Define No Fault Auto Insurance

What is No Fault Auto Insurance?

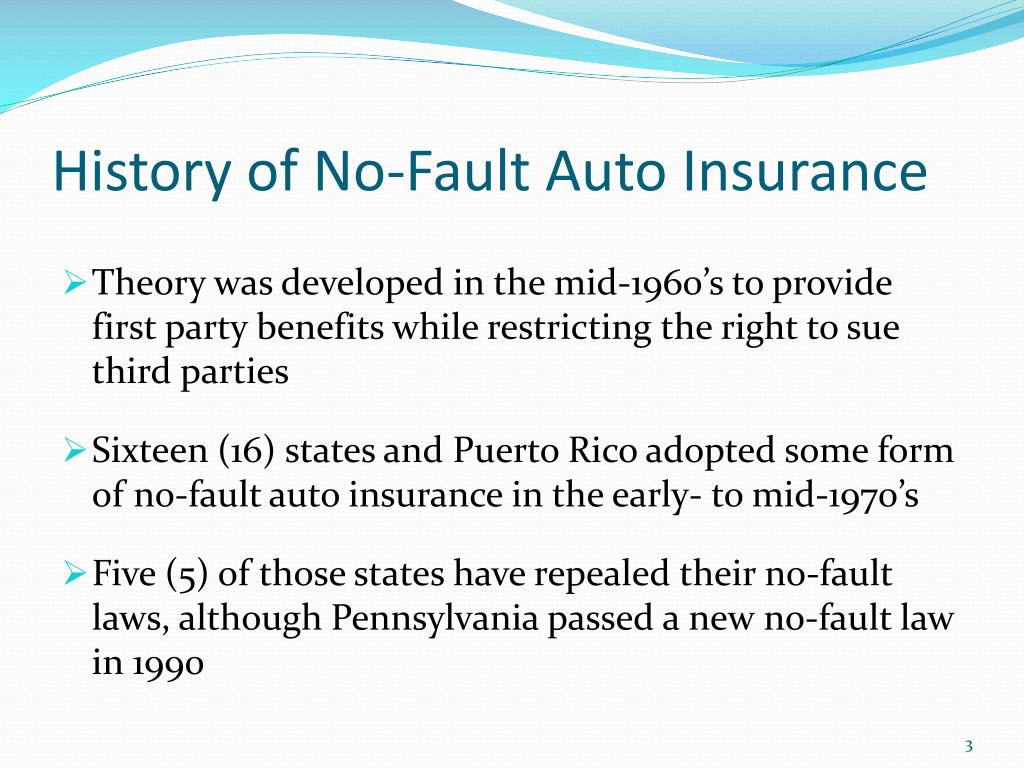

No fault auto insurance is a type of insurance coverage that provides protection to drivers and their vehicles in the event of an accident. The coverage is designed to protect drivers regardless of who is at fault in the accident. In other words, regardless of who caused the accident, the no fault auto insurance policy will protect both drivers and their vehicles.

No fault auto insurance is available in many states across the country. It is required by law in some states, while other states have optional coverage for drivers. It is important for drivers to check the laws in their state and understand what type of coverage is required or available.

Benefits of No Fault Auto Insurance

No fault auto insurance provides a number of benefits for drivers, including:

- Protects drivers regardless of who is at fault in the accident.

- Provides coverage for medical expenses related to the accident.

- Allows drivers to avoid lengthy legal battles.

- Helps to speed up the settlement process.

What is Covered by No Fault Auto Insurance?

No fault auto insurance typically covers medical expenses related to the accident, as well as damage to the vehicles. It also provides coverage for lost wages and other expenses associated with the accident. The exact coverage varies from state to state, so it is important for drivers to check the laws in their state.

How Much Does No Fault Auto Insurance Cost?

The cost of no fault auto insurance varies depending on the type of coverage selected, the age and experience of the driver, where the vehicle is located, and other factors. Generally speaking, no fault auto insurance is more expensive than traditional auto insurance. This is because it provides more comprehensive coverage than traditional policies.

No fault auto insurance can be an important safety net for drivers. It is important for drivers to understand the laws in their state and the types of coverage available. This can help them make an informed decision about the type of coverage they need.

No Fault Insurance | Best rates in Your State | Ogletree Financial

Can No-Fault Insurance Cover Vehicle Damages in a Car Accident?

What is No Fault Insurance and How Does a Claim Work? | Atlanta Car

PPT - Reserving for Unlimited Long-Term No-Fault (PIP) Claims

Michigan legislation would repeal No-Fault auto insurance system by