Average Auto Insurance Cost In Virginia Per Month

Friday, September 15, 2023

Edit

Average Auto Insurance Cost In Virginia Per Month

Understanding Auto Insurance in Virginia

Purchasing auto insurance in Virginia is a necessity for any driver. Virginia requires all drivers to have a minimum amount of liability coverage in order to legally operate their vehicles. Liability coverage is designed to protect other drivers in the event of an accident. This coverage is required to help protect other drivers in the event of an accident caused by the policyholder. In addition to liability coverage, drivers in Virginia can purchase optional coverage such as comprehensive, collision, and uninsured/underinsured motorist coverage.

Average Cost of Auto Insurance in Virginia

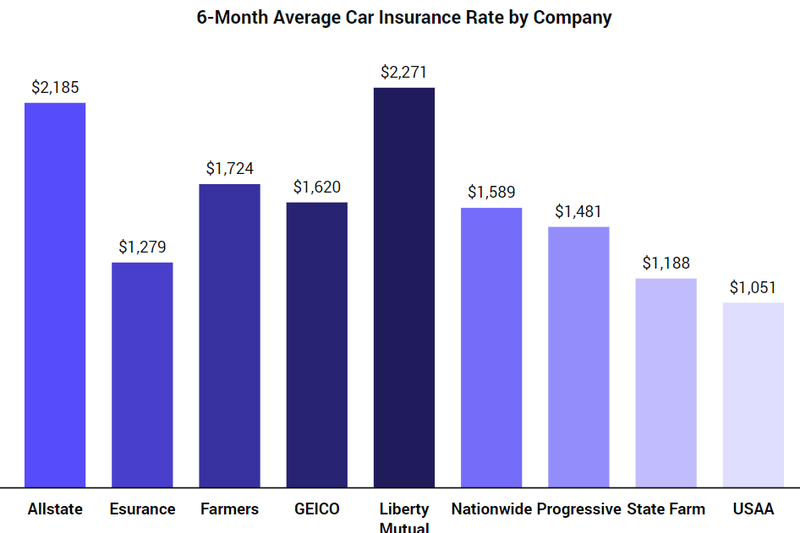

The average cost of auto insurance in Virginia is $1,105 per year. This cost is based on a policy with the state minimum liability coverage requirements. However, the actual cost of auto insurance in Virginia will depend on a variety of factors. These factors include the driver’s age, driving history, credit score, and the type of vehicle being insured.

Factors That Affect Auto Insurance Rates in Virginia

Age is one of the most important factors that auto insurance companies take into consideration when setting rates. Generally, drivers under the age of 25 tend to pay higher rates than older drivers since they are seen as higher risk. Drivers with a poor driving record or those who have had multiple violations or accidents can also expect to pay higher rates. Credit score is also a factor that many auto insurance companies use to determine rates. Those with a good credit score will generally pay less than those with a poor credit score. Lastly, the type of vehicle being insured can also affect rates. Some vehicles are considered to be more expensive to insure than others.

Finding the Best Auto Insurance Rates in Virginia

When shopping for auto insurance in Virginia, it’s important to compare rates from multiple companies in order to get the best deal. Drivers should always make sure they understand the coverage they are getting and the cost associated with it. It’s also important to know the minimum liability coverage required by the state so that drivers are adequately covered in the event of an accident. Additionally, drivers should consider purchasing additional coverage such as comprehensive, collision, and uninsured/underinsured motorist coverage.

Saving Money on Auto Insurance in Virginia

There are several ways that drivers in Virginia can save money on their auto insurance. One of the best ways to save is to shop around and compare rates from multiple companies. Drivers should also look for discounts that may be available, such as a good driver discount or a multi-car discount. Additionally, drivers should consider raising their deductible as this can lower their premiums. Lastly, drivers should make sure they are taking advantage of any available safety features, such as an anti-theft device, as this can also lower rates.

Conclusion

Drivers in Virginia are required to have auto insurance in order to legally operate their vehicles. The average cost of auto insurance in Virginia is $1,105 per year, but this cost can vary depending on a variety of factors. Drivers should always make sure they are adequately covered and shop around to get the best deal. Additionally, there are several ways that drivers can save money on their auto insurance, such as looking for discounts, raising the deductible, and taking advantage of safety features.

Virginia Auto Insurance Rates - Average Cost Of Car Insurance Per Month

Virginia Auto Insurance Rates - Average Cost Of Car Insurance Per Month

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

What is the Average Cost of Car Insurance in the US? | The Zebra

Average Price Of Car Insurance Per Month - designby4d