A Great Number Of Managed Care Insurance Plans Quizlet

Managed Care Insurance Plans: Your Guide to Understanding the Basics

What is Managed Care Insurance?

Managed care insurance is an increasingly popular type of healthcare insurance plan that is designed to manage the cost of care, as well as to provide comprehensive coverage. Managed care plans are offered by private insurance companies, as well as by governments and employers. These plans are typically designed to reduce costs by using a network of healthcare providers that have agreed to charge lower fees. In addition, managed care plans often provide additional benefits, such as preventive care and wellness programs.

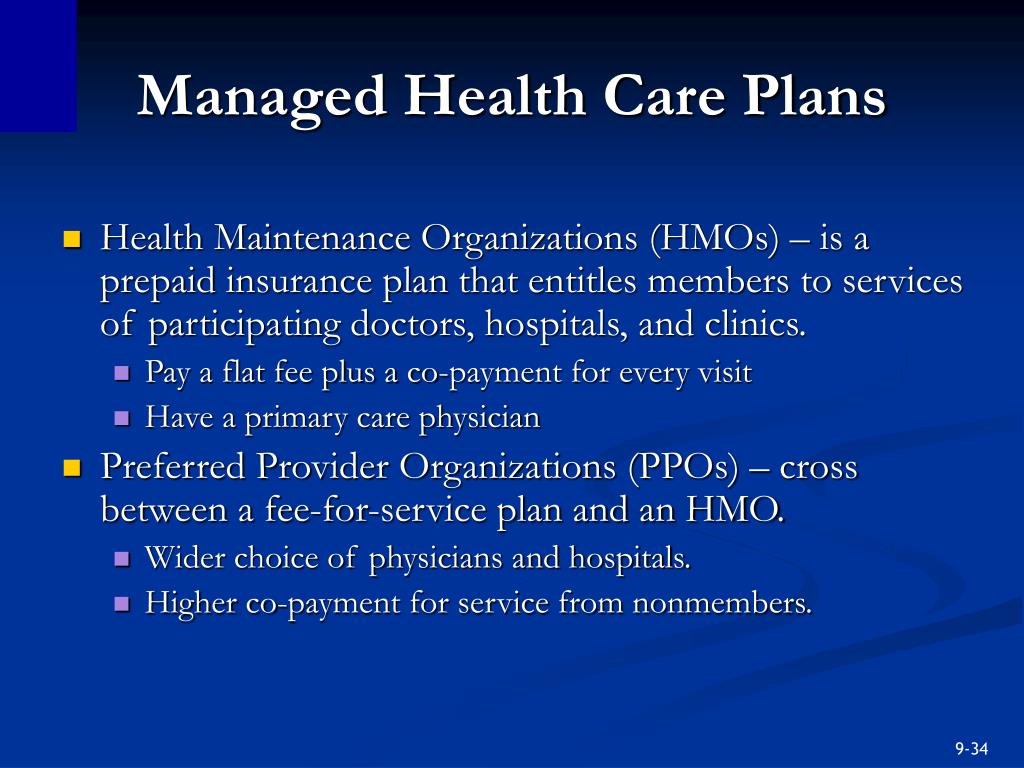

Managed care plans are typically divided into three categories: health maintenance organizations (HMOs), preferred provider organizations (PPOs) and point-of-service (POS) plans. Each of these plans offers different levels of coverage and cost, and it is important for consumers to understand the differences between them before choosing a plan.

Health Maintenance Organizations (HMOs)

Health maintenance organizations (HMOs) are managed care plans that generally require members to select a primary care physician (PCP) from within their network of providers. The primary care physician is responsible for providing most of the care that the patient needs, and is responsible for referring the patient to specialists within the network if needed. Under an HMO plan, members must generally obtain approval from the PCP before receiving care from any other provider. This type of plan typically offers lower co-payments for visits to the PCP, and does not require the patient to meet a deductible before being covered.

The main disadvantage of an HMO plan is that members are generally limited to the providers within the network, and may not be able to receive care from providers outside of the network. In addition, care may be denied if the PCP does not approve it.

Preferred Provider Organizations (PPOs)

Preferred provider organizations (PPOs) are managed care plans that provide members with access to a network of providers who have agreed to charge discounted fees. Unlike HMOs, PPOs generally do not require members to select a primary care physician, and members are not required to obtain approval before receiving services. PPOs typically allow members to receive care from providers outside of the network, although the patient may be responsible for a larger portion of the cost in these cases. PPOs also typically require members to meet an annual deductible before coverage begins.

The main disadvantage of a PPO plan is that it may be more expensive than an HMO plan. In addition, members may have to pay more for care received from providers outside of the network.

Point-of-Service (POS) Plans

Point-of-service (POS) plans are managed care plans that combine features of both HMOs and PPOs. Like HMOs, POS plans require members to select a primary care physician who is responsible for coordinating care. Like PPOs, POS plans allow members to receive care from providers outside of the network, although the patient may be responsible for a larger portion of the cost in these cases. In addition, POS plans typically require members to meet an annual deductible before coverage begins.

The main disadvantage of a POS plan is that it may be more expensive than an HMO or PPO plan. In addition, members may have to pay more for care received from providers outside of the network.

Choosing the Right Managed Care Plan

When choosing a managed care plan, it is important to consider the type of coverage that is needed, as well as the cost of the plan. It is also important to consider the network of providers that are available under the plan, as well as the levels of cost sharing and deductibles. Depending on the plan, there may also be additional benefits, such as wellness programs and preventive care.

By understanding the basics of managed care insurance plans, consumers can make an informed decision about the plan that is right for them.

PPT - Insuring Your Health PowerPoint Presentation, free download - ID

Managed Care Plans-HMO,PPO and POS of United States

Custom Essay | amazonia.fiocruz.br

PPT - Chapter 9 PowerPoint Presentation, free download - ID:454787