Nfu Mutual Car Insurance Prices

Saturday, July 8, 2023

Edit

Get the Best Deal on NFU Mutual Car Insurance Prices

What is NFU Mutual Car Insurance?

Nfu Mutual Car Insurance is one of the most popular car insurance companies in the UK. It is a mutual company, meaning it is owned by its customers and not by shareholders. NFU Mutual Car Insurance offers both comprehensive and third party, fire and theft cover, and you can tailor the cover to your own needs. They also offer a range of additional benefits, such as breakdown cover, windscreen cover, legal cover and a courtesy car.

Why is NFU Mutual Car Insurance Popular?

Nfu Mutual Car Insurance is popular because of the benefits they offer. Their comprehensive cover is considered one of the best in the industry, as it covers a wide range of risks and includes a range of additional benefits. They also have a reputation for providing excellent customer service, which is one of the key reasons customers opt for NFU Mutual Car Insurance.

How to Get the Best NFU Mutual Car Insurance Prices

The best way to get the best NFU Mutual Car Insurance prices is to shop around and compare quotes from different providers. This will ensure that you get the best deal possible, as the prices can vary significantly between providers. Additionally, you should also make sure to take advantage of any discounts or special offers available. These can often reduce the cost of the policy substantially.

What Factors Affect NFU Mutual Car Insurance Prices?

There are a number of factors that can affect the cost of your NFU Mutual Car Insurance policy, including your age, the type of car you drive and your driving history. The type of cover you select will also affect the cost of your policy. Additionally, your location can also have an impact, as the cost of car insurance can vary depending on where you live. Finally, the level of excess you choose can also have an effect on the price of your policy.

How to Make a Claim on NFU Mutual Car Insurance?

Making a claim on NFU Mutual Car Insurance is simple and straightforward. All you need to do is call their dedicated claims line and provide them with the details of the incident. They will then assess the claim and provide you with an estimate of the cost. If you are happy with the estimate, they will arrange for the repairs to be carried out and the cost of the repairs to be reimbursed.

Conclusion

NFU Mutual Car Insurance is a popular choice in the UK, thanks to the range of benefits they offer and their reputation for excellent customer service. To get the best deal on your policy, it is important to shop around and compare quotes from different providers. Additionally, you should take advantage of any discounts or special offers available, as this can help to reduce the cost of your policy. Finally, make sure to understand how the different factors can affect the cost of your policy.

Top 5 online Car Insurance websites - find the BEST deal for you

NFU Mutual - Berkhamsted & District Chamber of Commerce

NFU Mutual: Our Award-Winning Graduate Schemes - National Graduate Week

NFU Mutual Insurance Society signo publicitario — Foto editorial de

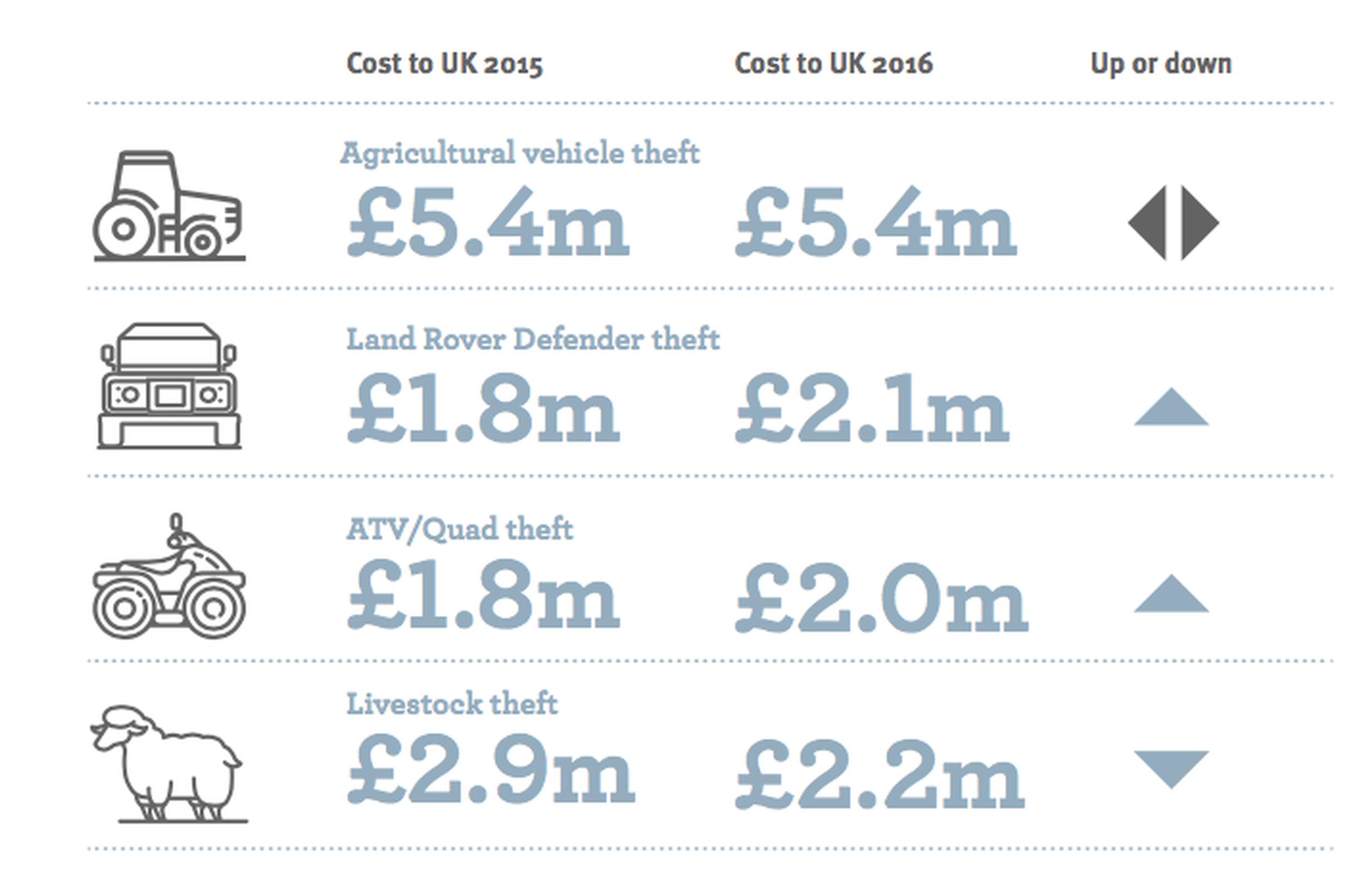

Countryside crime cost £39m in 2016, says insurer NFU Mutual