Car Insurance For First Time Drivers Under 25

Car Insurance For First Time Drivers Under 25

Overview

As a first time driver, you are faced with the challenge of finding the right car insurance policy. It can be a daunting task, especially if you are under 25. Car insurance is important for all drivers, but it can be especially important for young drivers. It's important to know the different types of coverage available, as well as the various factors that can affect the cost of your car insurance policy.

Factors That Affect Car Insurance Rates For Under 25

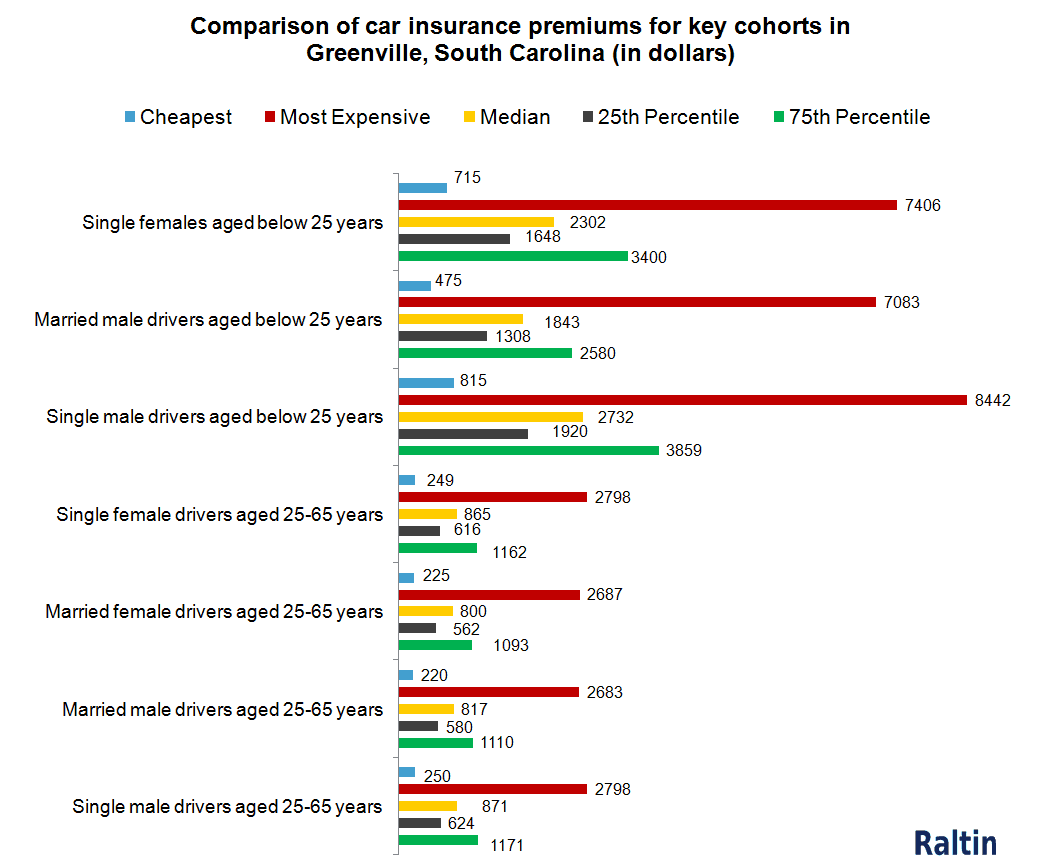

The factors that influence car insurance rates for young drivers can include their age, driving record, and type of car. Age is a major factor, as younger drivers are considered to be more of a risk for accident or injury. Additionally, a young driver's driving record plays a big role in determining the cost of their car insurance policy. Drivers with a clean record can expect to pay lower rates than those with a history of traffic violations or accidents.

The type of car you drive can also affect your car insurance rates, as some cars are deemed riskier to insure than others. High-performance sports cars are usually more expensive to insure, for example. Other factors that can affect your car insurance rates include your credit score, your location, and the amount of coverage you choose.

Types Of Car Insurance Coverage

When it comes to car insurance, there are a variety of different types of coverage available. These include liability coverage, which is required in most states, and which covers damages to other vehicles and property in the event of an accident. Collision coverage pays for damages to your vehicle in the event of an accident, while comprehensive coverage pays for damages caused by weather, theft, or other non-accident related issues. Uninsured motorist coverage protects you in the event of an accident with an uninsured driver.

Tips For Finding The Right Car Insurance For Under 25

When searching for car insurance for young drivers, it's important to shop around and compare policies from different providers. Additionally, it's important to consider any discounts you may be eligible for. Many insurers offer discounts for good students, for taking a driver safety course, and for having a good driving record. It's also a good idea to take the time to understand the coverage you're purchasing and make sure it meets your needs.

Conclusion

Finding car insurance for first time drivers under 25 can be a challenge, but it is possible to find a policy that is both affordable and meets your needs. It's important to understand the different types of coverage available, and to consider any discounts you may be eligible for. Taking the time to shop around and compare policies from different providers can help you find the right car insurance policy for you.

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

Under 25 Car Insurance – The Housing Forum

[INFOGRAPHIC] What all first-time drivers should know about car

![Car Insurance For First Time Drivers Under 25 [INFOGRAPHIC] What all first-time drivers should know about car](https://kwiksure.com/assets/images/Page_EN_w658px.jpg)

Cheap Car Insurance For First Time Drivers Under 25 - me2idesign

Car Insurance 101: Car Insurance for First-Time Drivers