

Types of Car Coverage Insurance | iChoose.ph

List of Auto Insurance Companies ~ General Auto Insurance