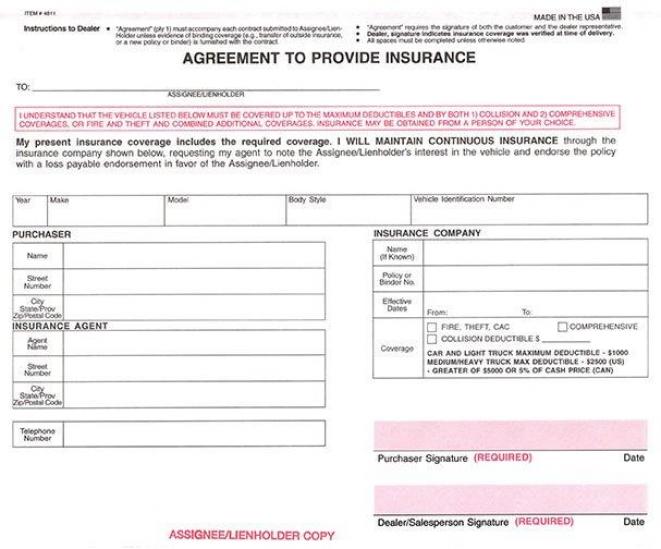

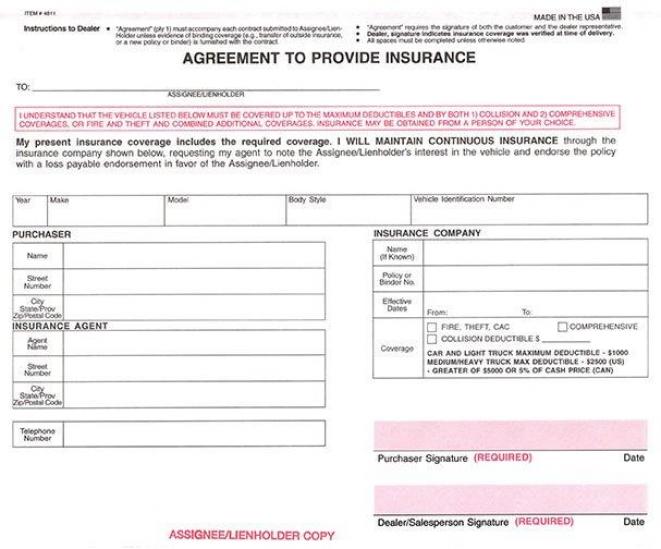

Agreement To Provide Auto Insurance Form

Understanding the Agreement To Provide Auto Insurance Form

Whether you are an auto insurance provider or an individual who needs auto insurance, it is important to understand the agreement to provide auto insurance form. This form is used to document the agreement between an auto insurance provider and an individual who needs to purchase auto insurance. It is important to be familiar with the information that is provided in the form, as well as the steps that are necessary to sign it. Knowing all the details of the agreement to provide auto insurance form can help in the process of obtaining the auto insurance you need.

What is an Agreement To Provide Auto Insurance Form?

An agreement to provide auto insurance form is a document that is used to document the agreement between an auto insurance provider and an individual who is purchasing auto insurance. This form includes important information that is necessary for the completion of the agreement. This includes the names of the parties involved, the type of coverage that is being purchased, the amount of coverage, the terms and conditions of the agreement, and any other relevant details.

Signing the Agreement To Provide Auto Insurance Form

Once the agreement to provide auto insurance form has been completed, the next step is for both parties to sign the document. This is typically done in the presence of a witness. This witness must be a third party who is not involved in the transaction and is not related to either of the parties. The witness must be at least 18 years old and must provide a valid form of identification when signing the document. After the document has been signed, it is important to keep a copy of the agreement for future reference.

Cancelling the Agreement To Provide Auto Insurance Form

The agreement to provide auto insurance form can be cancelled at any time by either party. If the individual who is purchasing auto insurance decides to cancel the agreement, they must notify the auto insurance provider in writing. The notice must be received by the auto insurance provider within a reasonable amount of time. Once the notice has been received, the auto insurance provider will cancel the agreement and refund any payments that have been made.

What to Do if There is a Dispute

If there is a dispute between the auto insurance provider and the individual who is purchasing auto insurance, it is important to contact the auto insurer immediately. If a dispute cannot be resolved between the two parties, then it is important to contact an attorney who specializes in auto insurance law. An attorney can provide legal advice and help in resolving the dispute.

Conclusion

The agreement to provide auto insurance form is an important document that is used to document the agreement between an auto insurance provider and an individual who is purchasing auto insurance. It is important to be familiar with the information that is provided in the form, as well as the steps that are necessary to sign it. Knowing all the details of the agreement to provide auto insurance form can help in the process of obtaining the auto insurance you need.

agreement to provide insurance form #4811 | AutoDealerSupplies.com is

Car Insurance Policy: March 2017

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

![Agreement To Provide Auto Insurance Form What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]](https://images.sampleforms.com/wp-content/uploads/2017/08/Vehicle-Insurance-Verification-Form-1.jpg)

Template Used Car Sale Agreement | HQ Printable Documents

Car Insurance Contract Example ~ designdsight