Best Gap Insurance For Cars

Wednesday, September 6, 2023

Edit

The Best Gap Insurance for Cars

What is Gap Insurance?

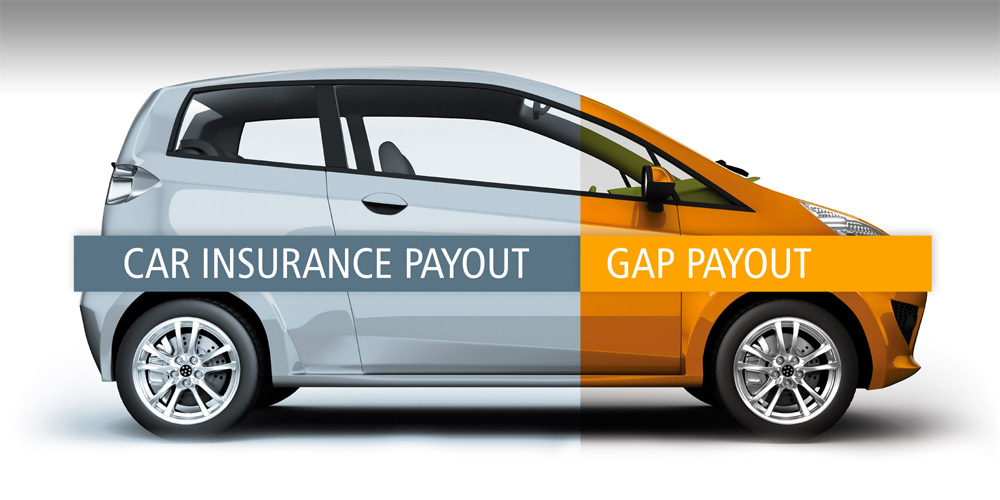

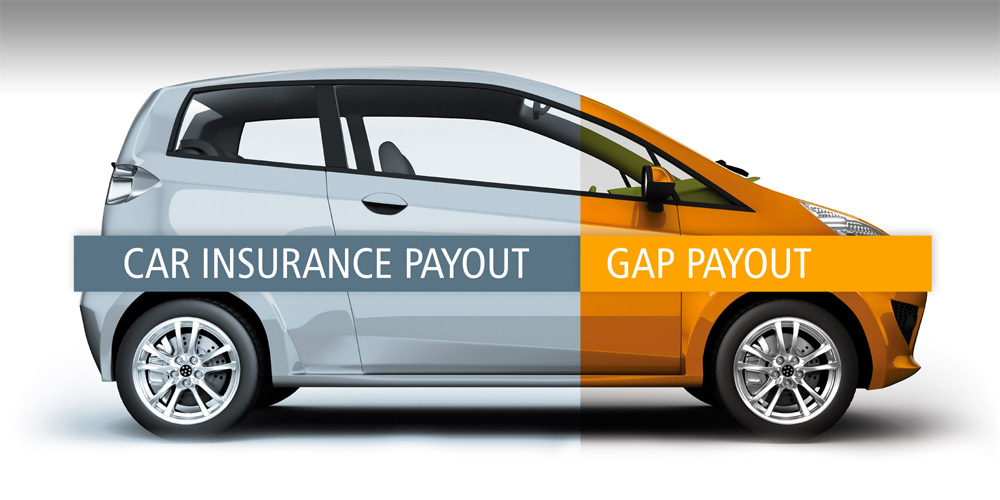

Gap insurance, also known as Guaranteed Asset Protection, is a type of car insurance that covers the difference between the amount your car is worth and the amount you owe on the loan or lease of your car. Gap insurance is an important form of coverage for car owners, particularly those who finance or lease their cars. It helps protect you financially if your car is stolen or totaled in an accident.

Gap insurance is an important type of coverage for car owners, as it can help protect you financially if your car is stolen or totaled in an accident. It covers the gap between the actual value of your car and the amount that you owe on the loan or lease of your car. Essentially, it helps to cover the cost of replacing your car if it's stolen or totaled in an accident.

When Do You Need Gap Insurance?

You should consider getting gap insurance if you are financing or leasing your car. When you purchase a car, the value of the car starts to depreciate immediately. This means that if you get into an accident and your car is totaled, you may end up owing more on the loan or lease than the actual value of the car. Gap insurance can help cover the difference so that you don't have to pay out of pocket.

If you have a low down payment, have negative equity from your last car loan, or have a longer loan term, you should consider getting gap insurance. This type of insurance can help protect you in the event that your car is stolen or totaled in an accident.

What Is the Cost of Gap Insurance?

The cost of gap insurance varies depending on the type of coverage you get and the length of the policy. Most policies range from $500-$1000, depending on the coverage and the length of the policy. Generally, the longer the policy, the more expensive it will be.

The cost of gap insurance is usually rolled into your monthly loan or lease payments. This means that you don't have to pay the full amount upfront, but rather over the course of your loan or lease.

What Are the Benefits of Gap Insurance?

The main benefit of gap insurance is that it can help protect you financially if your car is stolen or totaled in an accident. It covers the difference between the actual value of your car and the amount that you owe on the loan or lease of your car.

Gap insurance can also provide peace of mind knowing that you are financially protected in the event of an accident. If you have a loan or lease on your car, gap insurance can be a smart investment that can save you from having to pay out of pocket in the event of an accident.

Where Can You Get Gap Insurance?

Gap insurance is typically offered by car dealerships when you purchase a car or when you finance or lease your car. It is also available from some car insurance companies. Make sure to shop around and compare quotes to find the best coverage and the best rate for you.

It is important to note that gap insurance is typically non-refundable. This means that once you purchase the policy, you are locked into it. Therefore, it is important to make sure that you are getting the coverage that you need and that you understand the terms of the policy before you purchase it.

Conclusion

Gap insurance is an important type of coverage for car owners who finance or lease their cars. It helps to cover the difference between the actual value of your car and the amount you owe on the loan or lease in the event that your car is stolen or totaled in an accident. The cost of gap insurance varies depending on the type of coverage and the length of the policy, but it is typically rolled into your monthly loan or lease payments. Make sure to shop around and compare quotes to find the best coverage and rate for you.

Is GAP Insurance Worth It? - Exotic Car Hacks

What is GAP Insurance and do I need it when buying a car? | Auto Trader UK

What Is Gap Auto Insurance? Is It Worth It? and Should You Finance It

Buying a new car? Then read about the benefits of GAP insurance

Car Lease Gap Insurance Cost - girlscandesigns