Telematics Insurance Pros And Cons

What Is Telematics Insurance and Why Should You Care?

You may have heard of telematics insurance, but what is it and how can it help you? In this article, we'll take a closer look at the pros and cons of telematics insurance, and how it could benefit you. Telematics insurance is a type of insurance that uses technology such as GPS and sensors to track the movements and habits of the person being insured. This type of insurance is becoming increasingly popular as it is seen as a more personalized way of offering insurance coverage, as well as being more cost effective.

Pros of Telematics Insurance

The main benefit of telematics insurance is that it is tailored to the individual, meaning that it can be tailored to suit different lifestyles. For example, if you are a safe driver, you may be able to get a more favorable rate than someone who is more reckless. In addition, telematics insurance can also be used to track mileage, which can help to save money for those who drive less. Finally, telematics insurance can also provide discounts for drivers who have taken defensive driving courses.

Cons of Telematics Insurance

While telematics insurance can be beneficial to some, there are also some potential drawbacks. One of the most common complaints is that it can be intrusive and can be seen as an invasion of privacy. In addition, it can be difficult to get accurate readings if the driver is in an area with poor cell phone reception. Finally, telematics insurance can be expensive, as the technology used is often costly.

Should You Get Telematics Insurance?

Ultimately, the decision to get telematics insurance should be based on your individual needs and circumstances. If you are looking for a more personalized form of insurance coverage, then telematics insurance may be a good option for you. However, if you are looking for a cheaper option, then it may be worth looking at other forms of insurance. Ultimately, it is important to weigh up the pros and cons of telematics insurance before making a decision.

Conclusion

In conclusion, telematics insurance can be a great option for those who are looking for a more personalized form of insurance coverage. However, it is important to weigh up the pros and cons before making a decision. If you are looking for a cheaper option, then it may be worth looking at other forms of insurance. Ultimately, telematics insurance can be a great way to save money and get personalized coverage, but it is important to do your research before making a decision.

Telematics Insurance Data - Telematics.com

Insurance telematics — Navixy Talks

Insurance Telematics – Milkwhale

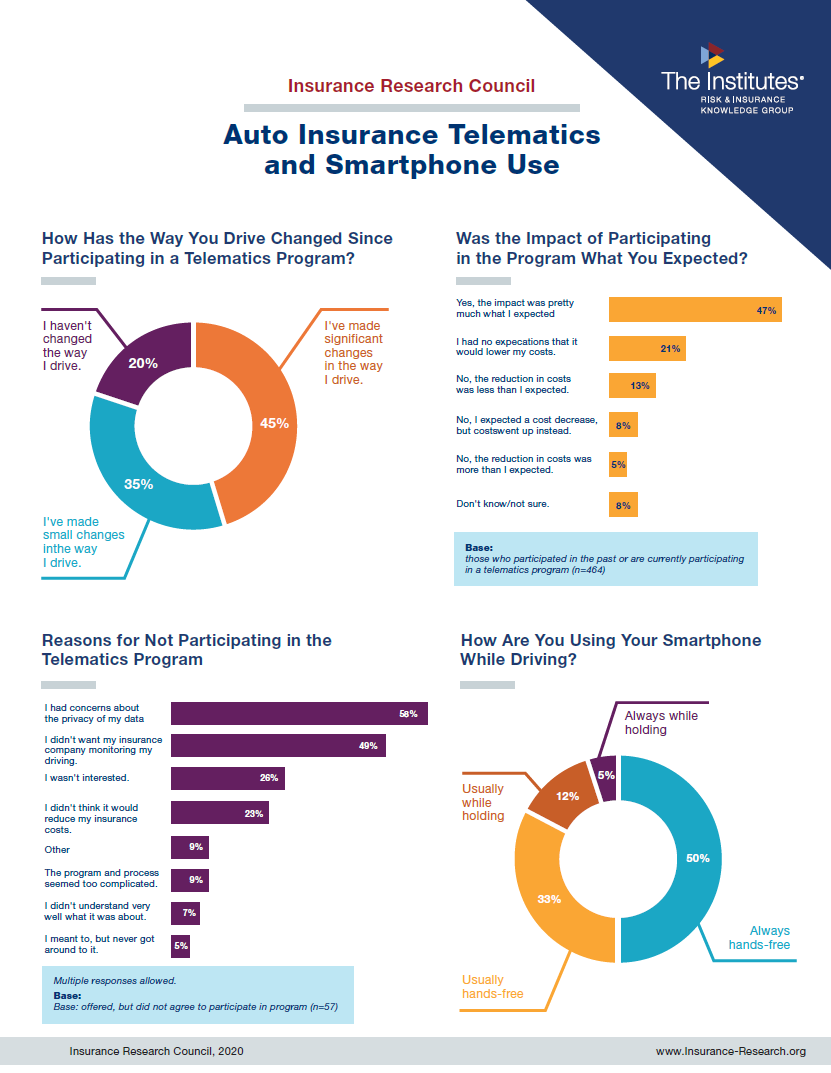

Auto Insurance Telematics & Smartphone Use: Consumer Survey Report

New report: The Global Automotive OEM Telematics Market – 4th Edition