Discover Card And Rental Car Insurance

Discover Card Rental Car Insurance: What You Need To Know

Many people use their Discover Card when renting a car for their vacation or business trips. And for good reason; Discover Card offers a variety of benefits and perks that make renting cars easy and affordable. But one of the most important benefits that Discover Card offers is rental car insurance. Knowing what rental car insurance coverage you have when you use your Discover Card can help you save money and provide added peace of mind on your trips.

What is Rental Car Insurance?

Rental car insurance is an optional coverage offered by rental car companies when you rent a car. It provides coverage for damage to or theft of the rental car in the event of an accident or other covered loss. It also provides liability coverage if you are held responsible for an accident. This coverage can be expensive, so it’s important to know if you already have it before you rent a car. That’s where your Discover Card comes in.

What Does Discover Card Rental Car Insurance Cover?

When you use your Discover Card to rent a car, you get included rental car insurance that offers collision damage and theft protection, as well as liability coverage. This coverage is included with your Discover Card at no additional cost, and it is primary coverage, meaning it pays out before your own car insurance does. This can save you money if you have to make a claim for a rental car accident.

What Are The Restrictions On Discover Card Rental Car Insurance?

There are several restrictions on the rental car insurance that comes with your Discover Card. It only applies to rental cars, not other vehicles such as motorcycles, RVs, or boats. It also only applies to rental cars that are rented for up to 31 consecutive days. If your rental car is stolen or damaged, you must file a claim with Discover within 20 days of the incident. And the coverage does not apply to any liability claims that exceed $50,000.

How Do I File A Claim With Discover?

If you need to file a claim for a rental car accident or theft, you can do so online or by calling Discover’s customer service line. You will need to provide the details of the incident, including the date and time of the accident, the location of the accident, the name and contact information of the other party, and any police report information. You will also need to provide a copy of your rental agreement and any repair or replacement estimates. Once you submit your claim, Discover will review it and let you know if you are eligible for coverage.

Conclusion

Using your Discover Card when renting a car can provide you with added peace of mind, since you know that you have coverage in the event of an accident or theft. And, since Discover Card rental car insurance is included at no additional cost, you can save money on your next rental car. So the next time you’re planning a trip, be sure to use your Discover Card to take advantage of the rental car insurance coverage it provides.

Do Discover Credit Cards Come With Rental Car Insurance?

Discover Card Rental Car Insurance Deductible

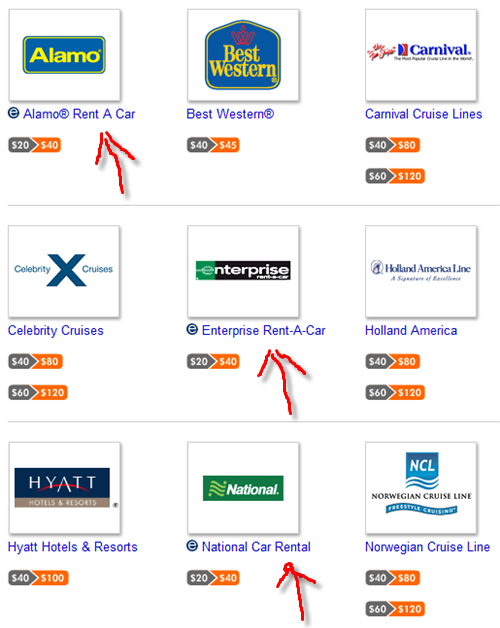

Credit Card Car Rental Rewards

Credit Cards That Offer Primary Car Rental Coverage