Can Insurance Cover Car If Title Not In My Name

Can Insurance Cover Car If Title Not In My Name?

What Is Auto Insurance?

Auto insurance is a form of insurance that provides financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Auto insurance can also offer financial protection against theft of the vehicle and possibly damage to the vehicle, sustained from things other than traffic collisions, such as falling objects, fire, flood, hail, vandalism, and other events.

Who Is Covered By Auto Insurance?

Auto insurance typically covers the policyholder and any other person driving the vehicle with the policyholder's permission. Depending on the type of policy, it may also cover any person who is a resident relative of the policyholder and any person who drives the vehicle while it is being used as a public or livery conveyance. In some cases, auto insurance may even cover any person or organization who uses or occasionally uses the vehicle.

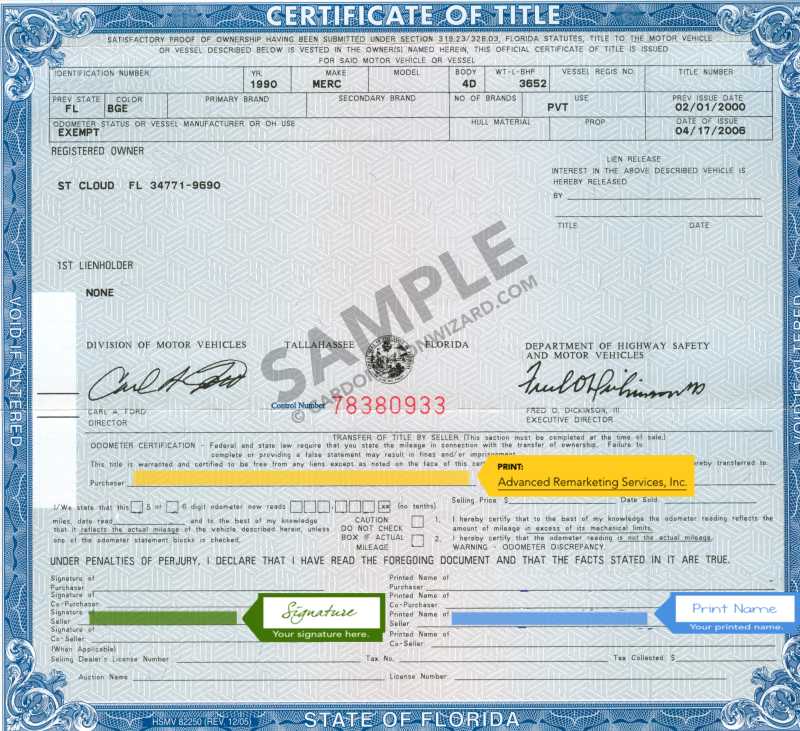

Can You Get Insurance on a Car That Is Not in Your Name?

Yes, you can get auto insurance on a car that is not in your name. However, it depends on the circumstances and the type of auto insurance policy you are looking for. Generally, the person who is listed on the title of the vehicle is the one who must purchase the auto insurance policy. However, if the vehicle is owned by someone else, such as a parent or a relative, they can purchase an auto insurance policy that covers anyone who drives the vehicle.

What Does Auto Insurance Cover?

Auto insurance typically covers the cost of repairs to the vehicle in the event of any accident or damage. It can also cover medical expenses for any injuries sustained in an accident, as well as liability for any property damage caused by the policyholder. In some cases, auto insurance may even cover the cost of a rental car while the policyholder's vehicle is being repaired.

Do You Need to Be the Registered Owner of the Car to Get Insurance?

No, you do not need to be the registered owner of the car to get insurance. In most cases, the person listed on the title of the vehicle is the one who needs to purchase the auto insurance policy. However, if the vehicle is owned by someone else, such as a parent or a relative, they can purchase an auto insurance policy that covers anyone who drives the vehicle.

Conclusion

In conclusion, you can get auto insurance on a car that is not in your name. However, it depends on the circumstances and the type of auto insurance policy you are looking for. Generally, the person who is listed on the title of the vehicle is the one who must purchase the auto insurance policy. However, if the vehicle is owned by someone else, such as a parent or a relative, they can purchase an auto insurance policy that covers anyone who drives the vehicle.

Can Someone Else Insure My Car if the Title Is Under My Name? | Pocket

California Car Title Template - Free California Bill Of Sale Forms Pdf

Marven's Money Musings: Hump Day Herald: Car's Paid Off Early!

Pa title insurance - insurance

Jacksonville, FL Charity Car Donation - Donate a Car in Jacksonville