Car Insurance First Time Driver Over 40

Monday, July 3, 2023

Edit

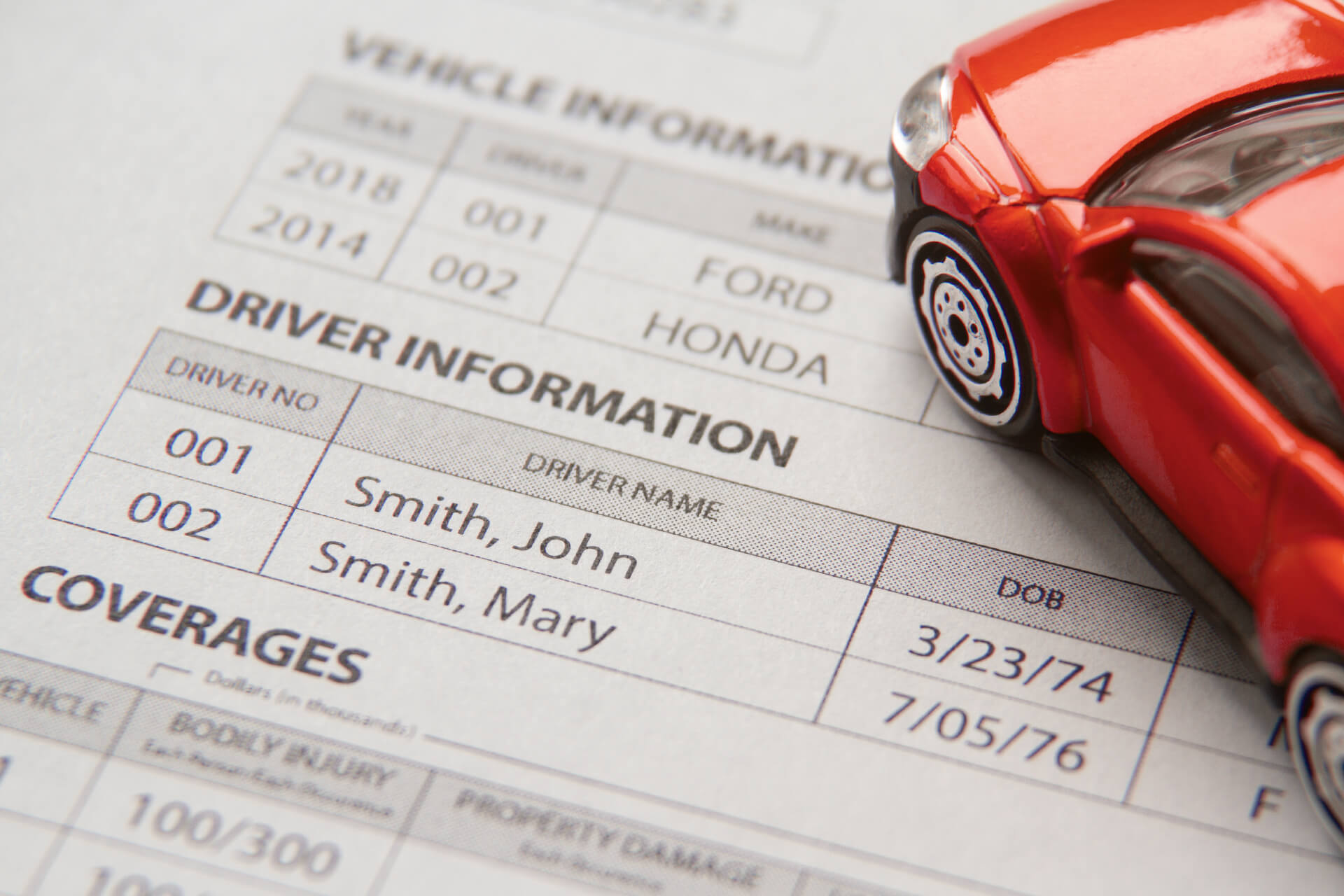

Car Insurance for First Time Drivers Over 40

Understanding Car Insurance for Older Drivers

Are you over 40 and considering getting a car for the first time? Or, perhaps you’re already a car owner and you’re looking for a better deal on car insurance? It's important to remember that car insurance premiums are based on risk factors, and being over 40 can often result in higher premiums. This is because older drivers are typically more likely to have an accident than younger drivers.

Fortunately, there are ways to get car insurance at a lower rate if you’re over 40 and a first time driver. To help you get the best deal, here are some tips for getting car insurance as an older driver.

Tips for Getting Affordable Car Insurance as an Older Driver

1. Shop around: It’s important to compare car insurance quotes from multiple companies and see which one offers the best coverage at the best price. Make sure to check the fine print and ask questions to make sure you’re getting the best deal.

2. Check your credit score: Insurance companies often use your credit score to determine premiums, so make sure it’s in good shape. Paying off any outstanding debts, disputing any inaccurate information on your credit report, and making sure all your bills are paid on time can help improve your credit score.

3. Look for discounts: Many insurance companies offer discounts for older drivers, so make sure to ask about any available discounts when you’re shopping for car insurance.

4. Consider raising your deductible: Raising your deductible is a great way to lower your premiums, but make sure you have enough money saved up in case you need to use it.

5. Drive safely: The best way to get lower car insurance rates is to be a safe driver. Avoid getting tickets and keep your driving record clean.

6. Consider usage-based insurance: Many insurance companies offer usage-based insurance programs that offer discounts for good driving habits. These programs use telematics technology to track your driving habits and offer discounts for safe driving.

Conclusion

Getting car insurance for first time drivers over 40 can be a challenge, but it doesn’t have to be. By shopping around, checking your credit score, looking for discounts, raising your deductible, driving safely, and considering usage-based insurance, you can get the best deal on car insurance.

Remember, car insurance premiums are based on risk factors, so it’s important to do your research and make sure you’re getting the best deal. With the right policy, you can get the coverage you need at a price you can afford.

[INFOGRAPHIC] What all first-time drivers should know about car

![Car Insurance First Time Driver Over 40 [INFOGRAPHIC] What all first-time drivers should know about car](https://kwiksure.com/assets/images/Page_EN_w658px.jpg)

2017 Car Insurance for First Time Drivers | Three Options for Coverage

How To Get Affordable First Time Driver Car Insurance – Easier Way To

How to Choose Ideal Car for First-Time Driver? | Car insurance, First

Page for individual images • Quoteinspector.com