Quote For Car Insurance Full Coverage

Quote For Car Insurance Full Coverage

What is Full Coverage Car Insurance?

Full coverage car insurance is an insurance policy that covers everything related to your car, from damages to other people’s vehicles and property to bodily injury and legal fees. It is the most comprehensive type of car insurance available, and while it may cost more than other types of car insurance, it can save you a lot of money in the long run if you are ever involved in a serious accident. Full coverage car insurance typically includes liability coverage, collision coverage, and comprehensive coverage.

Liability coverage protects you from the costs of any legal or medical fees related to an accident. This includes damage to another person’s property, as well as any medical costs associated with any injuries that occurred in the accident. Collision coverage covers any damage caused to your own car in the event of an accident, regardless of who is at fault. Comprehensive coverage covers any damage to your car that is not related to an accident, such as theft, fire, flood, or vandalism.

Why Do I Need Full Coverage?

Full coverage car insurance is important for a variety of reasons. First and foremost, it is important to have the right amount of coverage to protect yourself financially. If you are ever involved in an accident, you want to make sure that you have enough coverage to pay for any medical bills or legal costs. Additionally, if you are ever held liable for damages caused by an accident, you want to make sure that you have enough coverage to pay for any property or vehicle damage.

Having full coverage car insurance can also help you save money in the long run. If you are ever involved in an accident, having full coverage can help you avoid expensive out-of-pocket costs. Additionally, having full coverage can help you avoid having to pay for expensive repairs out of pocket. Finally, having full coverage can help you avoid having to pay for expensive rental car fees if your car is ever in the shop.

How Much Does Full Coverage Car Insurance Cost?

The cost of full coverage car insurance depends on a variety of factors, including your driving record, the make and model of your car, and the insurance company you choose. Generally speaking, full coverage car insurance tends to be more expensive than other types of car insurance. However, the cost of full coverage can be offset somewhat by discounts offered by many insurance companies. Additionally, some insurance companies may offer discounts if you bundle your car insurance with another type of insurance policy.

The best way to find the most affordable full coverage car insurance is to shop around and compare quotes from different insurance companies. You can use an online comparison tool to quickly and easily compare quotes from multiple companies. Additionally, you can speak with an insurance agent to get personalized advice on how to get the best rate on full coverage car insurance.

Tips for Getting the Best Quote For Full Coverage Car Insurance

When shopping for full coverage car insurance, there are a few tips you can follow to get the best quote:

1. Take the time to shop around and compare quotes from multiple insurance companies. This will help you find the most affordable rate.

2. Make sure you understand all of the coverage options available. This will help you get the coverage you need at the best rate.

3. Ask about discounts. Many insurance companies offer discounts for a variety of reasons, such as bundling policies or having a good driving record.

4. Consider increasing your deductible. This can help you get a lower rate, but be sure you can afford to pay the higher deductible in the event of an accident.

Conclusion

Full coverage car insurance is an important type of insurance to have, as it can protect you financially in the event of an accident. It is important to shop around and compare quotes from multiple insurance companies to find the most affordable rate. Additionally, you should make sure you understand all of the coverage options available so you can get the coverage you need at the best rate. Finally, be sure to ask about discounts and consider increasing your deductible to help you get a lower rate.

Incredible Car Insurance Quote Nz Ideas - SPB

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

What To Look for in a Full Coverage Car Insurance Quote in Florida Word

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

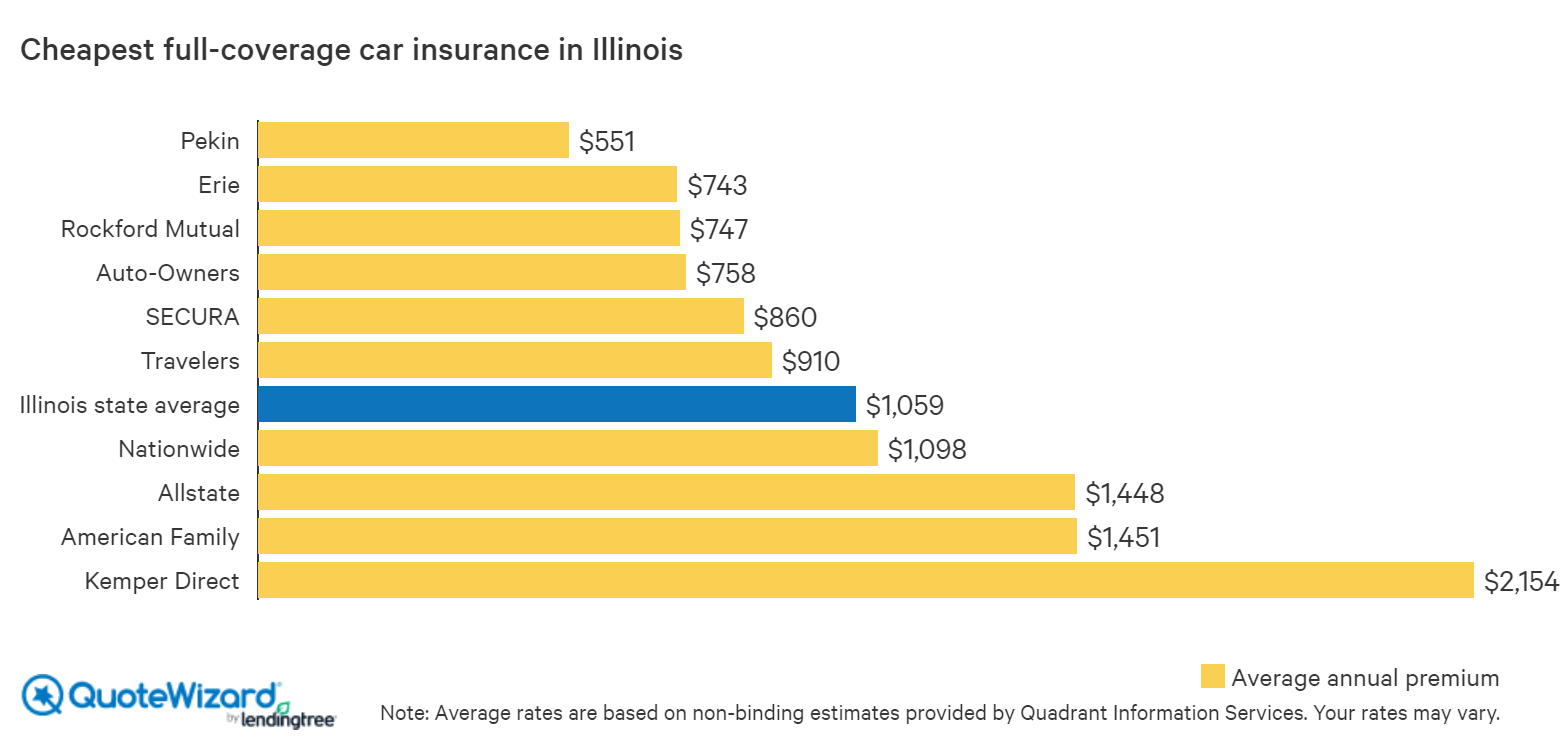

Find Cheap Car Insurance in Illinois | QuoteWizard