Average Cost To Insure Tesla Model 3

Friday, August 4, 2023

Edit

Average Cost To Insure Tesla Model 3

What is the Average Cost To Insure a Tesla Model 3?

The Tesla Model 3 is one of the most popular electric cars on the market today. As with any vehicle, you need to purchase insurance for it in order to protect yourself from any potential financial losses in the event of an accident. But how much does it cost to insure a Tesla Model 3?

The answer depends on several factors, including the type of coverage you choose and the driver's age, driving history, and location. Generally speaking, the average cost to insure a Tesla Model 3 is between $800 and $1,200 per year. However, this figure can vary greatly depending on the coverage and your personal situation.

Factors That Affect The Cost of Tesla Model 3 Insurance

When it comes to the cost of insurance for a Tesla Model 3, there are several factors that come into play. One of the most important elements is the type of coverage you select. For example, if you opt for comprehensive coverage, which includes protection from theft, weather-related damage, and other types of losses, you can expect to pay more for your insurance than if you choose only liability coverage.

Another factor that affects the cost of insurance is the driver's age and driving history. Younger drivers tend to pay more for insurance than older drivers, and drivers with a history of traffic violations or accidents usually pay more than those with a clean driving record.

Finally, the location of the vehicle can also play a role in the cost of insurance. If you live in an area with a high rate of auto theft or other types of losses, you can expect to pay more for your premiums.

How To Get the Best Rates for Tesla Model 3 Insurance

If you're looking for the best rates for Tesla Model 3 insurance, there are a few steps you can take. First, it's important to shop around and compare quotes from multiple insurers. This is the best way to ensure you get the most comprehensive coverage at the best price.

You should also consider raising your deductible to lower your monthly premiums. A higher deductible means you'll have to pay more out of pocket in the event of an accident, but it can lead to significant savings on your monthly insurance bill.

Finally, you should consider taking a defensive driving course, which can help you to improve your driving skills and reduce the risk of an accident. This can result in a lower insurance rate.

Tesla Model 3 Insurance Cost Summary

In conclusion, the average cost to insure a Tesla Model 3 can range from $800 to $1,200 per year. However, this figure can vary depending on the type of coverage you choose, the driver's age and driving history, and the location of the vehicle.

If you want to get the best rates for Tesla Model 3 insurance, make sure to shop around and compare quotes from multiple providers. You should also consider raising your deductible and taking a defensive driving course to reduce your premiums.

By following these tips, you can ensure you get the coverage you need at a price you can afford.

Tesla Model 3 Insurance Cost - Best Tesla Car Insurance Cost To Insure

Here's How Tesla Model 3 Is Cheaper To Own Than Toyota Camry

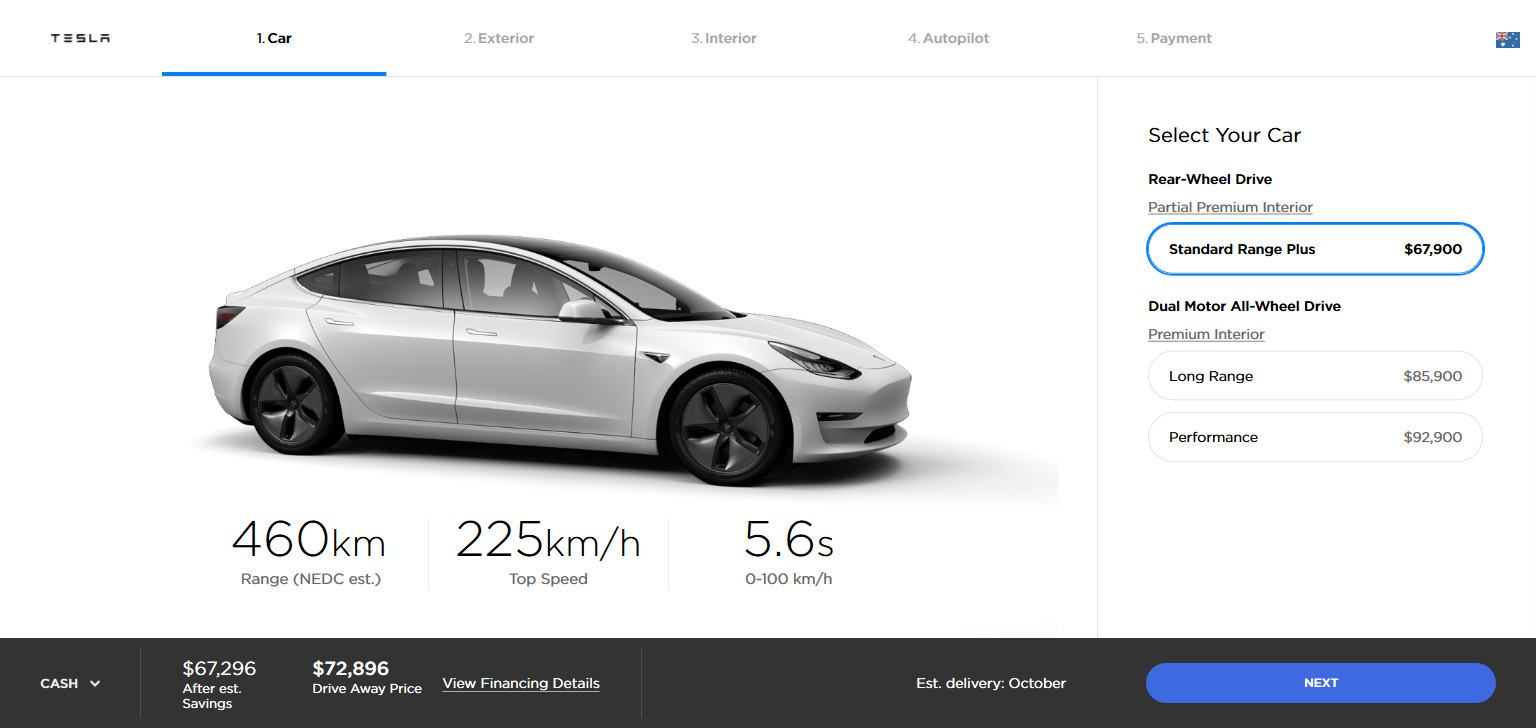

Tesla Model 3 prices jump in Australia as dollar falls against greenback

The Tesla Model 3 Most People Want Will Cost $890 A Month | enrg.io

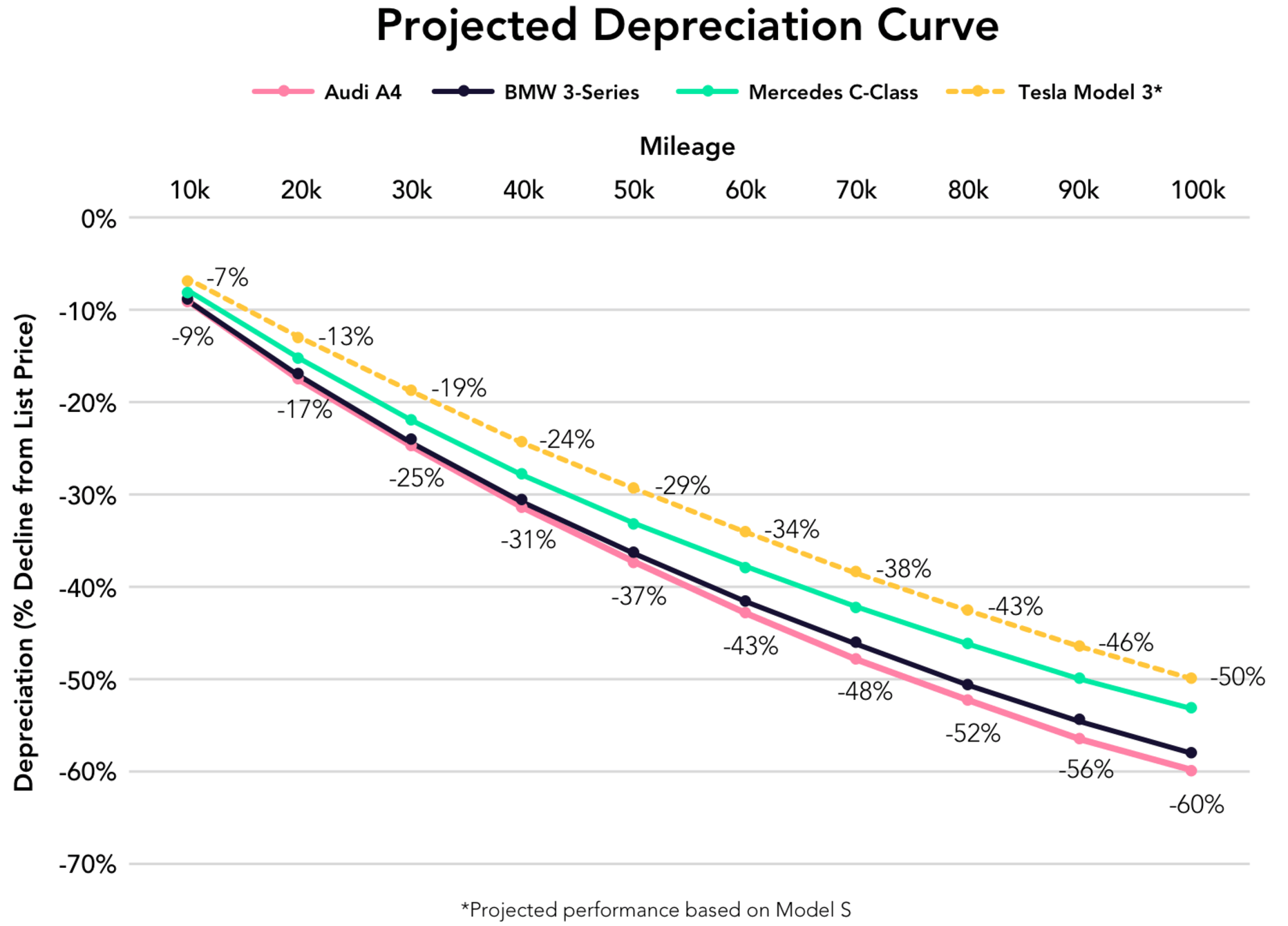

Tesla Model 3 to have best-in-class depreciation, report says - Electrek