Car Rental Insurance Vs Personal Auto Insurance

Should You Buy Car Rental Insurance or Use Your Personal Auto Insurance?

If you’re planning a road trip, you’ll need to consider whether you should buy car rental insurance or use your personal auto insurance. After all, you don’t want to be hit with huge bills if something goes wrong. Nobody wants to be stuck with expensive medical or car repair bills, and insurance can help you protect yourself and your finances.

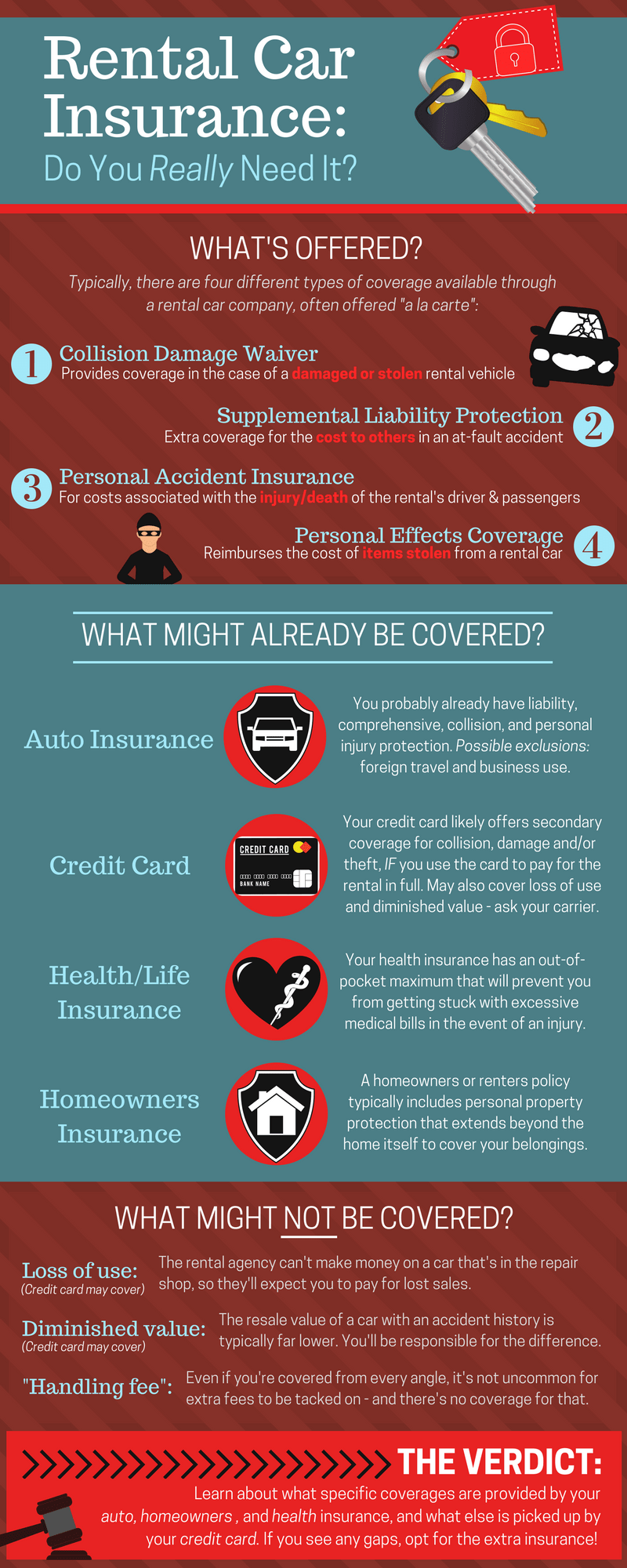

What Is Car Rental Insurance?

Car rental insurance is an insurance policy that covers damage to your rental car. It is usually offered by a rental car company, and it offers you protection against financial losses if something should happen to your rental car. The insurance covers the cost of repairing or replacing the car, as well as any third-party claims, such as medical bills. It also covers the cost of towing and labor, as well as the cost of a rental car while your own car is being repaired.

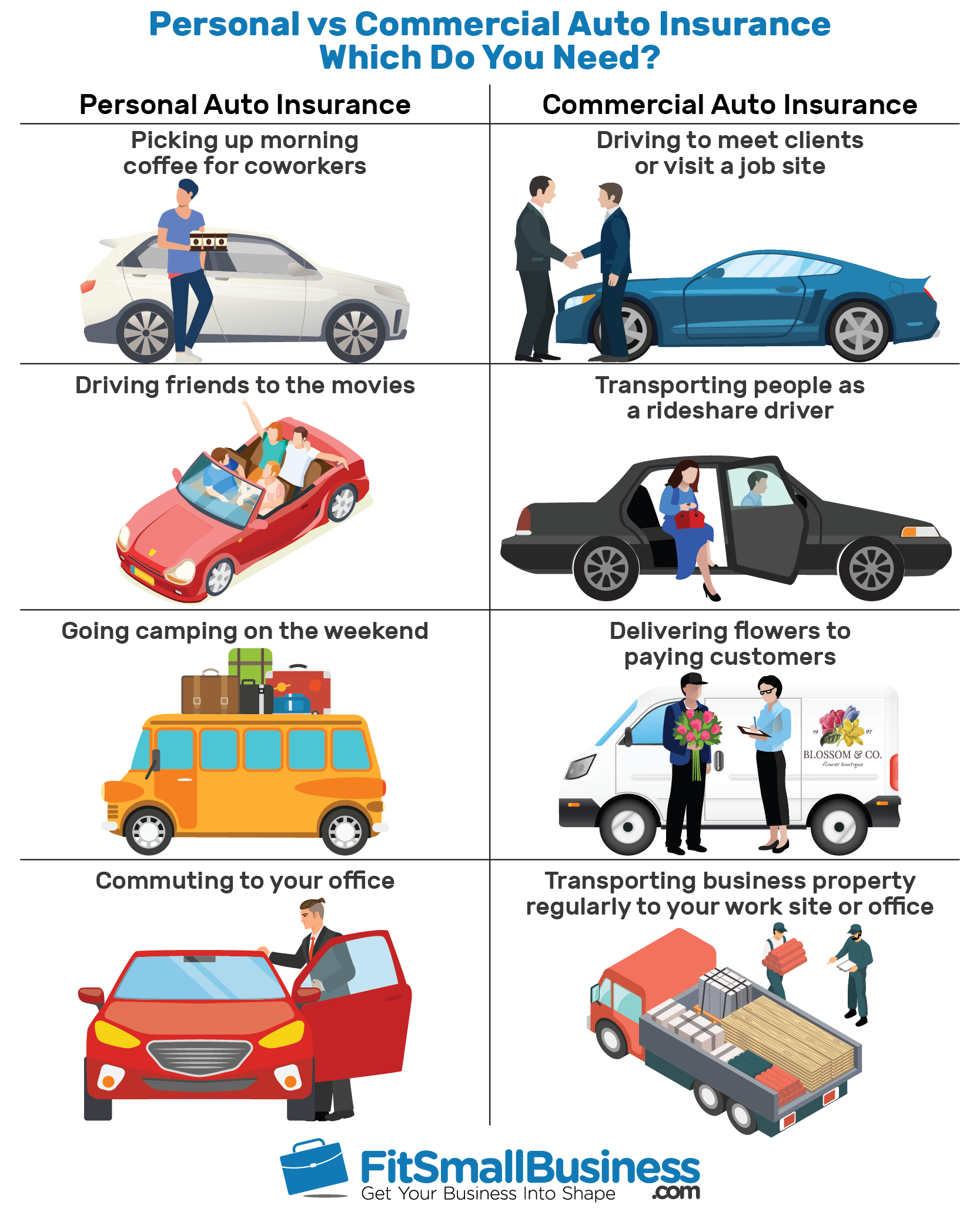

What Is Personal Auto Insurance?

Personal auto insurance is an insurance policy that covers damage to your own car. It is usually offered by your auto insurance provider, and it offers you protection against financial losses if something should happen to your car. The insurance covers the cost of repairing or replacing the car, as well as any third-party claims, such as medical bills. It also covers the cost of towing and labor, as well as the cost of a rental car while your own car is being repaired.

What Are the Benefits of Car Rental Insurance?

Car rental insurance offers several benefits. For one, it can provide you with extra protection if something should happen to your rental car. Secondly, it can provide you with peace of mind knowing that you are protected if something should go wrong. Lastly, it can save you money in the long run, as it can help you avoid expensive bills if something should happen to your rental car.

What Are the Benefits of Personal Auto Insurance?

Personal auto insurance offers several benefits. For one, it can provide you with extra protection if something should happen to your car. Secondly, it can provide you with peace of mind knowing that you are protected if something should go wrong. Lastly, it can save you money in the long run, as it can help you avoid expensive bills if something should happen to your car.

Conclusion

When deciding whether to buy car rental insurance or use your personal auto insurance, you should consider your own needs and circumstances. It is important to weigh the pros and cons of each option and decide which one is best for you. No matter which option you choose, make sure you are adequately protected in case something should happen to your car.

A Guide To Car Rental Insurance vs. Personal Auto Insurance Coverage

The Difference Between Personal and Commercial Auto Insurance

Car insurance infographic | 20 Miles North Web Design

16 Most Important Car Insurance Terms (Infographic)

Nrma Rental Car Insurance - actuadesign