How Does Gap Insurance Work If Car Is Totaled

What is Gap Insurance and How Does It Work If Your Car Is Totaled?

If you’ve recently purchased a new car, you may have heard of something called gap insurance. But what is gap insurance? Gap insurance is a type of auto insurance that covers the difference between the value of your car and the amount you owe on your car loan or lease. It can be a lifesaver if you find yourself in an accident and your car is totaled. Read on to learn more about how gap insurance works and why you may want to consider adding it to your auto insurance policy.

What Is Gap Insurance?

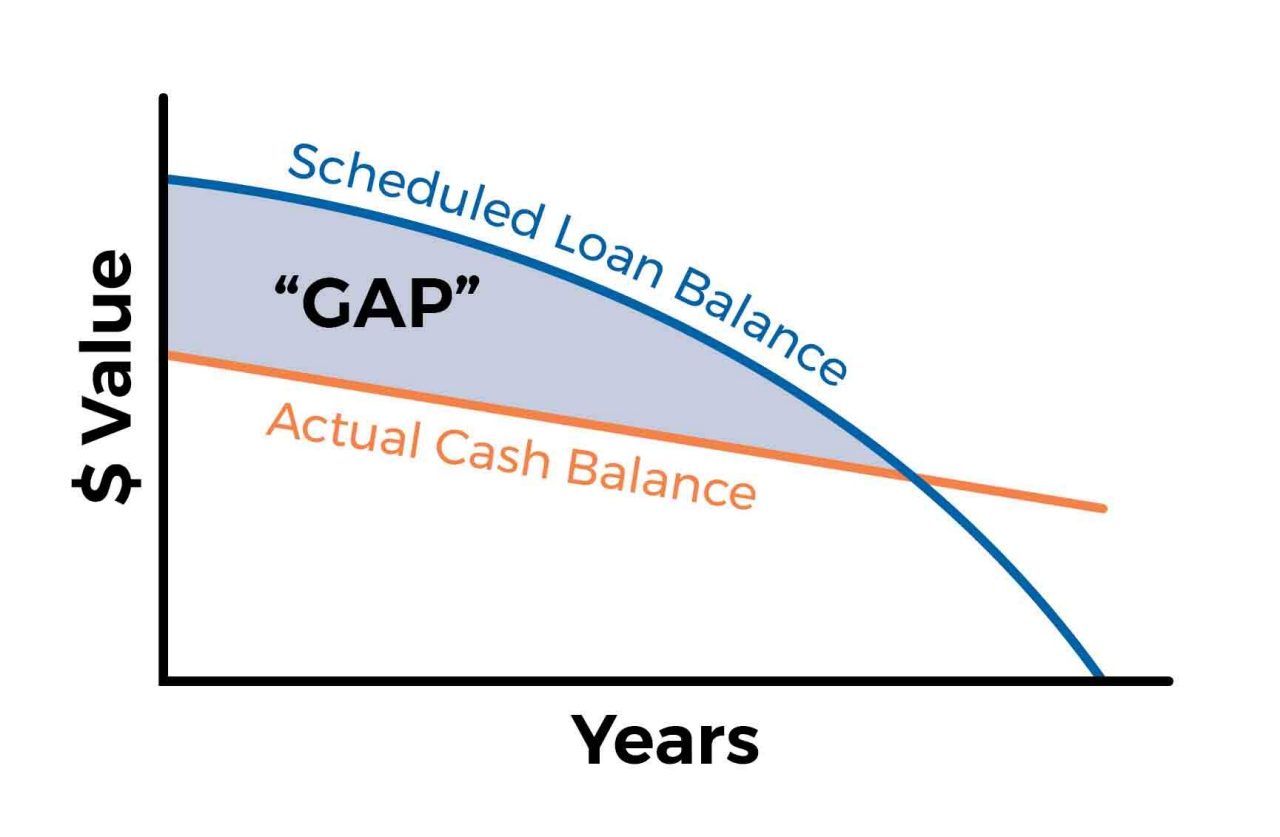

Gap insurance is a type of insurance that pays out if the value of your car is less than the amount you still owe on your auto loan or lease. It’s also known as “loan/lease payoff” coverage. This type of insurance is important because, in the event of an accident, your car’s actual cash value may be less than the amount you still owe on your loan or lease. This gap between your car’s actual cash value and the amount you owe on your loan or lease is called the “gap.”

How Does Gap Insurance Work?

Gap insurance works by covering the difference between the value of your car and the amount you still owe on your auto loan or lease. If your car is totaled in an accident, gap insurance will pay out the difference between the actual cash value of your car and the amount you owe on your loan or lease. This means that you won’t have to pay out of pocket to cover the difference between the actual cash value of your car and the amount you owe on your loan or lease.

Do I Need Gap Insurance?

If you have recently purchased a car, you may want to consider adding gap insurance to your auto insurance policy. Gap insurance is especially important if you’ve taken out a loan or lease on your car. In the event of an accident, the actual cash value of your car may be less than the amount you still owe on your loan or lease. If this happens, gap insurance will cover the difference so that you don’t have to pay out of pocket.

How Much Does Gap Insurance Cost?

The cost of gap insurance depends on several factors, such as the type of coverage you choose and the insurer you choose. Generally, gap insurance costs about 5-7% of the total cost of the car. However, some insurers may offer discounts or special deals on gap insurance. It’s a good idea to shop around and compare prices to get the best deal on gap insurance.

Conclusion

Gap insurance can be a lifesaver if you find yourself in an accident and your car is totaled. Gap insurance covers the difference between the value of your car and the amount you owe on your loan or lease. It’s a good idea to consider adding gap insurance to your auto insurance policy, especially if you’ve taken out a loan or lease on your car. The cost of gap insurance varies, so it’s a good idea to shop around and compare prices to get the best deal.

How Does Gap Insurance Work? | RamseySolutions.com

Page for individual images • Quoteinspector.com

Buying A Car Gap Insurance ~ designologer

GAP Insurance for Your Wheelchair Van | BraunAbility

Do you need gap insurance for your car? How does it work?