How Much Does Typical Car Insurance Cost

How Much Does Typical Car Insurance Cost?

Understanding the Factors That Influence Car Insurance Rates

The cost of car insurance can vary widely depending on a number of factors. Some of these factors include the type of car you drive, your age, and your driving record. Insurance companies use these factors to assess risk and determine what level of coverage you need and what your premiums will be. It’s important to understand these factors so that you can make an informed decision about your car insurance.

The Type of Car You Drive

The type of car you drive is one of the biggest factors that go into determining your car insurance rates. Generally speaking, the more expensive the car, the higher the rate. This is because more expensive cars are more likely to be stolen or damaged, and therefore the insurance company will charge more to cover the cost of repair or replacement. In addition, some cars are considered to be higher risk due to their age, make, or model. For instance, older cars are often more prone to breakdowns, and luxury cars are often targeted by thieves.

Your Age

Your age is another factor that insurance companies take into consideration when determining your car insurance rates. Generally speaking, younger drivers are seen as higher risk, and therefore they will usually have to pay higher rates. This is because younger drivers are more likely to be involved in an accident, and they often have less experience than older drivers. In addition, statistics show that younger drivers are more likely to speed and engage in other dangerous driving behaviors.

Your Driving Record

Your driving record is another factor that insurance companies look at when determining your car insurance rates. If you have had any moving violations or accidents in the past, then your rates are likely to be higher. Insurance companies view these types of incidents as an indication that you are a higher risk driver, and therefore they will charge more to cover you. In addition, having a good driving record can also qualify you for discounts with some insurance companies.

Other Factors

In addition to the factors mentioned above, there are some other factors that can affect your car insurance rates. Insurance companies may take into account things such as where you live, how much you drive, and whether or not you have any additional coverages. They may also consider your credit score, as people with higher credit scores are often seen as lower risk customers. Additionally, some insurance companies may offer discounted rates for people who are members of certain organizations or who have certain affiliations.

Finding the Right Car Insurance for You

When it comes to car insurance, it’s important to do your research and shop around. Different insurance companies will offer different rates and coverage, and it’s important to find the one that best fits your needs and budget. With some research and comparison shopping, you should be able to find a policy that is both affordable and provides the coverage you need. The cost of car insurance varies widely, so it’s important to do your research to ensure you’re getting the best deal possible.

The average cost of car insurance in the US, from coast to coast

Average Car Insurance For 18 Year Old Male Per Month - New Cars Review

Looking at the costs of auto insurance in Ontario, and ways motorists

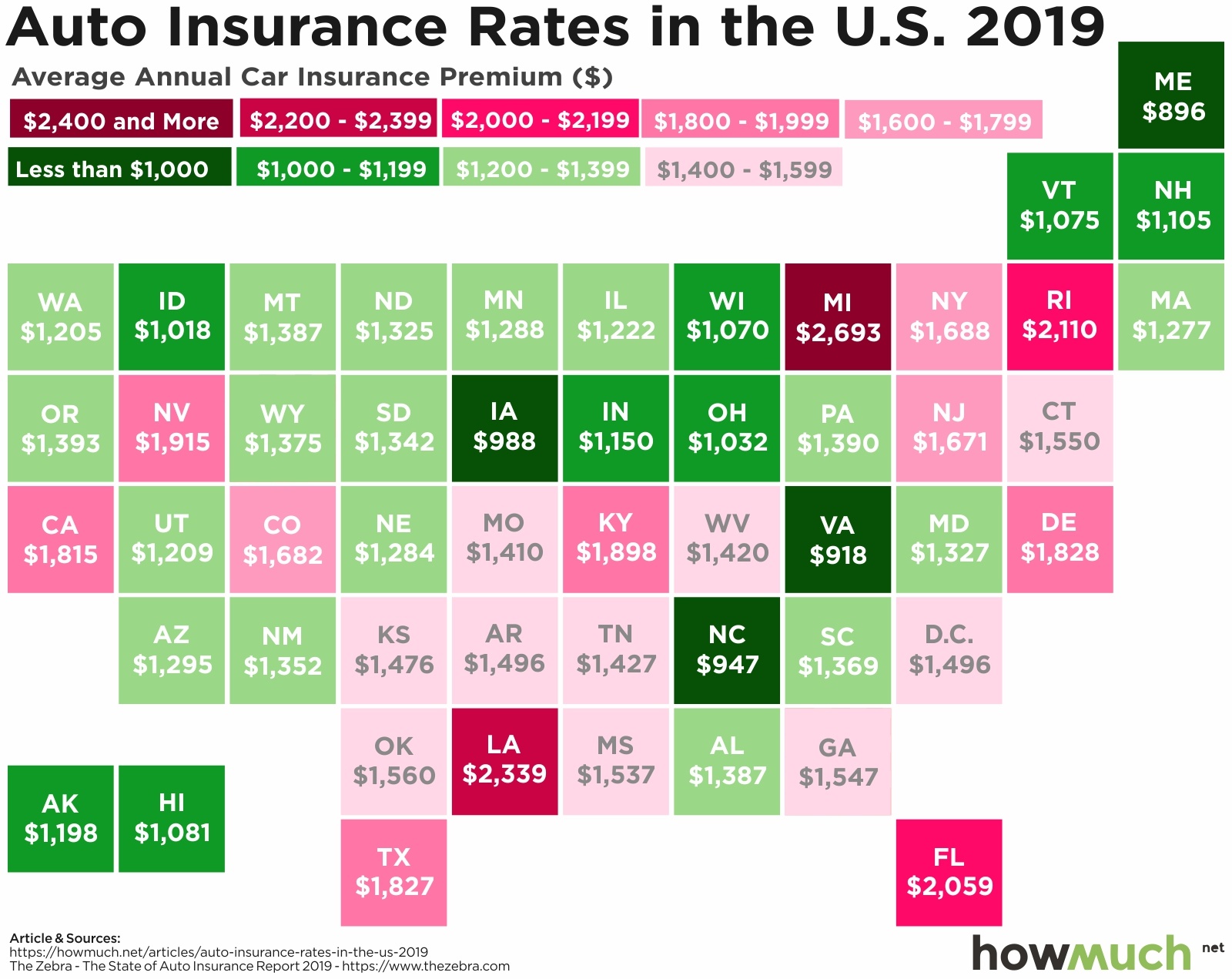

What do Americans Pay for Car Insurance in 2019?

Factors Influencing the Cost of Car Insurance in Albuquerque, NM